Sublime

An inspiration engine for ideas

CRE Bubble update. 1/5th of its original value! money heaven getting crowded. @TripleNetInvest

August 21 – Bloomberg (Natalie Wong and Carmen Arroyo): “Money managers who bought a $705 million commercial-mortgage bond tied to Manhattan’s Worldwide Plaza building are at risk of substantial losses after the property’s... See more

Lawrence Lepard, "fix the money, fix the world"x.com

In 2004, Michael Bloomberg started the biggest war in Wall Street history.

After discovering Reuters' secret plan to steal his $20 BILLION empire...

He launched a response so brutal, he nearly destroyed the rival firm forever.

Here's the full story: 🧵... See more

Every morning at first light, he walked the course alone with a caddy. “I was so bad I didn’t want to bother anyone else,” he told me. He bought balls by the dozen from Costco, hemorrhaging them into water hazards and woods.

Between rounds, he read.

T. Rowe Price had given him the archives of all 50 New Horizons shareholder letters. Ellenbogen was... See more

Between rounds, he read.

T. Rowe Price had given him the archives of all 50 New Horizons shareholder letters. Ellenbogen was... See more

Attention Required! | Cloudflare

To protect against default, the Exchange required full cash collateral to borrow gold. But that was an opening for speculations by clever traders like Gould. If a trader bought gold and then immediately lent it, he could finance his purchase with the cash collateral and thereby acquire large positions while using very little of his own cash.

Charles R. Morris • The Tycoons: How Andrew Carnegie, John D. Rockefeller, Jay Gould, and J. P. Morgan Invented the American Supereconomy

In a matter of months, Meriwether and his colleagues had lost nearly $2 billion of personal wealth, marks on their careers they would never erase.

Gregory Zuckerman • The Man Who Solved the Market

Zach Horwitz

@zachhorwitz

anyone, the market crashed. SoftBank’s stock sank more than 90 percent by year’s end, and Masa himself lost $70 billion—more wealth than any single investor had ever lost.

Reeves Wiedeman • Billion Dollar Loser: The Epic Rise and Spectacular Fall of Adam Neumann and WeWork

Fired at 39. Took $10M, now worth $100B. He built a machine every trader on Wall Street can’t live without. You’ve definitely used his product.

Toad Capitalx.com

One of my favorite stories ever.

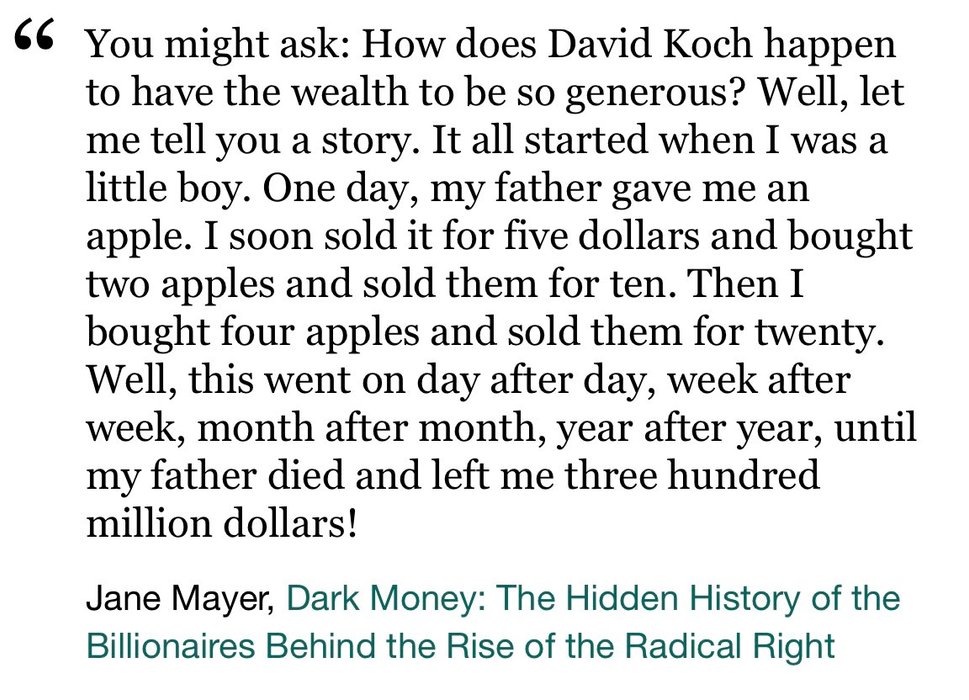

David Koch—industrial magnate, arts patron, plane-crash survivor, Libertarian Party VP candidate, bon vivant, absolute Chad, and by far the more fun member of the Koch Brothers duo—understood scale. https://t.co/DU6VI58qAn