Sublime

An inspiration engine for ideas

Papers are organised into only three categories: needs attention, should be saved (contractual documents), and should be saved (others).

Marie Kondo • The Life-Changing Magic of Tidying: A simple, effective way to banish clutter forever

If you’re carrying big debt balances and you’re serious about getting rid of them, you’ll need to make life changes. At the very least, you have to break the lifestyle habits that got you into any consumer debt you may have.

Jesse Mecham • You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want

Do you have any automatic debits and memberships that automatically renew monthly or annually? Don’t just let them accrue without deciding if you really need the product or service they’re paying for. If you don’t use it, lose

Nancy Levin • Worthy: Boost Your Self-Worth to Grow Your Net Worth

The last cleansing action suggested is to release the clutter in our life. We take a look in our storage areas and garage. We get rid of the stuff we’ve been packing around for years every time we move. We give it to a charitable organization. We take a look in our closets. Possibly, if we haven’t worn it in a year or a year and a half, we give it

... See moreBill P. • Drop the Rock: 2-Book Bundle: Drop the Rock, Second Edition and Drop the Rock, The Ripple Effect

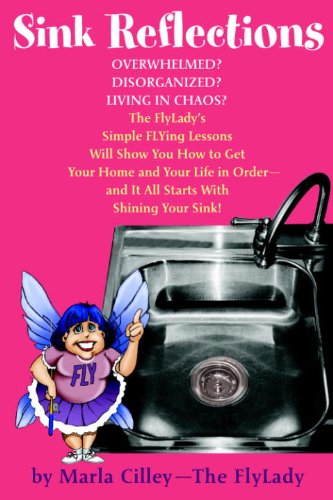

Sink Reflections: The FlyLady's Simple Flying Lessons Will Show You How to Get Your Home and Your Life in Order

amazon.com

Spark Joy: An Illustrated Master Class on the Art of Organizing and Tidying Up (The Life Changing Magic of Tidying Up)

amazon.com