Sublime

An inspiration engine for ideas

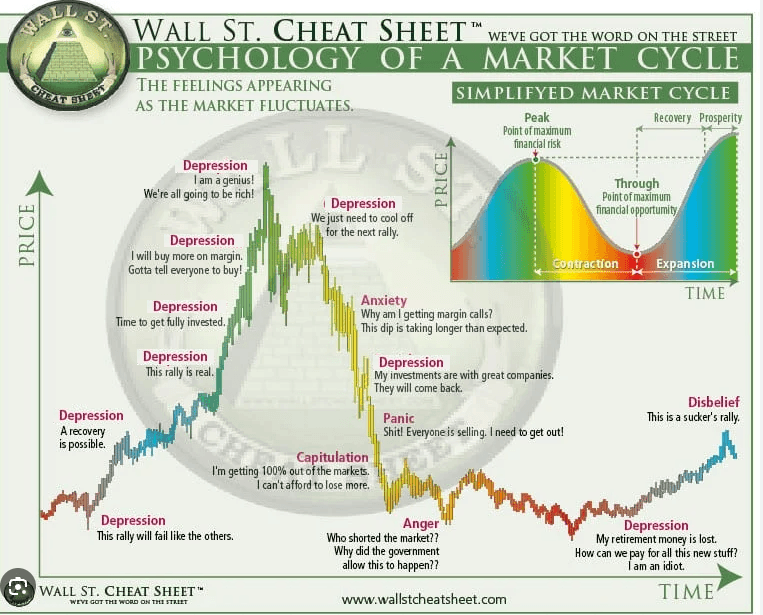

The best forecast on the current market structure and situation of new shiny stuff is explained very well by the OG, Legend of this industry @cobie.

You should read this and keep everything written here before buying new coins.

As things go, I think about trading majors or meme coins for... See more

AlchemistXBTx.com

Realtime Stock Market Quotes, Unusual Options Alerts/Earnings/Price/Analyst Notifications, DCF, RV, Scenario Analysis and Deep Learning Momentum Models all in one app!

Check us out at https://t.co/rbggpf04WP

FundSpec.IOx.com

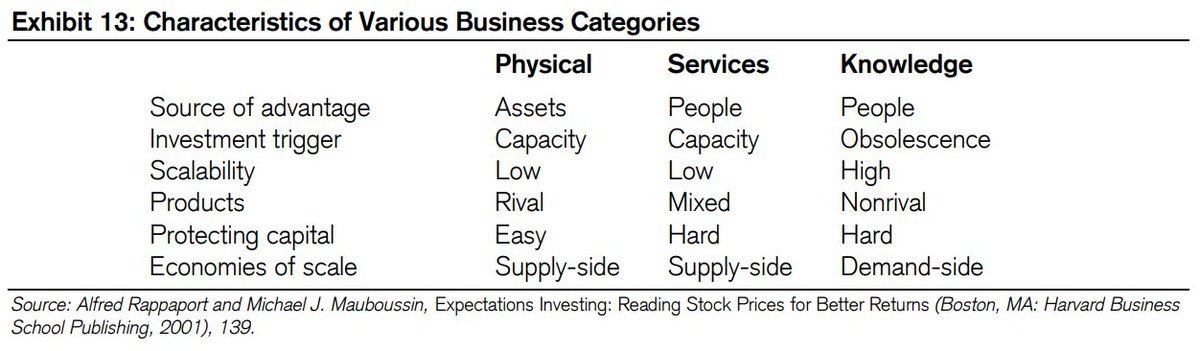

Powerful insights included in this table !

Every investor should take note https://t.co/Bb9muJlpAB

Updated AI Agents/Infra holdings (plus things I'm looking at + things I wish I had more of):

Note: obviously fast moving market. Things always subject to change. Don't just buy things because they're on my list. I have sub 100k entries on a lot of the big winners because I was early...it means my bags are large and when... See more

IcoBeast.eth🦇🔊x.com