Sublime

An inspiration engine for ideas

Asset-Based Valuation There are three main asset-based valuations: book value (BV), fair market value (FMV), and liquidation value (LV).

Walker Deibel • Buy Then Build: How Acquisition Entrepreneurs Outsmart the Startup Game

Now we can understand post-money valuation as the value of a company, immediately after the latest amount of venture capital is invested.

Bradley Miles • #BreakIntoVC: How to Break Into Venture Capital And Think Like an Investor Whether You're a Student, Entrepreneur or Working Professional (Venture Capital Guidebook Book 1)

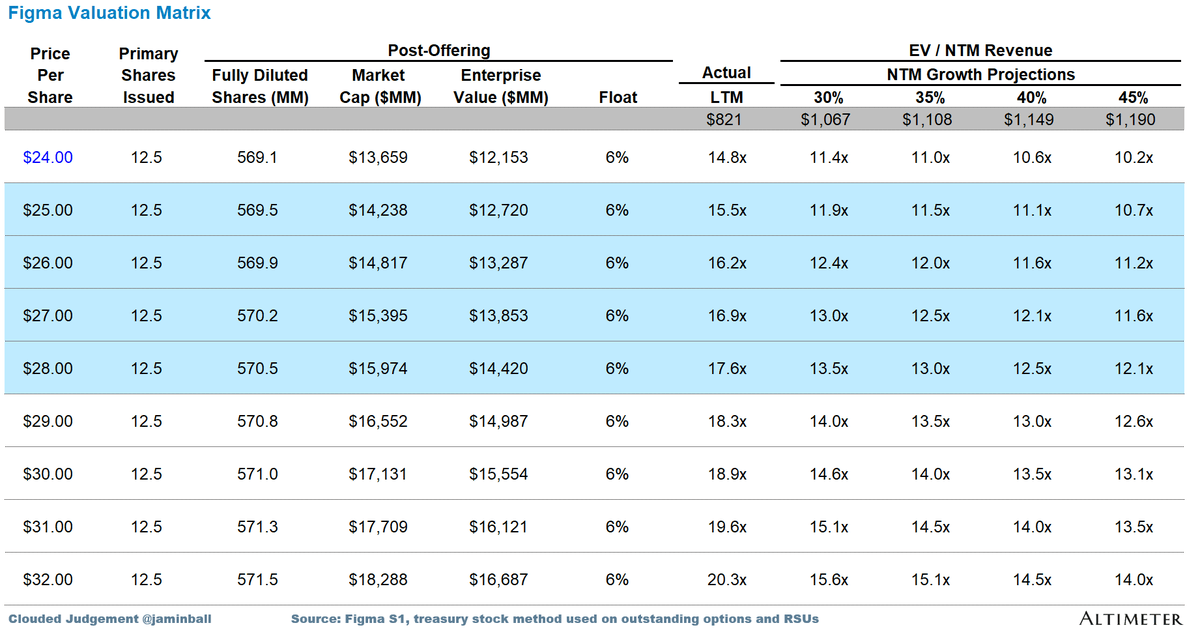

Figma is going public, and just filed an updated S1 with a price range of $25 - $28 / share. At the midpoint this implies roughly a $15b market cap and a ~11x NTM revenue multiple. Company is growing ~46% YoY with 28% LTM FCF margins $FIG https://t.co/HRYORpRQbx

1/7 Quick thoughts on $ADBE acquisition of Figma

In June'21, Figma raised $200 Mn at $10 Bn valuation. Even though a lot has changed since then in the public markets, ADBE just paid $20 Bn for Figma.

No wonder VCs don't mark to market 😉

Here's how I'm thinking ... See more

nametwitter.comAsset valuation is a dollar value assigned to an asset based on actual cost and nonmonetary expenses. These can include costs to develop, maintain, administer, advertise, support, repair, and replace an asset; they can also include more elusive values, such as public confidence, industry support, productivity enhancement, knowledge equity, and owne

... See more