Sublime

An inspiration engine for ideas

David

@dfg

Each ran a highly decentralized organization; made at least one very large acquisition; developed unusual, cash flow–based metrics; and bought back a significant amount of stock. None paid meaningful dividends or provided Wall Street guidance. All received the same combination of derision, wonder, and skepticism from their peers and the business pr

... See moreWilliam Thorndike • The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success

Dave Berkus, one of the first early-stage angel investors (and still actively investing),

Judy Robinett • Crack the Funding Code: How Investors Think and What They Need to Hear to Fund Your Startup

7521382978492791445cantos-ventures-iii-memo--1-

The document provides insights into Cantos Ventures III, LP, its investment focus in frontier tech, and its mission to back technology companies with global-scale impact in areas like climate change, disease, poverty, and armed conflict.

LinkPedro Marcano Delbert

@pdelbert

Filip Sjölander

@vresig

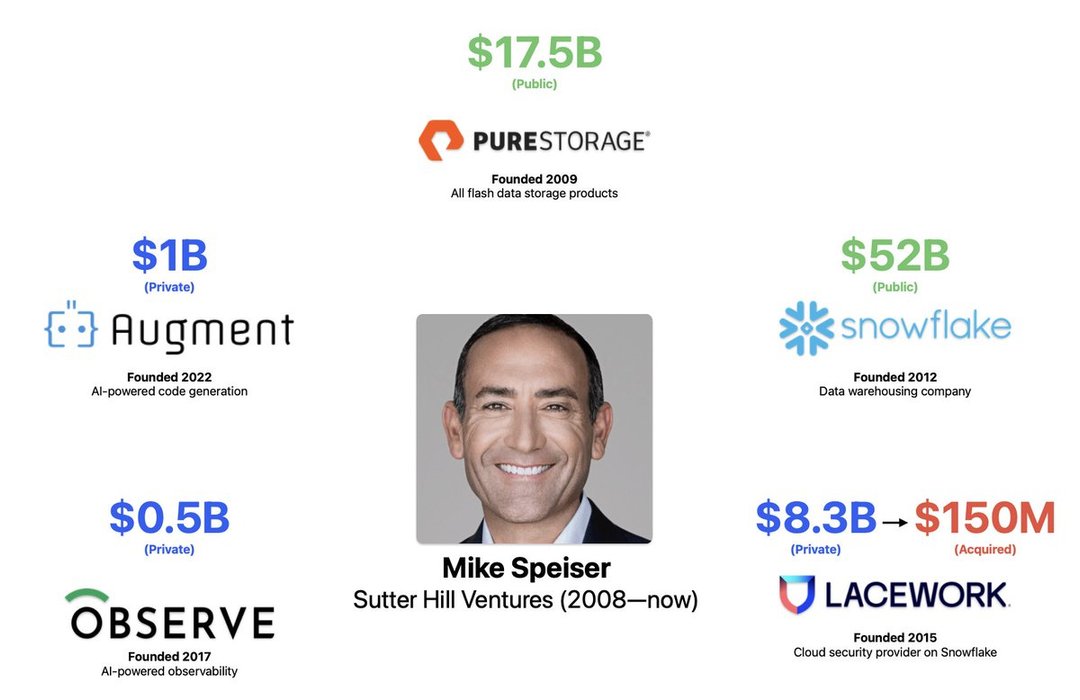

Mike Speiser is one of the most unique investors who isn't as well known outside the valley.

At Sutter Hill, he incubates one startup at a time, acts as founding CEO and gets it off the ground.

His track record is insane, creating $70B of value from 5 companies over 15yrs! https://t.co/B4Gg4pGzmn

Allocations

allocations.com