Sublime

An inspiration engine for ideas

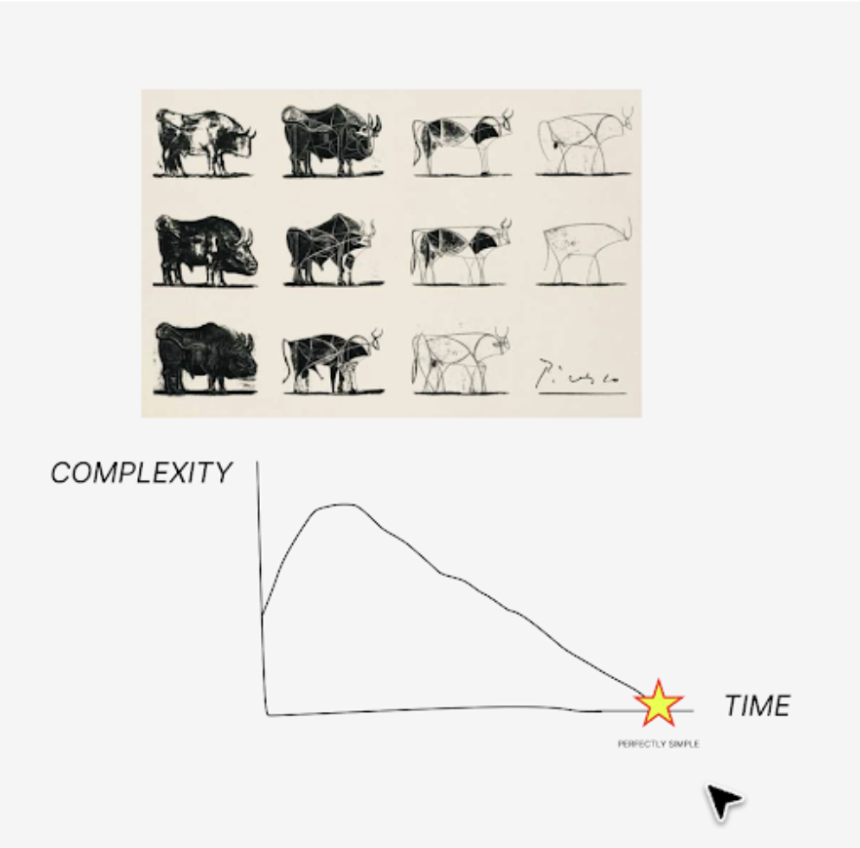

true masters feel the answer before they can explain the answer in words.

If you want to untangle something, like string or a cord, focus on adding as much “looseness” as you can rather than trying to untangle it.

-Kevin Kelly

Idle agents will turn us into even more of productivity monsters

Every industrial leap promised more leisure. Instead, it raised the baseline.

Factories did not shorten ambition. And as agents run 24/7, time becomes even more yield-bearing.

So AI may mean we’ll have more time for “less mundane things”, but markets will likely turn that into higher

... See moreThe man who comes back through the Door in the Wall will never be quite the same as the man who went out. He will be wiser but less sure, happier but less self-satisfied, humbler in acknowledging his ignorance yet better equipped to understand the relationship of words to things, of systematic reasoning to the unfathomable mystery which it tries,

Self-reflection questions on identity, integrity, ego, and regret to cultivate humility, gratitude, empathy, and happiness.

TRANSCRIPT

Am I thinking independently or going along with the tribal views of a group that I want to be associated with? Whose approval am I auditioning for? Which of my principles would I abandon if they stopped earning me praise and recognition? If I could see myself talk, what would I cringe at the most?

What question am I afraid to ask because I suspect I

... See more