Sublime

An inspiration engine for ideas

Spent 7 hours researching a true master of small cap private equity:

- 586 transactions

- Acquire $1 million to $10 million EBITDA companies

- Average deal $12 million

- 72% IRR

- 7x cash on cash returns

He had two rare public... See more

PrivateEquityGuy (Mikk Markus)x.comJeff Horing has never done an interview like this because he’s too busy investing at Insight Partners.

Despite having built a $100B investment firm, he feels like he’s as in the weeds as he was during the firm's early days. As he said, “My schedule is dictated by 24-year-olds.”

Insight does... See more

Patrick OShaughnessyx.com

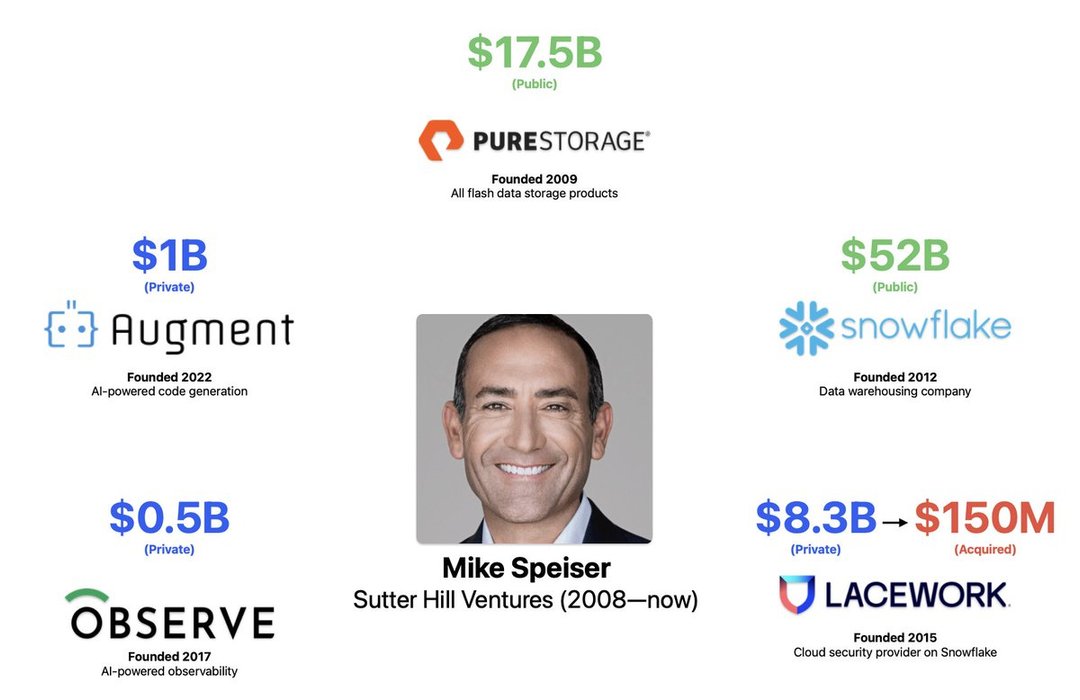

More firms are incubating companies as early-stage valuations rise.

A few successes:

• Snowflake ($49B mrkt cap) by Sutter Hill Ventures

• Affirm ($6B mrkt cap) by HVF Labs

• Hims & Hers ($1.3B mrkt cap) by... See more

Yamauchi No.10 Family Office

y-n10.com

He was Uber CEO Travis Kalanick's right-hand man.

Meet @emilmichael, Uber's former Chief Business Officer who helped the company raise $15B.

(00:00) Fighting the "Taxi Mafia" in Italy 🤬

(04:03) Tips for building on-the-ground teams

(09:56) Founders "going direct"... See more

Jason Levinx.com

napoleon bonaparte’s heir runs a search fund to buy small cap services business https://t.co/NGMTYppewu

GLP1s have added $1T in market cap to Eli and Novo over the last 5 years. That's 3x+ the market cap created by all biopharma startups over the last 30 years combined. This is a bit of an indicment of the biotech startup ecosystem. There are many $1T and even $10T drugs to be invented, we just don't fund them. Through no one persons fault, the... See more

Blake Byersx.com