Sublime

An inspiration engine for ideas

Joe Lonsdale (@JTLonsdale ) has created more billion dollar companies than anyone else in the U.S.

Today, a third of his money is going towards building *new* companies.

How does he figure out what to build? He looks for 'conceptual gaps' in the world.

And he... See more

Shaan Purix.comPaul Mackiewicz

@honorable

If you're a founder contemplating taking funding from a partner at a big VC fund it is a legitimate question to ask yourself (and the partner) whether they'll even be at the firm in 12-18 months.

Crazy turnover happening right now. Some public, a lot of it behind the scenes.

Yuri Sagalovx.comAny founders interested in pitching GoodLight Capital? They are a new VC firm based out of Tennessee actively writing $200K checks in companies building in Future of Work, FinTech, EdTech, and more.

I'd be happy to get you connected.

Darrel Frater ✝️x.comis there a VC fund that provides literal mafia services to help autistic eth devs with too much power stay alive?

seems to be a growing niche ☠️

what's your value add? 🔫

@paradigm @a16z @consensys @polychaincap @PanteraCapital @standardcrypto @dragonfly_xyz... See more

Ameen Soleimanix.comHi Mira,

My name is Zak, and I’m a summer analyst at Growth Equity Partners Capital Fund. We’ve heard great things about you from our network and are big believers in AI so we would love to connect!

We’re a $15bn AUM Menlo Park-based investment firm that invests in technology businesses... See more

Zak Kukoffx.com

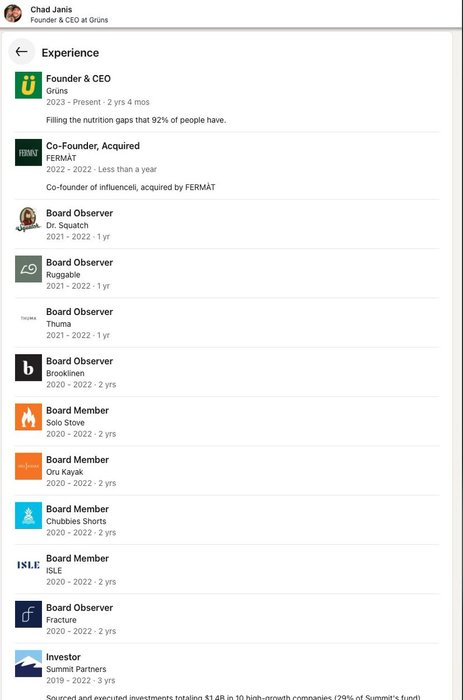

The gruns CEO's linkedin is like one of those fake shit posts people do in tech or finance-

where the guy seemingly worked for every major company on earth...

but he really lived that life.

Summit PE investor, deployed billions, to fastest growing brand in... ever? https://t.co/3Fqz9yIczk