Sublime

An inspiration engine for ideas

Frank Becker

@alien8

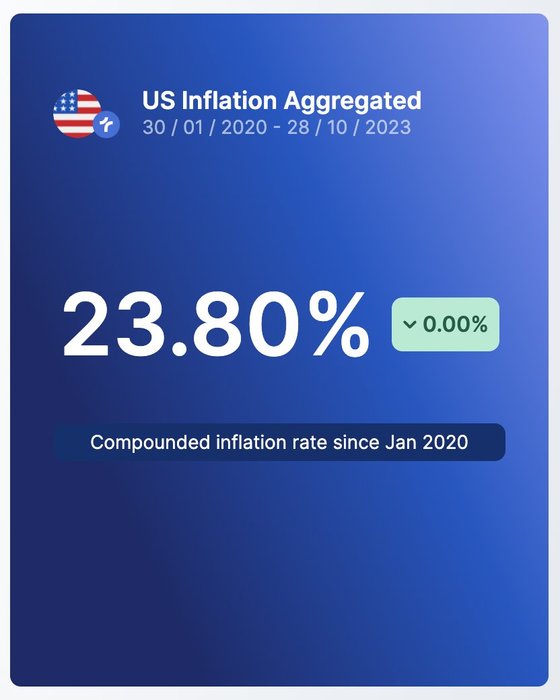

If you've held USD cash since 2020:

- 23.8% of your purchasing power has been erased

If you've held GBP since 2020:

- 32.3% of your money's value is now gone.

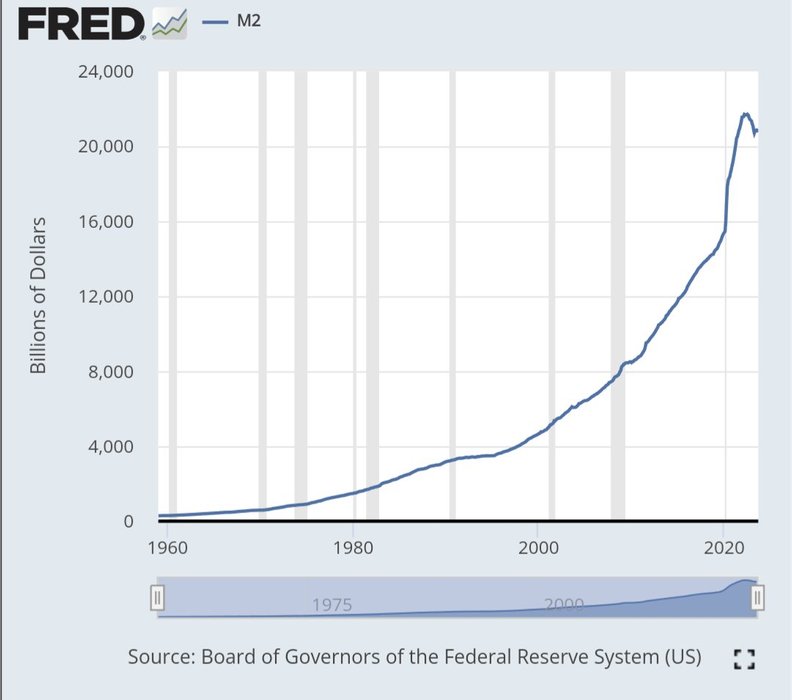

This isn't due to "greedy corporations" as the media would gaslight you to believe.... See more

I don’t agree with @ProfessorWerner on everything here - I can’t stomach the quantity theory of inflation - but it is so refreshing to hear someone call out the present housing bubble for the asset price inflation it is. Tucker’s reaction shows people intuitively grasp this. 🏠📈 https://t.co/8iF6hA8WEC

Certaines nations choisissaient l'or et d'autres l'argent ce qui eut d'énormes conséquences funestes. La Grande-Bretagne fut la première à opter pour un étalon-or moderne en 1717, sous l'impulsion du physicien Isaac Newton qui dirigeait la Royal Mint. L'étalon-or devait jouer un grand rôle dans l'essor de son commerce à travers son empire de par le

... See moreMarie Oneissi • l'Étalon-Bitcoin

Bitcoin TreasuryCos & The Roaring 20s

bewaterltd.com

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.comJust a moment...

economist.com

The central relationship that money crystallizes is between lender and borrower.