Sublime

An inspiration engine for ideas

Fireside Chat: A Plan for Humanity with Bryan Johnson

youtube.com

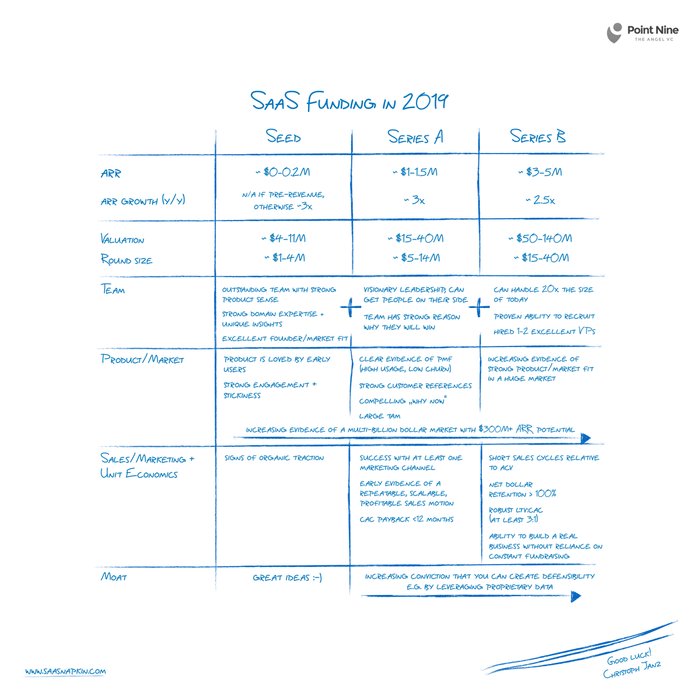

Since we're back to 2019 valuations, may as well bring back the #SaaS Funding Napkin via @chrija of @PointNineCap #vc https://t.co/ChSoPXv6Eh

Lux unveils $142M seed round in EvolutionaryScale co-led with @natfriedman @danielgross + @pdhsu w/ @amazon + @nvidia

They’re also revealing + making available ESM3––a natively multimodal + generative language model for proteins + the largest biological language model in history

Josh Wolfex.com

Skyfire raised a $8.5M Seed to allow AI to pay on behalf of humans

- It's a $250B+ market opportunity to be "the Visa/Mastercard for AI"

> 13 slide pitch deck https://t.co/FnvDSv0Jx7

Huge. Ilya aims for a $30b valuation! He found his own way to climb the mountain to ASI!

"Sutskever has told associates he isn't developing advanced Al using the same methods he and colleagues used at OpenAI. He has said he has instead identified a "different mountain to climb" that is showing early signs of promise,... See more

My conversation with @JoshuaKushner

This is Josh’s first long-form interview of this type, so we cover as much as possible

Thrive manages $15B, invests early and late stage, and often starts companies in addition to investing

We pick it all... See more

New in Dealmaker: Andreessen Horowitz partner Michelle Volz is leaving the firm to raise her own "American Dynamism" focused fund. Plus, Forward CEO speaks up after shutting down his company & Airtable's green shoots

https://t.co/iPf7vNxjqg

natasha mascarenhasx.comAggressive Overbids. The Vision Fund is notorious for offering companies multiples more money at higher valuations than they were planning on raising and threatening to invest in competitors instead if they said no. If a company set out to raise $250 million, Masa asked them what they’d do if they had a billion. This elbowed out other investors and... See more