Sublime

An inspiration engine for ideas

@Biohazard3737 Also in term of "not-so-reliable" matrix i.e. IRR: VC asset class sits ahead of above stated egs.

Some selective funds would go somewhere 35% but yes lower bound can touch -8.1%

Overall, its a risky asset class - but not as bad as LPs/other investors assume it is. https://t.co/gneb1dT6vS

So anyway here's a 7-year-old reddit post with 12 upvotes about higher order moments of statistical distributions that's actually really insightful, even for kurtosis. https://t.co/unob6dEY64

Predating Uber, I had written and published nearly a thousand essays on topics like user growth, metrics, viral marketing—along the way, popularizing tech industry jargon like “growth hacking” and “viral loops.”

Andrew Chen • The Cold Start Problem: How to Start and Scale Network Effects

Want to learn how Joel Greenblatt earned 40%?

Watch the video to learn more. https://t.co/VEcXn4mgmf

The Investing for Beginners Podcastx.comTanay Nagar

@violetjockey

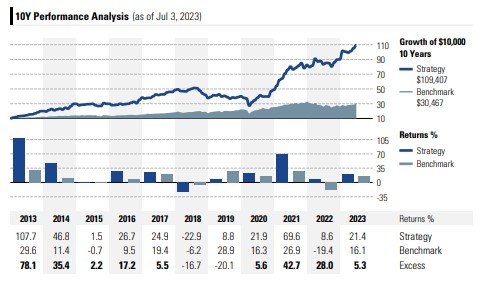

Shoutout to Oliver Keating, Physics Scientist, who has been running this #microcaps model live and public since 2013 with 23.6% CAGR. A steal at $25 per month. https://t.co/nqEhwZn3T6 https://t.co/MIFWSZ4o5b

Kalpen Shah

@kalpen

@RMW_Allocator It's based on data from the book A Random Walk Down Wall Street by Burton Malkiel.

Rene Sellmannx.com