Sublime

An inspiration engine for ideas

The threat to a buy-and-hold program is the investor himself. Following his stocks and listening to stories and advice about them can lead to trading actively, producing on average the inferior results about which I’ve warned. Buying an index avoids this trap.

Edward O. Thorp • A Man for All Markets

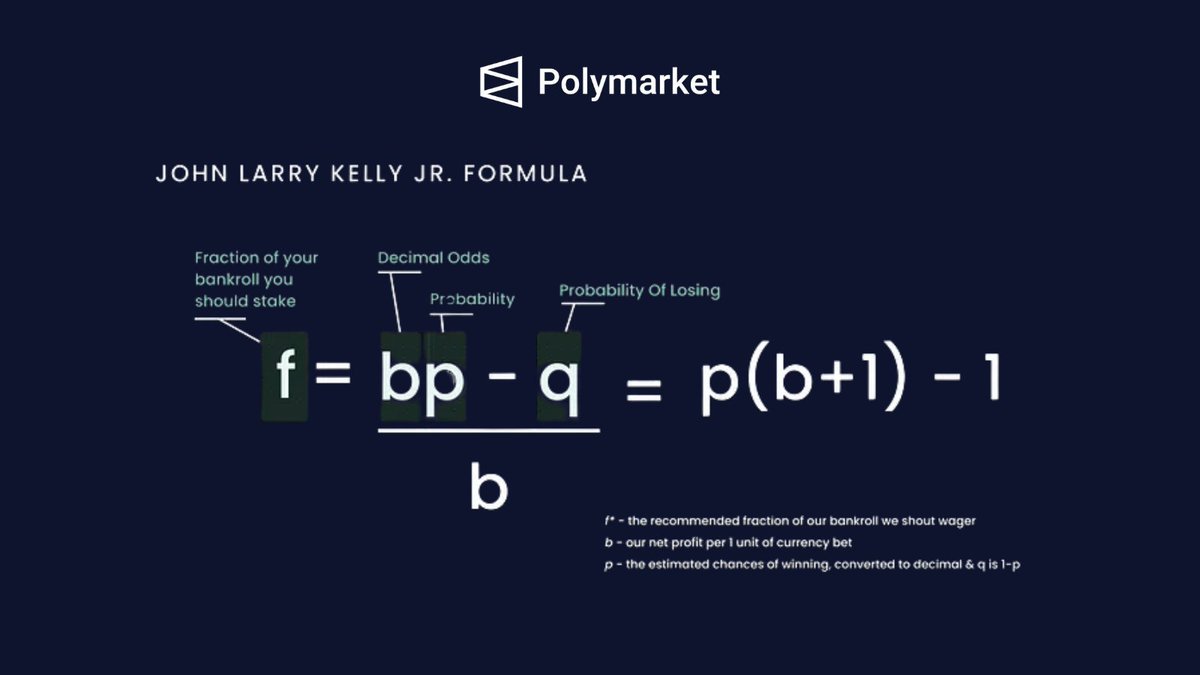

While the equation might appear formidable, it can be further simplified to edge/odds, which is intuitive in operation. If the Kelly bettor is offered an even-money bet with no edge—for example, a coin flip where the bettor can double, or lose, whatever money is wagered—the optimal bet is zero. The Kelly Criterion won’t allow a bettor to take an

... See moreAllen C. Benello • Concentrated Investing: Strategies of the World's Greatest Concentrated Value Investors

To drive that point home, let’s examine some retirement planning models that even a math-phobic would love because they’re so incredibly simple. You can decide for yourself if this overwhelming simplicity changes your conclusion about how much is enough to retire? The first simple model is known as the Rule of 25. According to this rule, you figure

... See moreTodd R. Tresidder • How Much Money Do I Need to Retire? (60 Minute Financial Solutions)

When faced with a choice of wagers or investments, choose the one with the highest geometric mean of outcomes. This rule, of broader application than the edge/odds Kelly formula for bet size, is the Kelly criterion.

William Poundstone • Fortune's Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street

The best description of my lifelong business in the market is “skewed bets,” that is, I try to benefit from rare events, events that do not tend to repeat themselves frequently, but, accordingly, present a large payoff when they occur.