Sublime

An inspiration engine for ideas

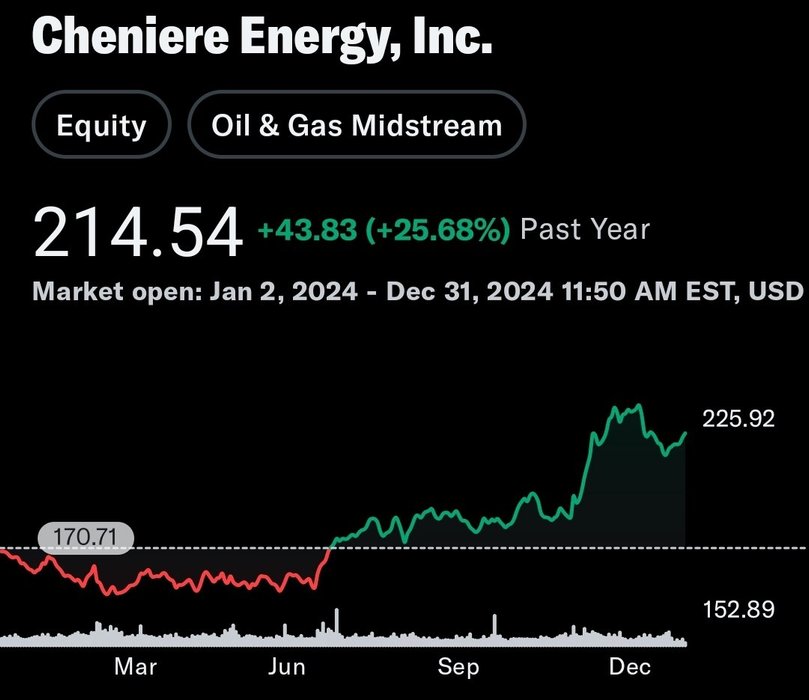

My top pick for 2025 is

Cheniere Energy $LNG! (+90%)

Here's a short summary or checkout my youtube video in the comments👇

$LNG has 17 years worth of contracts based on a fixed fee of $2.5/mmbtu + a lifting margin, which makes it more of an infrastructure/export bet than a pure... See more

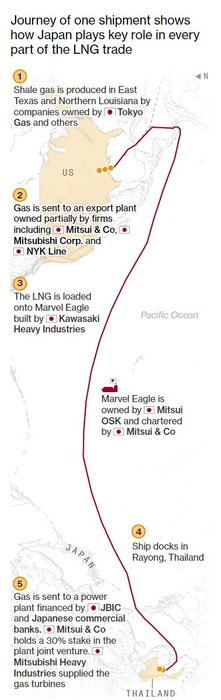

Open this picture. It illustrates the EXTENT of Japan's dominance in the LNG supply chain

