Sublime

An inspiration engine for ideas

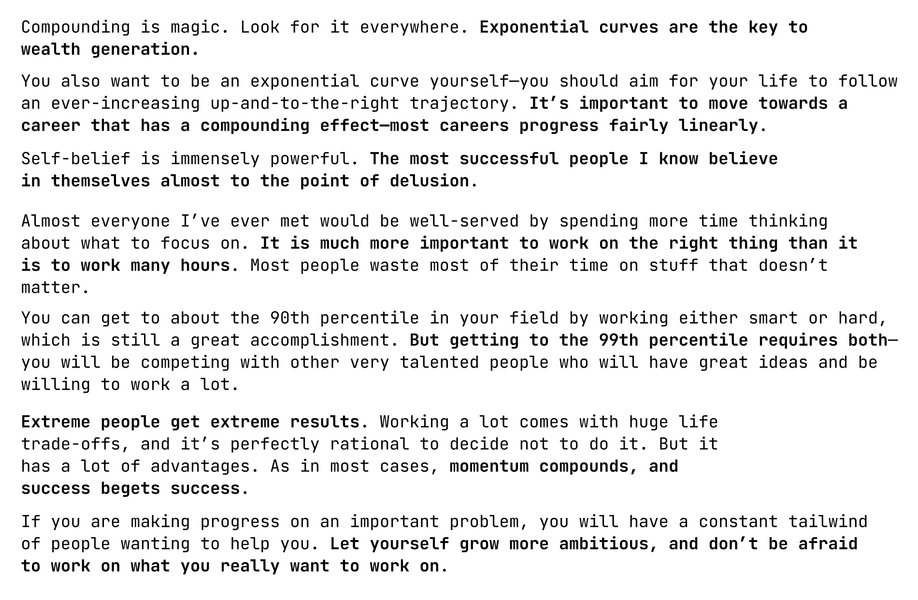

You Don't Understand Compound Growth

whoisnnamdi.com

Play iterated games. All the returns in life, whether in wealth, relationships, or knowledge, come from compound interest.

Tim Ferriss • The Almanack of Naval Ravikant: A Guide to Wealth and Happiness

returns. Jim Simons, head of the hedge fund Renaissance Technologies, has compounded money at 66% annually since 1988. No one comes close to this record. As we just saw, Buffett has compounded at roughly 22% annually, a third as much. Simons’ net worth, as I write, is $21 billion. He is—and I know how ridiculous this sounds given the numbers we’re

... See moreMorgan Housel • The Psychology of Money: Timeless lessons on wealth, greed, and happiness

Not being forced to sell stocks to cover an expense also means we’re increasing the odds of letting the stocks we own compound for the longest period of time. Charlie Munger put it well: “The first rule of compounding is to never interrupt it unnecessarily.”

Morgan Housel • The Psychology of Money: Timeless lessons on wealth, greed, and happiness

The time it takes for an exponentially growing stock to double in size, the “doubling time,” equals approximately 70 divided by the growth rate (expressed as a percentage). Example: If you put $100 in the bank at 7% interest per year, you will double your money in 10 years (70 ÷ 7 = 10). If you get only 5% interest, your money will take 14 years to

... See moreDonella H. Meadows • Thinking in Systems: International Bestseller