Sublime

An inspiration engine for ideas

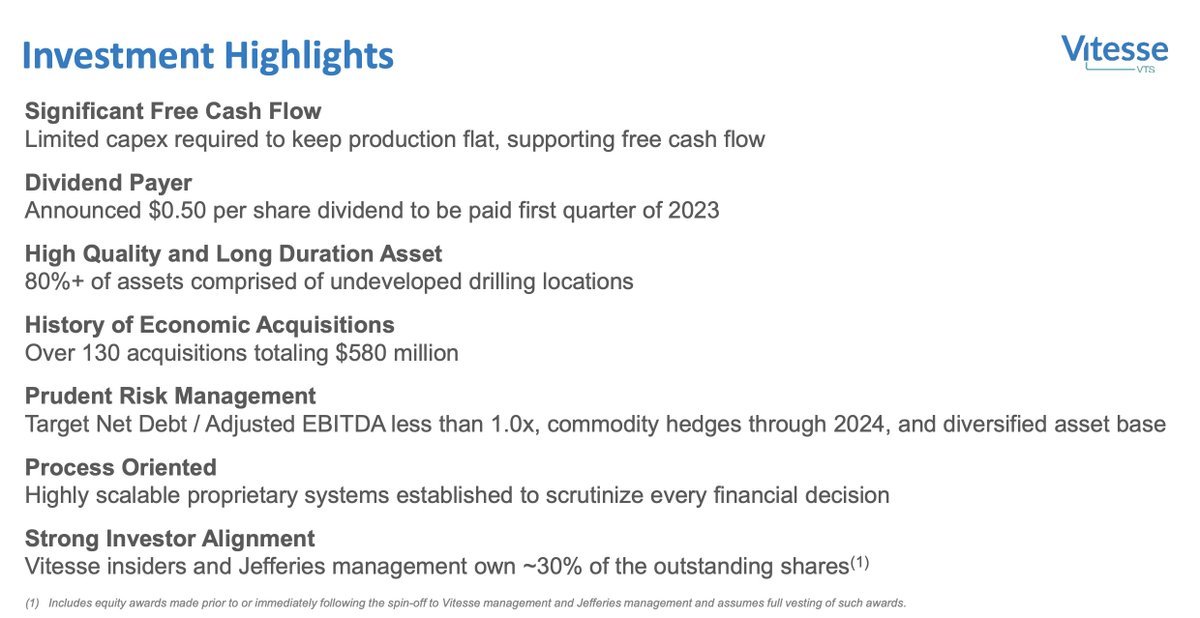

A write-up about a recent spin-off is available on Focused Compounding:

Vitesse Energy $VTS: A 10% Dividend Yield and Discount to “PV-10” Make this Spin-Off a Cheap Speculation on Oil

• Solid B/S

• Insider buying

• $60m share repurchase program

___L... See more

I opened my dividend growth portfolio in 2011 with about $100 and very small monthly contributions.

Since then…

The portfolio has grown an average of 43% each year (including my contributions).

Dividend income has grown each year by an average of 39%. https://t.co/nf2Wska3rT

Get yourself a dividend check EVERY MONTH

Jan- $FDX $PEP

Feb- $AAPL $MA

Mar- $JNJ $CVX

Apr- $NKE $WMT

May- $LOW $ET

Jun- $NEE

Jul- $BBY $MDLZ

Aug- $DE $ACN

Sep- $KO $MSFT

Oct- $JOM $MRK___LINEBRE... See more

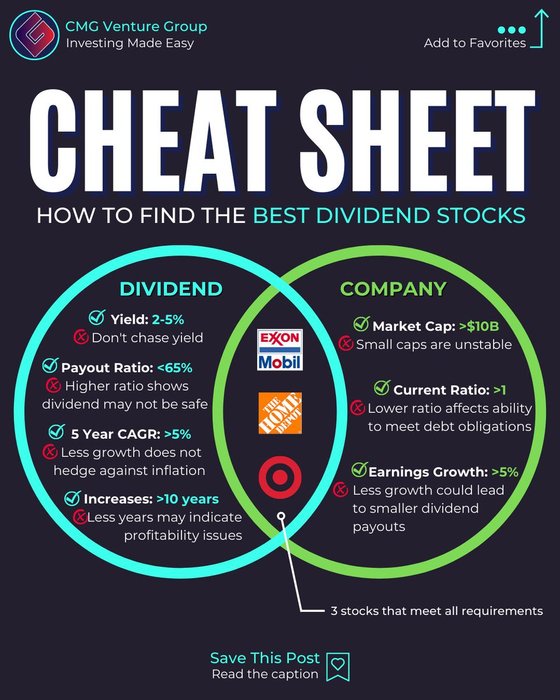

@RuffinFinance Agreed, the high ratio could be due to falling stock price or just be unsustainable in the long run.

