Sublime

An inspiration engine for ideas

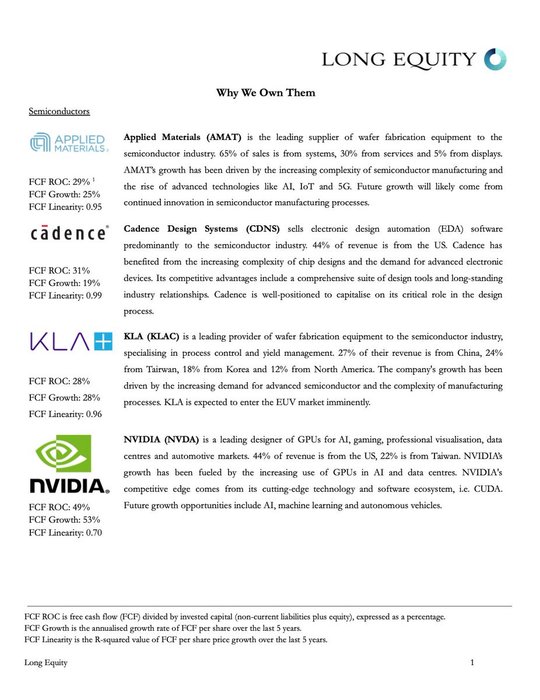

Equities are an asset that represents the present value of a discounted flow of cash flows generated by corporations. The value of these assets is driven by a combination of policy rates, nominal GDP, profitability, and liquidity conditions. Maintaining a durable edge in equities requires a view of all of the above.

Prometheus Research • Equity Market Outlook

GitHub - jlevy/og-equity-compensation: Stock options, RSUs, taxes — read the latest edition: www.holloway.com/ec

github.com

As we discussed earlier, growth equity refers to late-stage venture capital deals that will typically help the company reach the public markets (IPO) or get acquired by a strategic company or financial sponsor.

Bradley Miles • #BreakIntoVC: How to Break Into Venture Capital And Think Like an Investor Whether You're a Student, Entrepreneur or Working Professional (Venture Capital Guidebook Book 1)

like—long-term debt divided by shareholder’s equity. It’s a little like the financial leverage ratio, except that it’s more narrowly focused on how much long-term debt the firm has per dollar of equity.