Sublime

An inspiration engine for ideas

Motilal Oswal released 2023 wealth Creation study

Sharing my old Curation of the Motilal Oswal Wealth Creation Studies (27 in total) in one place. {1996 to 2022} https://t.co/4a6qtXFCWc

The Future is Small: Why AIM will be the world's best market beyond the credit boom

amazon.com

Media-first investor

Darren LI • 1 card

Future of Wealth Management and Investing

sari and • 64 cards

StocksToWatch

Vansh Aggarwal • 1 card

VCs are facing the "Big Budget Effect" that is plaguing Hollywood studios right now. In the year 2000 you had just three movies that had made $1B+. Titanic, Jurassic Park, and Star Wars Episode I. Today you have 45+ movies that have made over $1B, and some of them have made $2B+ like Avengers and Avatar.

Kyle Harrison • The Death of a Venture Fund

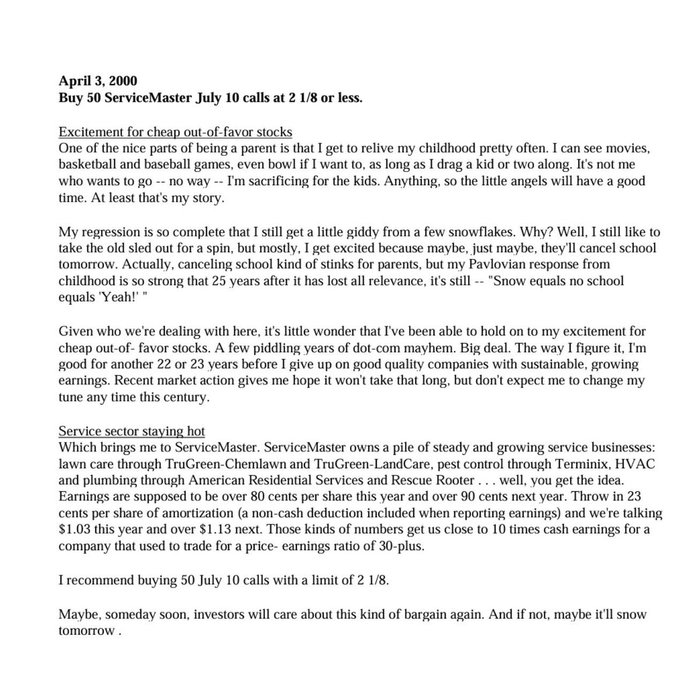

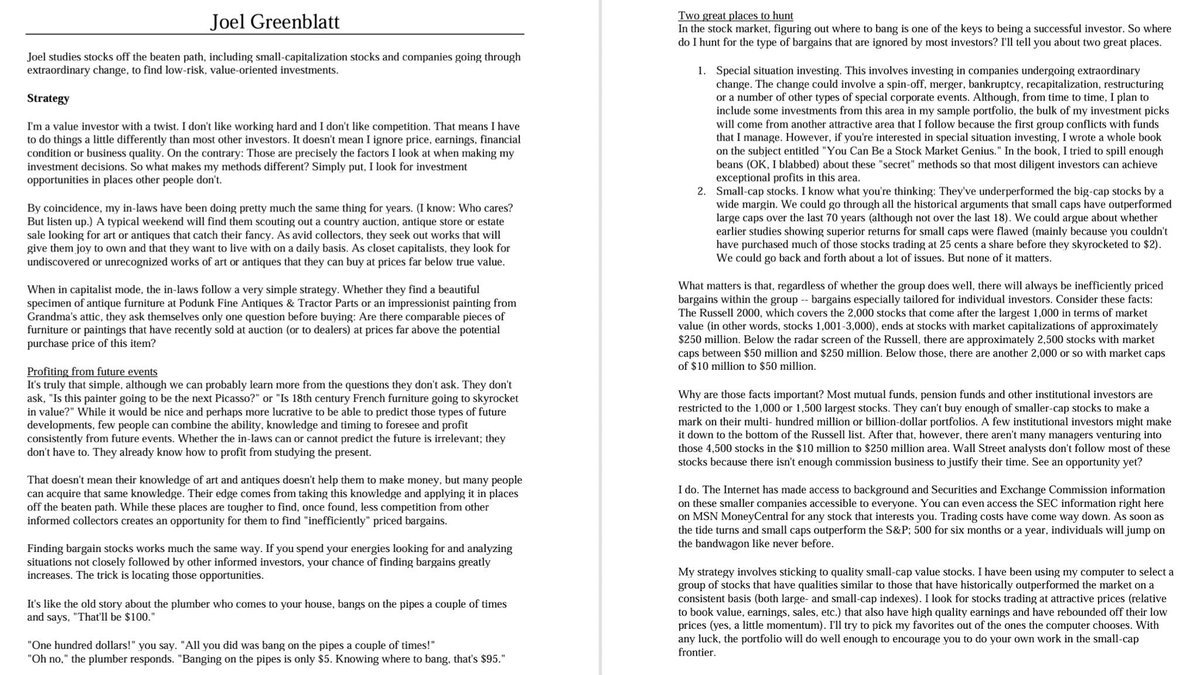

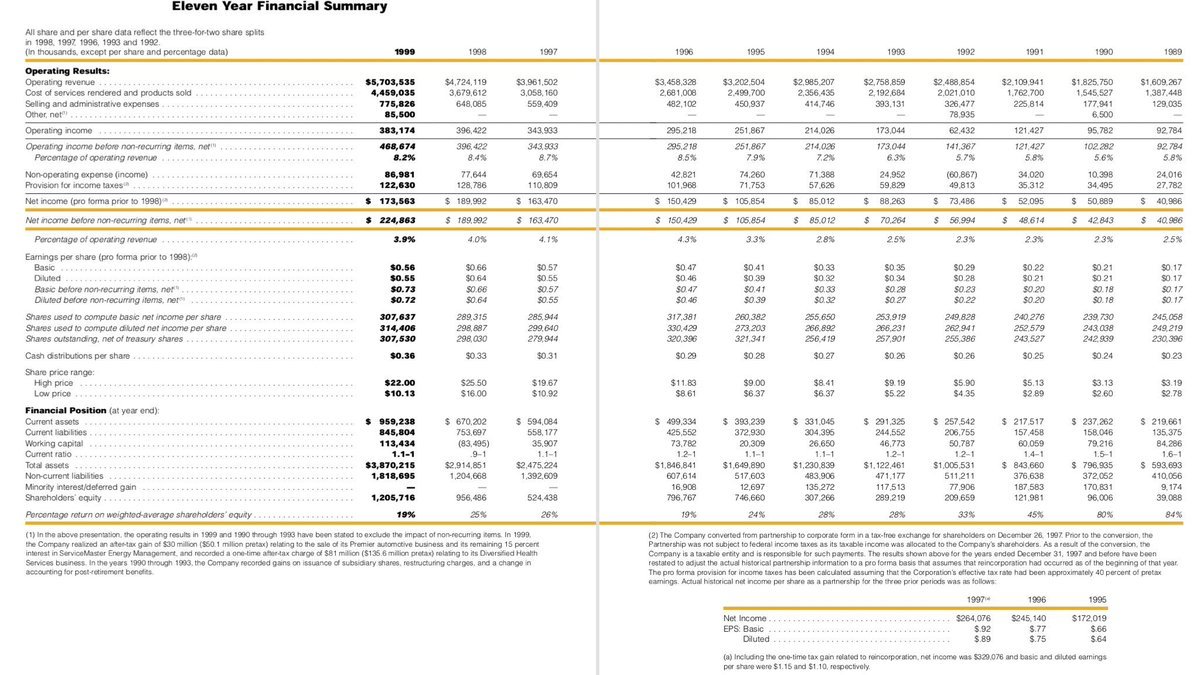

How does Greenblatt invest his PA?

One example: Calls options on “growing service businesses” when they trade for “close to 10 times cash earnings.”

Here’s a writeup and his bio from 2000: https://t.co/87YcVFyI5R

Burry is all in on China

Last week he reported that he upped his stake in 3 Chinese stocks

JD $JD - added 100%

Baidu $BIDU - added 66.7%

Alibaba $BABA - added 29%

David Tepper, who is extremely bullish on China, owns all three of... See more