👉 A Japanese company produces the shale gas

👉 Gas is sent to an LNG plant partially owned by a Japanese company

👉 LNG is loaded on a ship built and owned by a Japanese company

👉 The ship is... See more

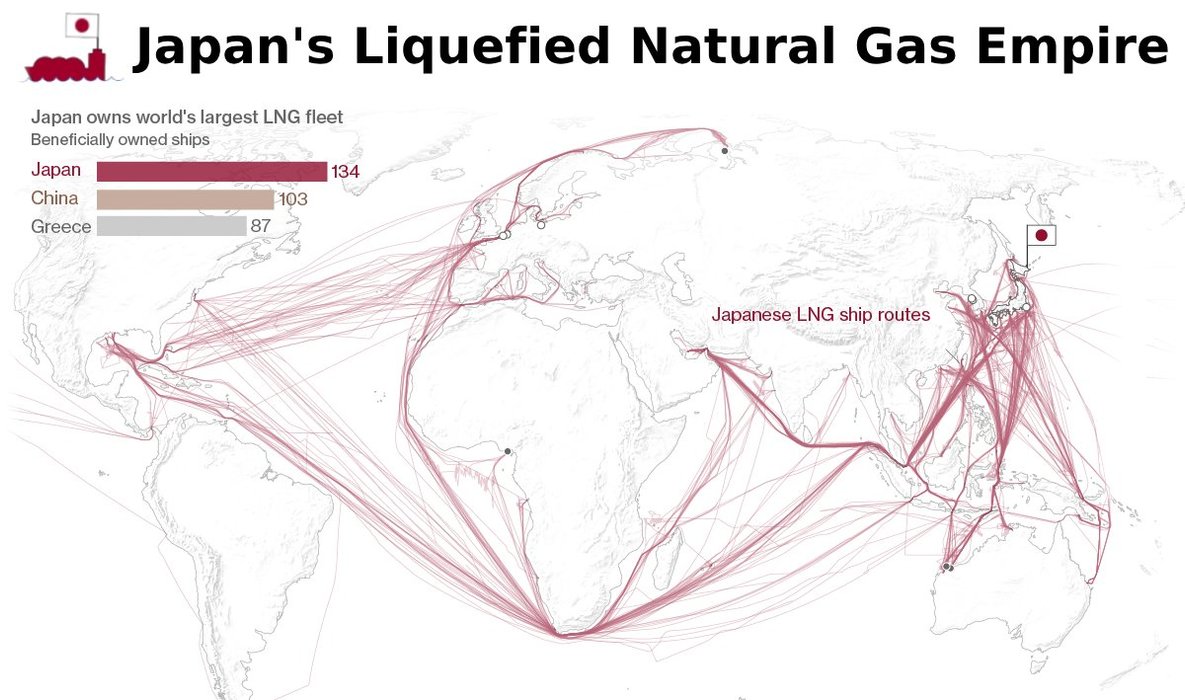

How Japan ignored climate critics and built a global natural gas empire

🇯🇵❤️🚢

Every six hours, somewhere in the world, an LNG shipment controlled by a Japanese company leaves a port. However, these tankers are only the tip of the iceberg

A thread... See more

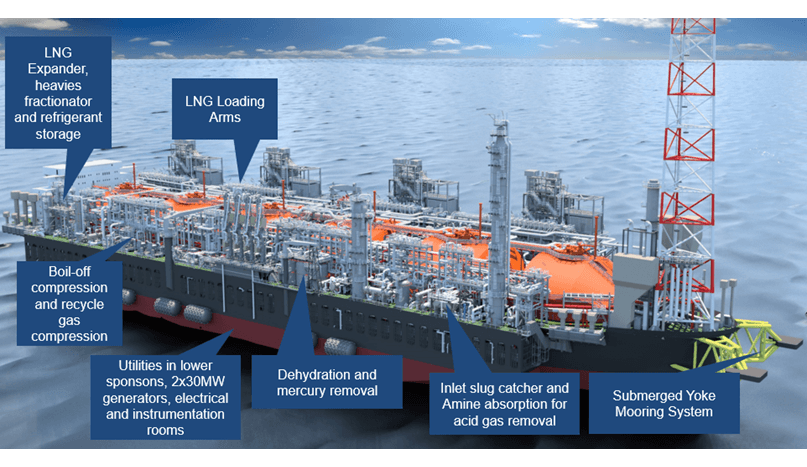

$GLNG Today Argentina energy independent $YPF updated investors on their LNG aspirations for using gas from the Vaca Muerta gas field for LNG exports, and it looks very much like Golar's Hilli is the plan. https://t.co/8lSavlvl4y

Not advice but these folks own the only neodymium mine in the USA https://t.co/FbWVtc85TO

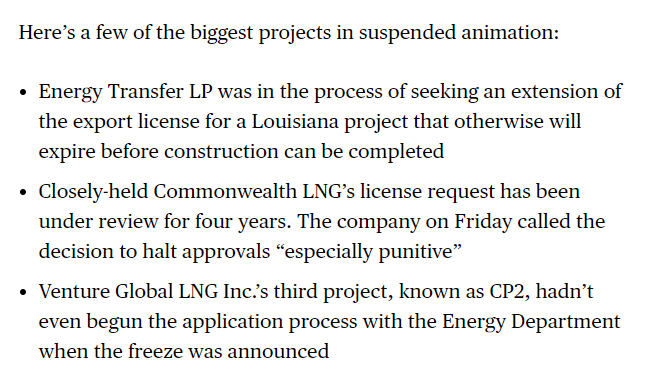

There are some projects that don't have the approvals and may be delayed by the new Biden policies

Other European/Asian LNG buyers may think twice before signing a deal with a supplier that doesn't have the right approvals. Without those buyers, US projects may not move forward https://t.co/0hWshfyuqC

Talen Energy $TLNE has so far been a textbook out-of-bankruptcy play. Came out of the gates cheap, trading OTC (hence uplisting catalysts as well), no coverage, industry tailwinds, plus it helped this wasn't a micro-cap. Uplisting is now expected around Q2/3.

We highlighted this one often in our TMM, our regular... See more

Added $AYRWF $CURLF $MSOS this morning.

Watching $GDNSF for one more add before the bill gets signed this week.

H.L. Menckenx.com