Sublime

An inspiration engine for ideas

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.com

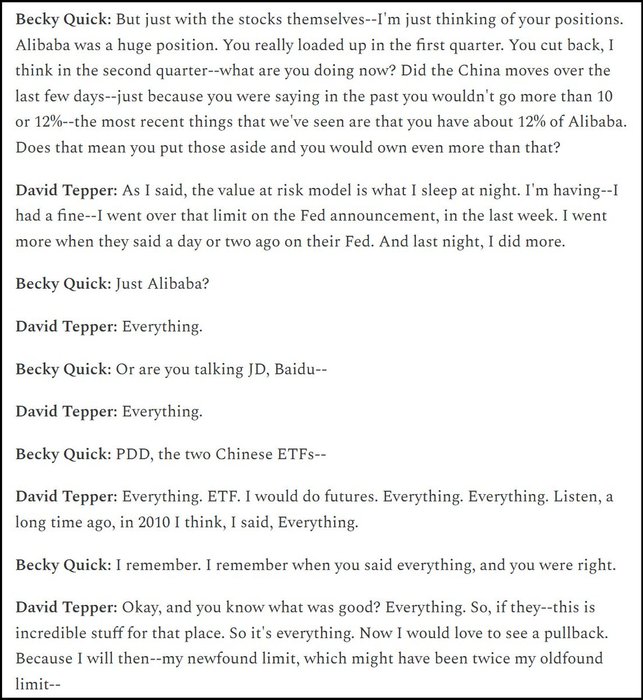

Fourteen years ago, David Tepper went on Squawk Box and shared how he made $7bn in a single year and laid out his worldview and a strategy that worked for the coming decade.

Last week, almost fourteen years to the day, David returned to Squawk Box to discuss China, stimulus, AI, and more. He starts by discussing whether... See more

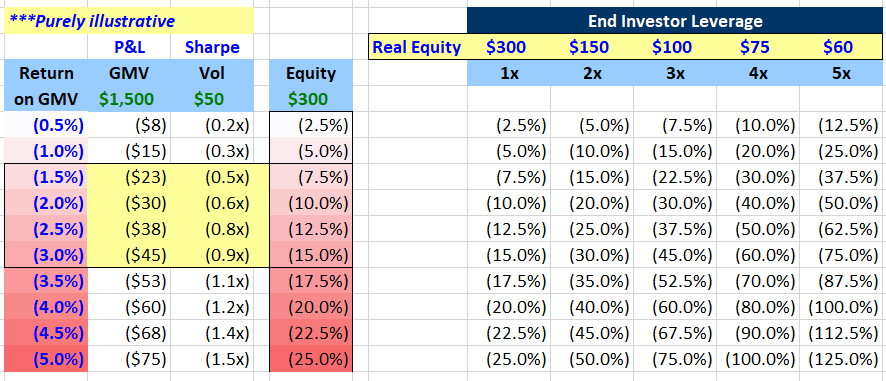

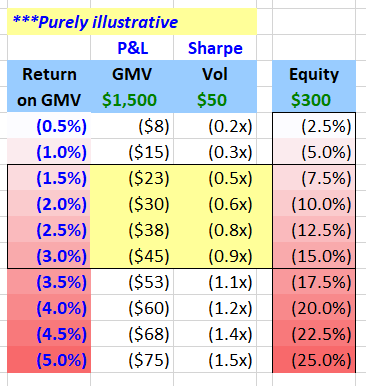

BLOOMBERG ARTICLE ON SYSTEMIC RISK FROM PODS

Some interesting points in this Bloomberg article on multi-manager funds.

A couple points stood out to me, and there were a couple points I would add. What stood out:

1) PODS ARE BIG. 30% of HF GMV per GS report (does... See more

Brookfield Asset Management has $750B in assets under management & 100+ yrs experience investing in the backbone of the economy

They call this “a hinge moment in history” w/profound implications for inflation, interest rates, & investing

Their macro update & investment plan…

Austin Liebermanx.com

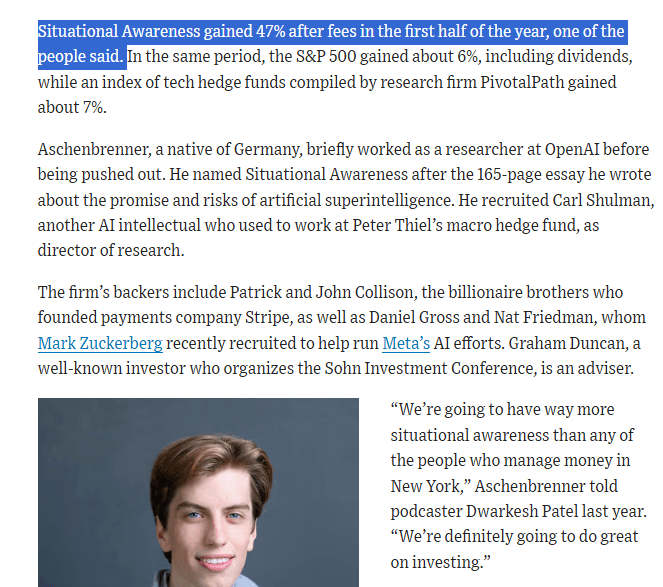

Leopold Aschenbrenner's fund has outperformed basically every mainstream hedge fund YTD and he's running 1bn+ of capital btw

the gulf billionaires & pension funds are watching this

capital management will soon become an activity exclusively done by chronically online zoomers... See more

Explaining why crypto has low correlation with risk assets and predicting its future as a major institutional asset class.

TRANSCRIPT

Yeah, so I actually strongly believe that Bitcoin and other blockchain assets are going to generally have a very low correlation with risk assets.

The reason is smart money doesn't own it.

And the reason all these other weird asset classes that intrinsically have nothing in common or highly correlated is modern portfolio theory was so successful

... See moreIn it’s heyday, Goldman’s special situations group was the navy SEALs of money making. Today’s guest, Alan Waxman, used to run that group before leaving to build Sixth Street, now a $115b behemoth.

SSG heads were sometimes of the more brainy, nerdy variety. Not Waxman. He is a force of nature and energy who apparently... See more

Patrick OShaughnessyx.com3 to 5 is more than 20.