Sublime

An inspiration engine for ideas

The magic formula uses last year’s earnings.

Joel Greenblatt • The Little Book That Beats the Market

Ed Thorp is a trading legend with one hell of a resume:

- Godfather of quant investing

- Created the first card-counting system

- Founded the first quant hedge fund

He also crushed the market & returned ~19% CAGR for 30... See more

Meet Joel Greenblatt, A true investing wizard (Averaged 40% annual returns for 20 years)

Here are 7 books he believes every investor should read 🧵 https://t.co/18JuAQ0hul

Eric Mandelblatt started Soroban Capital at 35 with $500M and built it into a $10B fund over 15 years.

He has compounded at a 21% CAGR since inception, and is an expert at investing in cyclical stocks most investors won’t touch.

Let's dive into his investment strategy + story:

Sahil Khetpalx.com

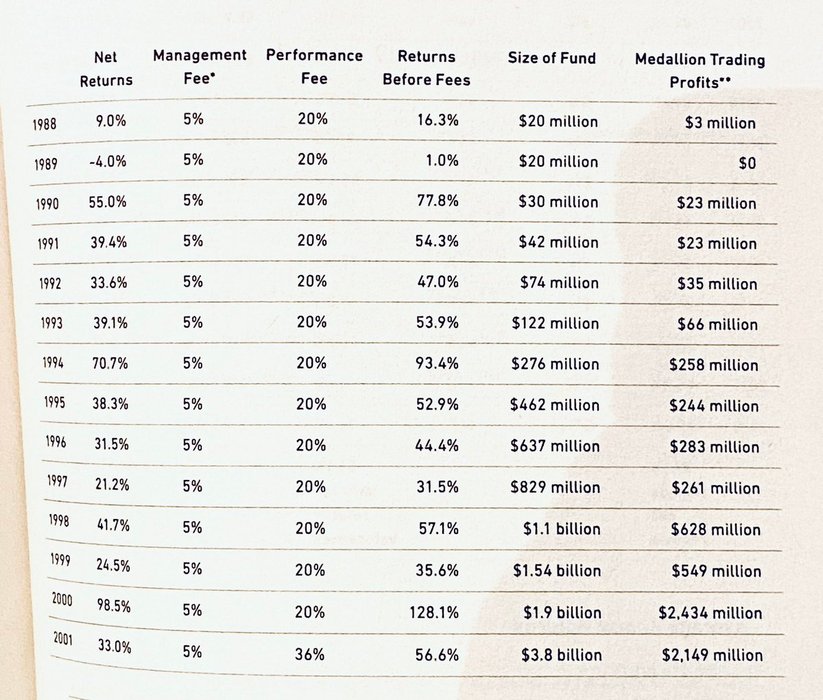

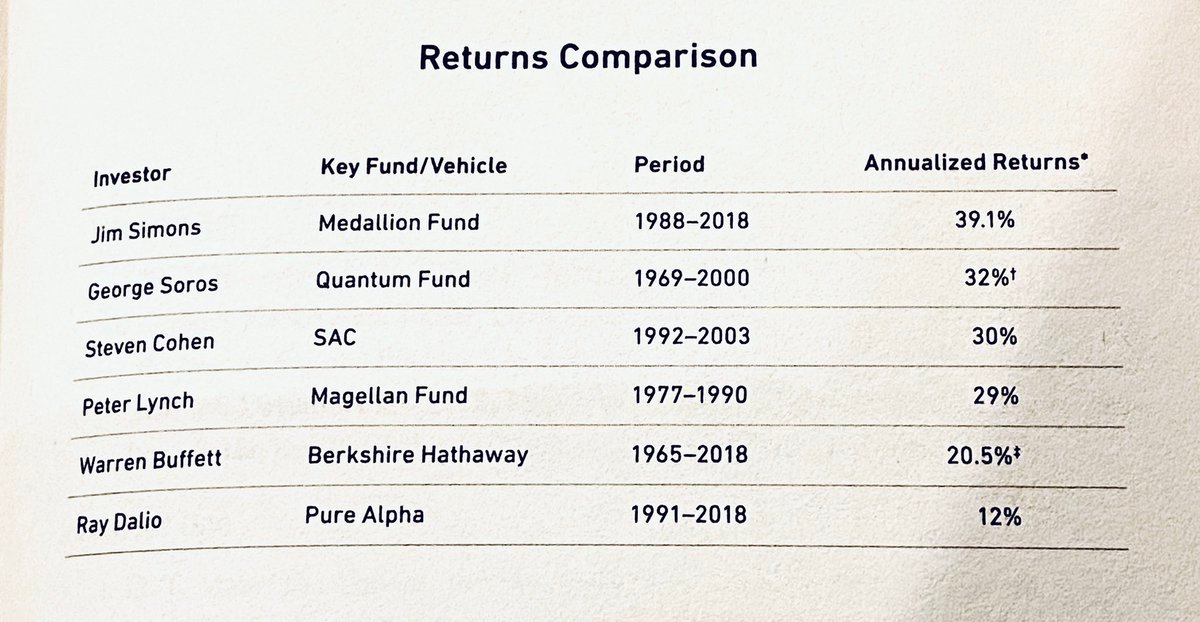

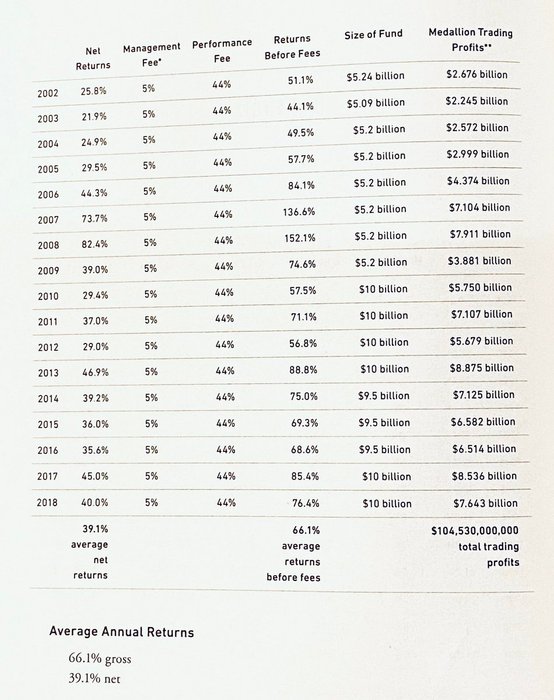

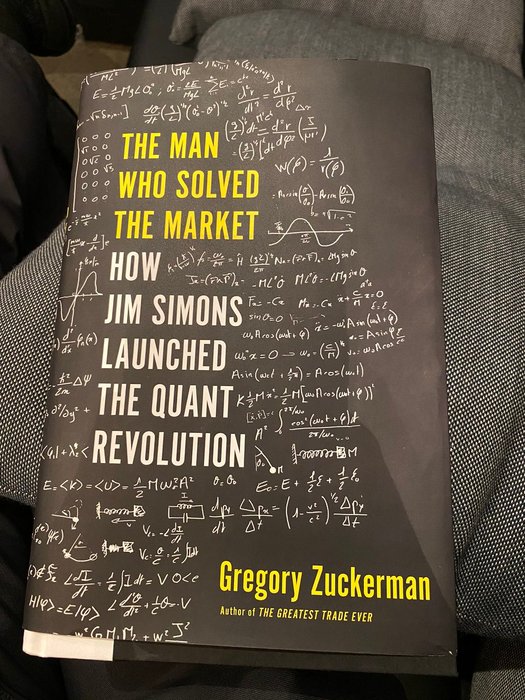

Reading the biography of Jim Simons, one of the most successful investors of all-time.

“Work with the smartest people you can, hopefully smarter than you.. be persistent and don’t give up easily.”

Here are his returns. https://t.co/l4mZiZusEB

The success of each fund entirely rests on the top one to three companies in the fund. There’s often even a large gap between the returns from the No. 1 company and those from the runner-up. Fred Wilson, co-founder of Union Square Ventures, uses a heuristic of thirds: “one deal returns the fund, another 3 to 4 deals return it again, and the rest

... See more