Sublime

An inspiration engine for ideas

Investment Principles.pdf

drive.google.com

If those investors received their money from several different sources who did not directly own a percentage of the portfolio companies, then those individuals are venture capitalists and they are receiving money from limited partners (these are endowments, foundations, public pensions, high net worth individuals etc.).

Bradley Miles • #BreakIntoVC: How to Break Into Venture Capital And Think Like an Investor Whether You're a Student, Entrepreneur or Working Professional (Venture Capital Guidebook Book 1)

Fund administration, public accounting CPA - Liccar Inc.

liccar.com

LiquiLoans (NDX P2P Private Limited)

liquiloans.comThe owners who provide most of the capital to the business are the limited partners (LPs). They are called “limited partners” because their liability is limited to their investment. If they invest $100,000, then $100,000 is all they can lose as passive investors in the partnership.

Robert Walker • Pass The 65: A PLAIN ENGLISH EXPLANATION TO HELP YOU PASS THE SERIES 65 EXAM - UPDATED FOR 2017

Rick Guerin’s write up for: The Security I Like Best

Personal Property Leasing Company

( I’m sure @MohnishPabrai would be interested in this one ) https://t.co/NI9QO9hnPN

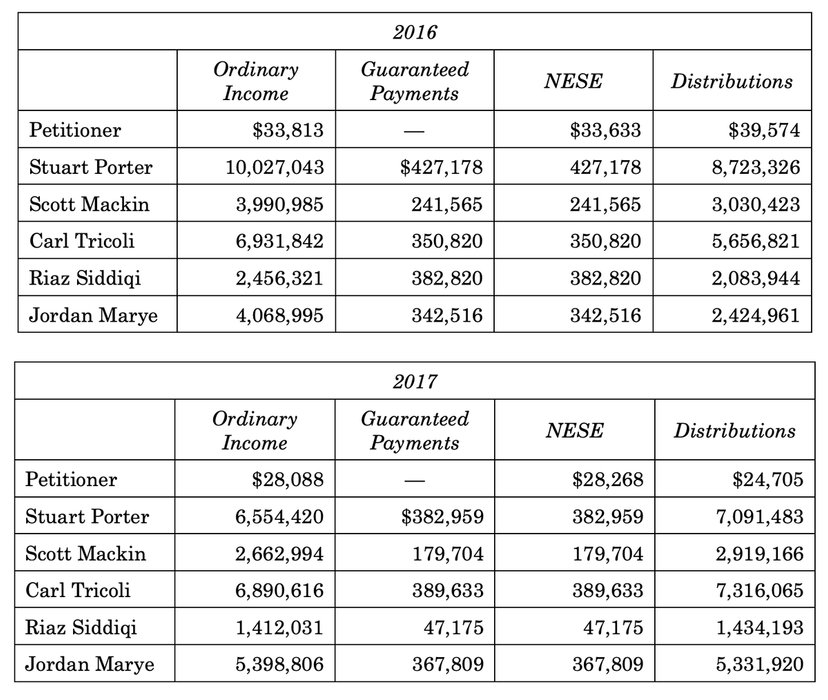

Today in Tax Court - another "LP in name only" argument fails. This time for $50 million+ of additional self-employment income.

Denham is a hedge fund with a general partner and 5 "limited partners" (LPs).

The LPs, as described in the opinion, were LPs in name... See more