Sublime

An inspiration engine for ideas

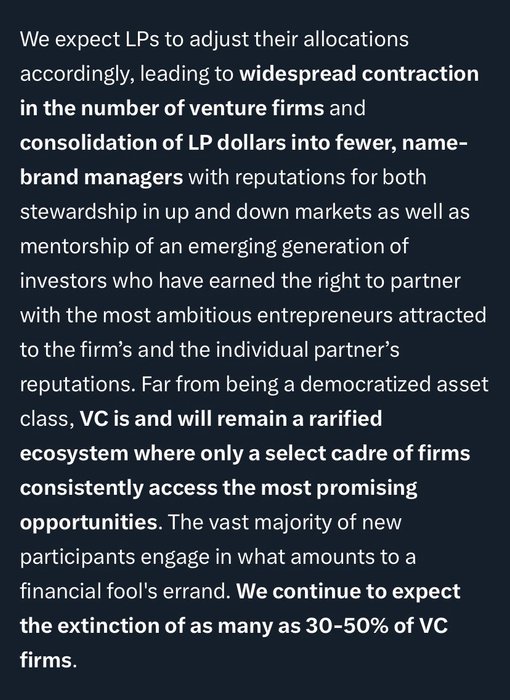

The concentration is already underway.

The five largest US VC funds captured 44% of new funding in Q1. It’s difficult to frame that as returning to a healthy status quo.

It’s worth considering the influence of a multi-stage brand name firm like Lux writing an open letter about the... See more

Who do "people-who-study-people" think is the best role model?

I know @WilliamGreen72 has talked about Arnold Van Den Berg. @FoundersPodcast has called Ed Thorp his "personal blueprint."

Who else?

Tom Morganx.comThe endowment and pension fund agree to invest. Cynthia and Mercedes then form “CynMerc” Ventures, which will invest in early stage private companies. With this first fund—let’s call it CynMerc I, CynMerc Ventures will spend 3-5 years investing the money and 5 more years (8 to 10 years in total) to get the pension and endowment money back plus a

... See moreBradley Miles • #BreakIntoVC: How to Break Into Venture Capital And Think Like an Investor Whether You're a Student, Entrepreneur or Working Professional (Venture Capital Guidebook Book 1)

The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.

Peter Thiel, Blake Masters • Zero to One

John Zito is a Partner and Deputy CIO of Credit at Apollo, overseeing the firm’s global Credit business and team (which makes up ~$450bn of Apollo’s total ~$630bn AUM). John is also a member of the Firm’s Leadership Team. Apollo’s platform spans the full financing universe across public and private markets, including corporate credit, direct... See more

Advice from a Founder Who Built a $390M Company at 57 | LucidLink, Peter Thompson

youtube.comBio — Jo Lepore

jolepore.comAs @fredwilson pointed out, and I agree, “we don’t need more firms deploying $10B. We need lots of little venture firms deploying $100M. It results in more choice for entrepreneurs.” - great article on the rising bread of “Alpha Generators”. https://t.co/EyBUfDZ1xo

Adi Levanon🎗️x.com