I use this cheat sheet when choosing the right dividend stocks. https://t.co/MYIm5neQoc

Gentleman’s Idea #1:

Stonex Group $SNEX

Allocation: $30,000

Current Price: $98

Target: $120

Stonex Group, preciously INTL FC Stone, is a sleepy Futures Brokerage that has rapidly evolved into one of the largest agricultural and metals ... See more

Some R2000 $iwm names with both high ROIC and good capital allocation factors (do your own DD!):

$AGX

$IDT

$ZIP

$CVLT

$MQ

$CORT

$ATEN

$LZ

$FC

$FC

$RMNI

Ryan Telfordx.comInvestments

Joel Martinez • 1 card

There are plenty of options for building a Dividend Empire:

Dividend Growth

$HD

$DG

$MA

$TXN

$ABBV

$AVGO

Blue-Chip

$KO

$PG

$JNJ

$PEP

$AAPL... See more

Dividendologyx.com

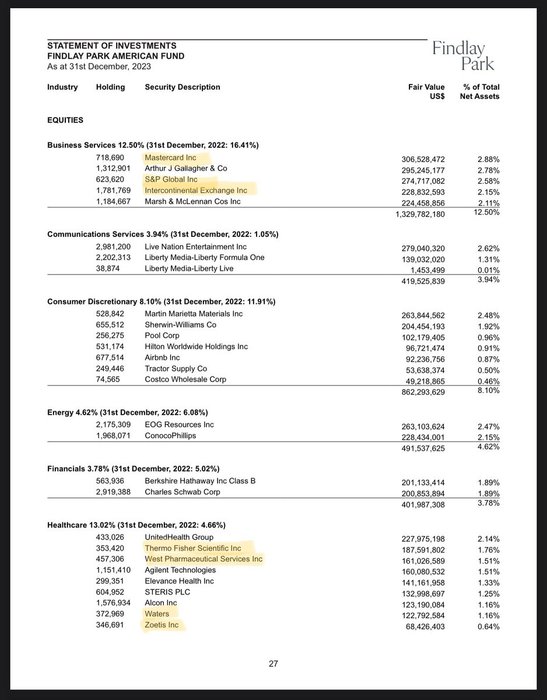

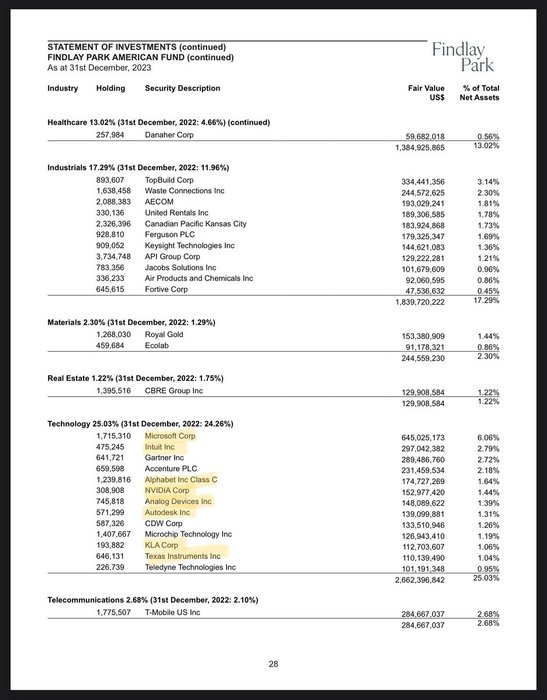

Here are the holdings in the Findlay Park American fund.

I’ve highlighted the companies that I own and would invest in.

Any thoughts on the portfolio? https://t.co/tfuwBKxqp2