Sublime

An inspiration engine for ideas

I have found my hero.

(Source: Why the Japanese Yen Is So Volatile - Bloomberg Originals) https://t.co/6VOXqphvAl

Goshawk Tradesx.comFelix Zulauf's big market calls for 2024 & beyond:

- S&P 500 makes minor new highs in Q1 2024 (4900) but this will be a "trap" that will suck in too much capital at the wrong price & cause a "big" decline. Oct 2022 lows (<3600) very much in play

- Bond rally likely to continue - for now. But... See more

Jack Farleyx.comIn it’s heyday, Goldman’s special situations group was the navy SEALs of money making. Today’s guest, Alan Waxman, used to run that group before leaving to build Sixth Street, now a $115b behemoth.

SSG heads were sometimes of the more brainy, nerdy variety. Not Waxman. He is a force of nature and energy who apparently... See more

Patrick OShaughnessyx.comJeff Horing has never done an interview like this because he’s too busy investing at Insight Partners.

Despite having built a $100B investment firm, he feels like he’s as in the weeds as he was during the firm's early days. As he said, “My schedule is dictated by 24-year-olds.”

Insight does... See more

Patrick OShaughnessyx.com

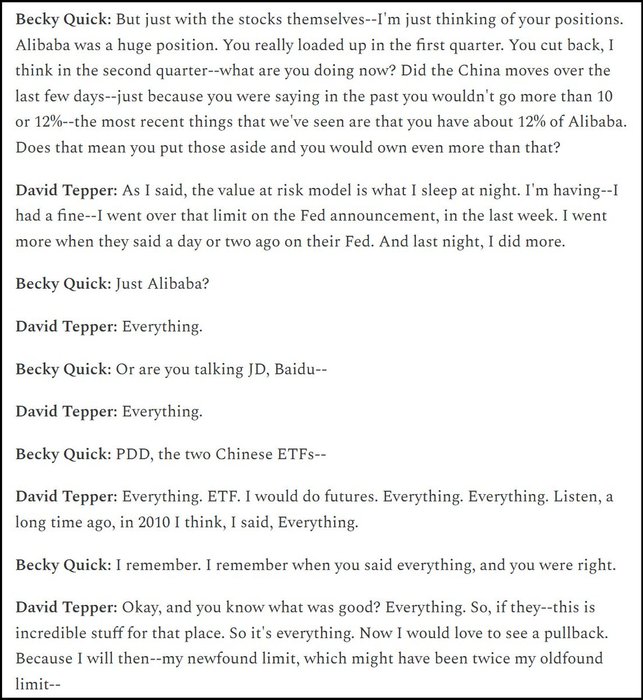

Fourteen years ago, David Tepper went on Squawk Box and shared how he made $7bn in a single year and laid out his worldview and a strategy that worked for the coming decade.

Last week, almost fourteen years to the day, David returned to Squawk Box to discuss China, stimulus, AI, and more. He starts by discussing whether... See more

Brookfield Asset Management has $750B in assets under management & 100+ yrs experience investing in the backbone of the economy

They call this “a hinge moment in history” w/profound implications for inflation, interest rates, & investing

Their macro update & investment plan…

Austin Liebermanx.comSpent 7 hours researching a true master of small cap private equity:

- 586 transactions

- Acquire $1 million to $10 million EBITDA companies

- Average deal $12 million

- 72% IRR

- 7x cash on cash returns

He had two rare public... See more

PrivateEquityGuy (Mikk Markus)x.comToday’s guest, Andrew Milgram, spent $600M buying NYC taxi medallions at the peak of Uber's power—an investment which gives you a sense of Andrew’s style.

He describes a “K-shaped economy,” where one small group of companies does incredibly well while the rest struggle.

Amidst it all he... See more

Patrick OShaughnessyx.com