Sublime

An inspiration engine for ideas

A major new project, funded by Emma Bloomberg’s education nonprofit Murmuration, in partnership with the Walton Family Foundation, is trying to fix that knowledge gap by releasing one of the largest and most in-depth surveys ever completed on Gen Z.

Peter Hamby • Out with The Olds!

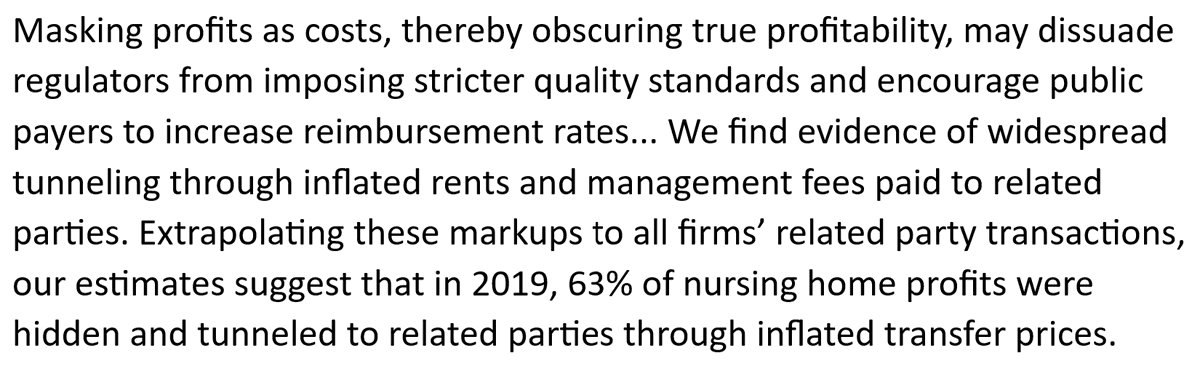

A study @Arnold_Ventures funded shows how for-profit nursing homes are increasingly funneling money to subs through above market rent and management fees, then claiming weakening profitability demands higher reimbursement rates. https://t.co/rfZctd6Iub

Publications

shristi • 1 card

Valuation

sari and • 8 cards

The Parisian elite convinced their friends in business and finance to vote for this. Its hilarious. All these guys go to the Ecoles where they’re taught vague PoMo leftish stuff that makes them irrationally afraid of ever-looming fascism. Enjoy losing all your wealth guys! 🇫🇷🤡 https://t.co/XEBPxyvyqW

In other words, a poor kid in the US is nearly four times more likely to graduate from college than a foster kid.

Rob Henderson • Troubled: A Memoir of Foster Care, Family, and Social Class

Universities Under Siege: Exposing the Taxpayer-Funded Leftist Indoctrination Machine

https://t.co/H3AGP74iTk @Saorsa1776

Bannon’s WarRoomx.comHigher education

Alisa Rosenthal • 1 card

Econ/Policy

Bruce Tang • 2 cards