Sublime

An inspiration engine for ideas

Lexy McDonald is the 22y old founder of Her Help, a wellness & girlhood app:

> 197,219,176 views over 5 accounts

> 3,190 posts in 3 years => 3/day on avg

Quick breakdown of her TikTok content formats: https://t.co/sjLkqa0s41

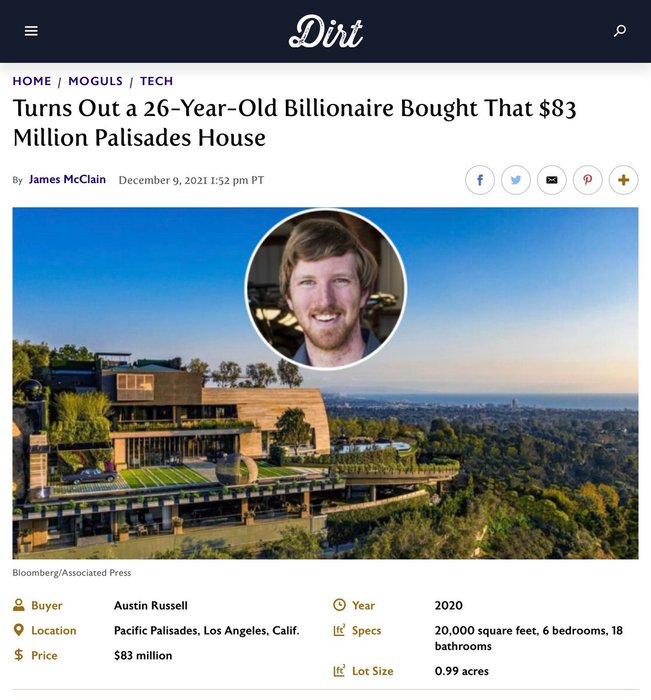

The spoils of tech mega-grift: $LAZR founder Austin Russell owns the $83m house from Succession. The stock, which was pumped to the dumbest investors by mega-banks, has lost $15.8bn since 2021 (down 77%). The biz had $41m rev, a negative 148% gross margin & lost $446m last year. https://t.co/vDBN4aOk8t

Wealthfront has stalled out around $21 billion in assets under management (AUM) as it faces stiff competition from well-funded incumbents, and it still loses a lot of money. It charges only 0.25% of every dollar it manages for accounts with over $5,000.

Benjamin Rollert • Not Boring Memo: Composer

Thanks to a new licensing agreement, Facebook now pays NYT directly for content.

The (Not Failing) New York Times — Mine Safety Disclosures

Some highlights have been hidden or truncated due to export limits.

Michael Lewis • Going Infinite: The Rise and Fall of a New Tycoon

Once again, the conventional VC wisdom is wrong, argues @kirstenagreen in @theinformation opinion. This is going to be a spicy one. https://t.co/UIlNPMT2NM

Jessica Lessinx.comKatie: It's a great question. We're seeing that the middle class suffers in traditional institutional settings. Crypto democratizes participation. Investigative reporting is an area where crypto can help - we've seen crypto crowdfunds take off.

Ezra Klein • Opinion | A Crypto Optimist Meets a Crypto Skeptic (Published 2021)

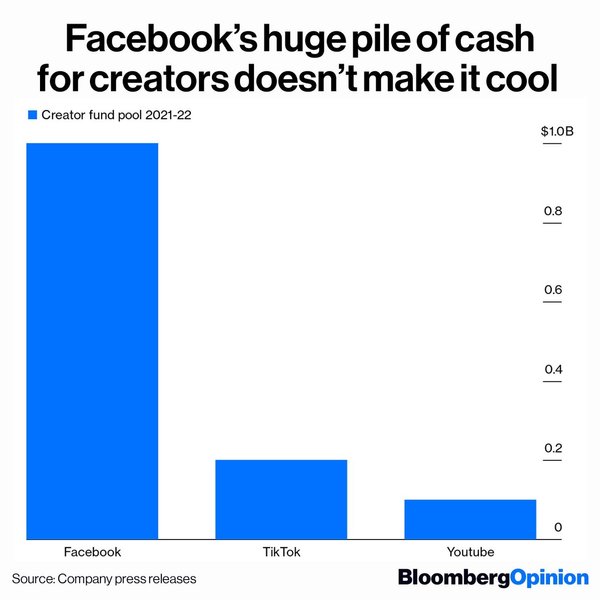

Facebook is betting big ($1 billion) to get its piece of the creator economy. But even for a dominant technology platform, money alone doesn’t guarantee success.

Facebook’s move is intended to counteract TikTok’s soaring popularity with new influencers and the rapid growth of other startups that enable artists and... See more

instagram.comThis is a marketplace and valuations can go up and down, but valuations are not as important as understanding who the other investors are, how the business is doing, who the customers are, and who’s on the team.