Sublime

An inspiration engine for ideas

I've heard @vkhosla and more say more VCs hurt companies not help them.

@SamCorcos @Levels is the best when it comes to leveraging an investor base:

🚀 1,500 requests to investors

❤️ @jeff_jordan best with 91% response rate

🔥 110 @a16z... See more

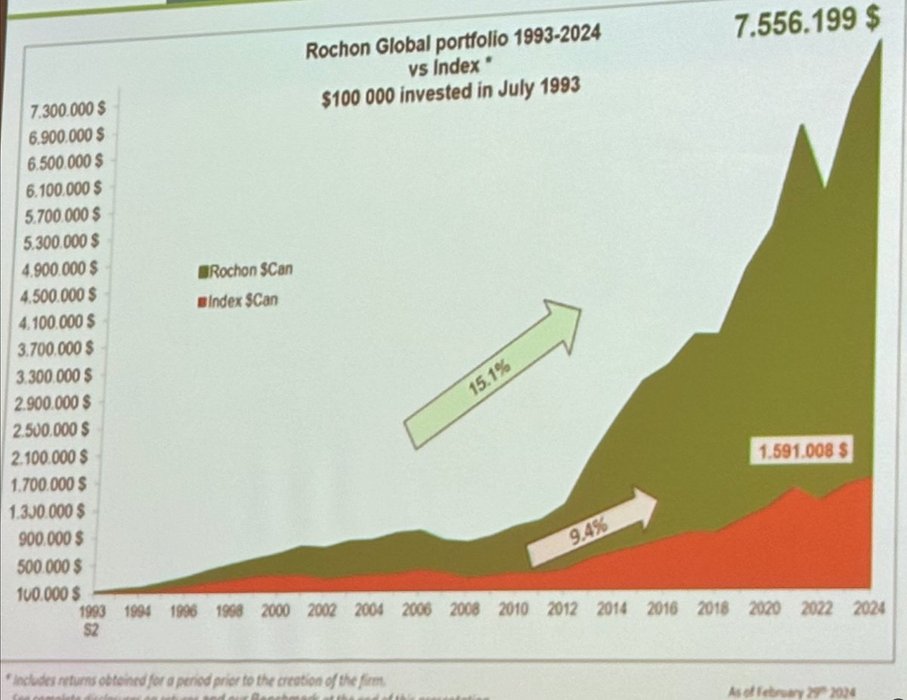

Sharing the "Lessons from 30 years of investing" by Francois Rochon, his presentation at the 10th Value Spain conference.

My favourite quote:

"Holding on to a company that is reporting bad results or going through serious troubles is not patience. It is... See more

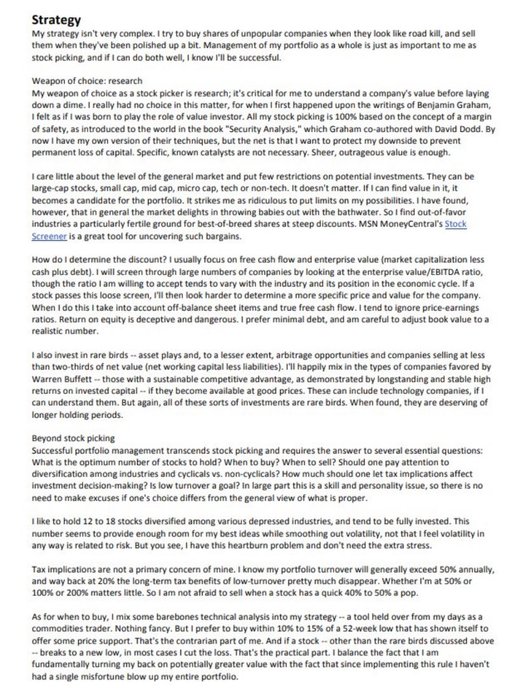

Michael Burry’s investment strategy

Source:@marketplunger1 https://t.co/iQ5U36x1ts

Three focus areas for investment: crypto, fintech, and emerging markets . I expect roughly 50% of investments to be crypto-related.

On the speed and concentration spectrum, Generalist capital sits left of centre and plans to invest in ~20 companies over the next 18 months. Reasons for this approach include : 1. Meaningful Ownership; 2. Maintain an... See more

On the speed and concentration spectrum, Generalist capital sits left of centre and plans to invest in ~20 companies over the next 18 months. Reasons for this approach include : 1. Meaningful Ownership; 2. Maintain an... See more

Mario Gabriele • Generalist Capital: In Search of Epics | The Generalist

Heard from LPs this week:

Spent time w/ one of Top 5 largest pools of capital in the 🌎 . They do not look at past track record. At all.

What do they look for?

- Deep specialization

- Efficient decision making

- Repeatable process

-... See more

Meghan Reynoldsx.comTobi Lütke - Building Islands of Innovation - [Invest Like the Best, EP.393] — Invest Like the Best with Patrick O'Shaughnessy

overcast.fmOne thing I'm always on the lookout for with people. Are they moving quickly? Are they evolving quickly? In my view, at the end of the day, when you're betting on a founder, especially if the market's not super clear, what you're trying to do is, you're trying to predict that, that particular person will have as many shots on goal as possible,

... See more