Sublime

An inspiration engine for ideas

top search firms obsess over top multistage giants.

im building nucleus to support the emerging and on-the-way managers building tomorrow’s top 10. my take: at least 5 new funds crack every list by 2030, replacing legacy platforms bleeding their best partners

to back them properly, we’re... See more

napoleon bonaparte’s heir runs a search fund to buy small cap services business https://t.co/NGMTYppewu

Spent 7 hours researching a true master of small cap private equity:

- 586 transactions

- Acquire $1 million to $10 million EBITDA companies

- Average deal $12 million

- 72% IRR

- 7x cash on cash returns

He had two rare public... See more

PrivateEquityGuy (Mikk Markus)x.com

If you are ever considering starting an investment firm, I highly suggest you read Graham Duncan's letter to a friend.

(Sage advice from someone who started his fund at 31 and today manages a $2b fund himself.)

Here are few ideas from his masterpiece:

1. Life is... See more

There are some important changes underfoot in private markets:

1. Returns are compressing - few funds are able to consistently achieve the necessary spread over the risk-free rate to justify fees and illiquidity.

2. LPs are segregating bi-modally: 1) a growing group of smaller family... See more

Chamath Palihapitiyax.com

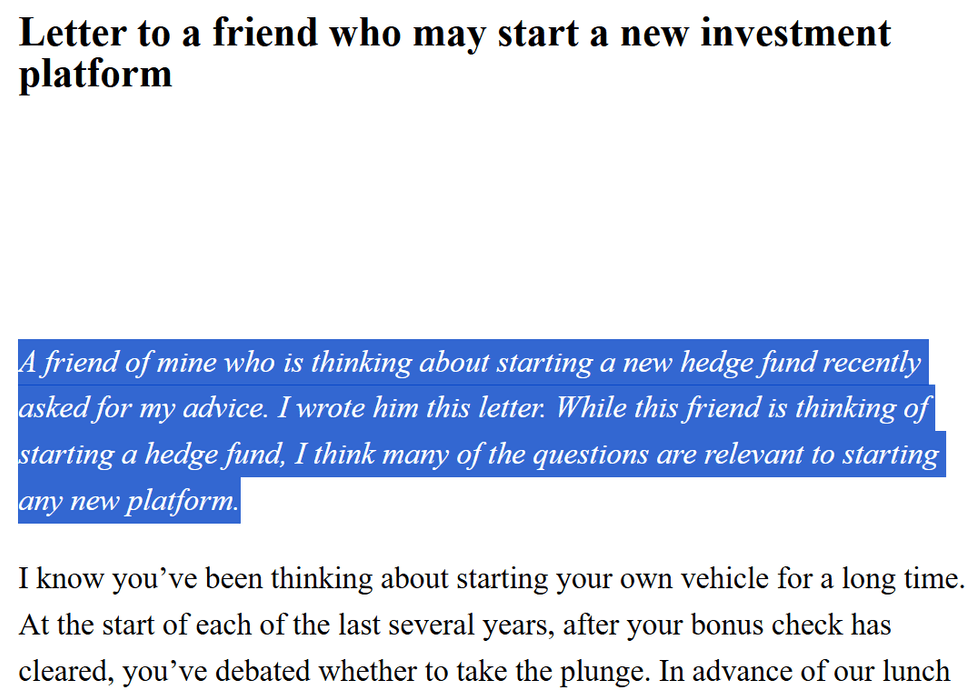

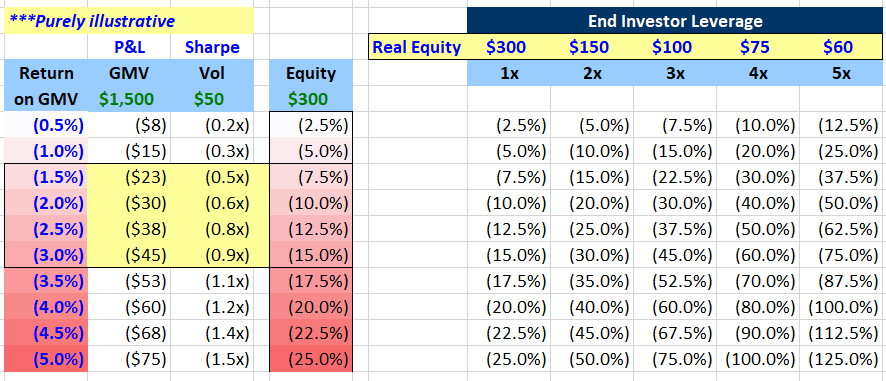

BLOOMBERG ARTICLE ON SYSTEMIC RISK FROM PODS

Some interesting points in this Bloomberg article on multi-manager funds.

A couple points stood out to me, and there were a couple points I would add. What stood out:

1) PODS ARE BIG. 30% of HF GMV per GS report (does... See more

I'm obsessed with building a Personal Holding Company.

The idea: build dozens of cash-flowing businesses, partner with great operators to run them.

Who is/has done this effectively?

Few people come to mind:

- @jspujji

-... See more

Alex Liebermanx.comIn it’s heyday, Goldman’s special situations group was the navy SEALs of money making. Today’s guest, Alan Waxman, used to run that group before leaving to build Sixth Street, now a $115b behemoth.

SSG heads were sometimes of the more brainy, nerdy variety. Not Waxman. He is a force of nature and energy who apparently... See more

Patrick OShaughnessyx.com

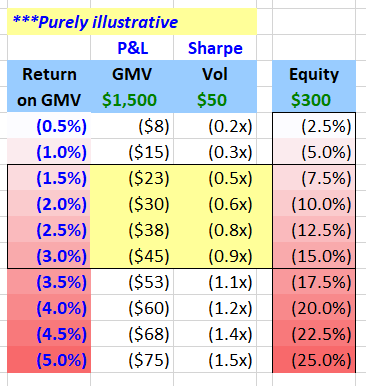

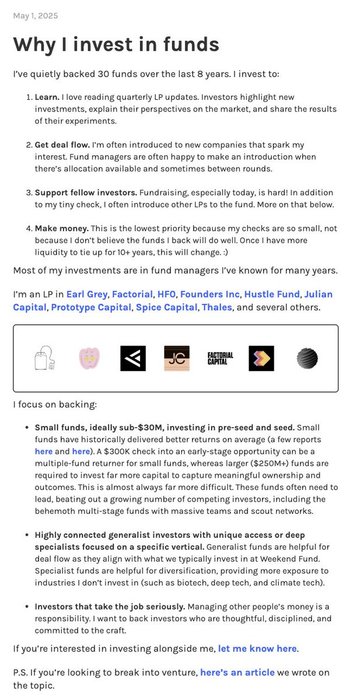

I’ve quietly invested in 30 funds over the last 8 years.

Here's what I focus on and why.

(if you want to co-invest with me as an LP, see the next tweet) https://t.co/2J9sKw23CX