Sublime

An inspiration engine for ideas

It’s been almost five years to the day since the idea first hit me.

I was working at Goldman Sachs, watching wealthy clients grow their fortunes. There was nothing magical about it — they just had the one thing that mattered most: capital to compound. https://t.co/265uCx1GJW

Abdul Al-Asaadx.comEmbracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.com

Latest 'Capital Wars' Substack https://t.co/oGSxo7RdUS https://t.co/FMQRQLmrqh

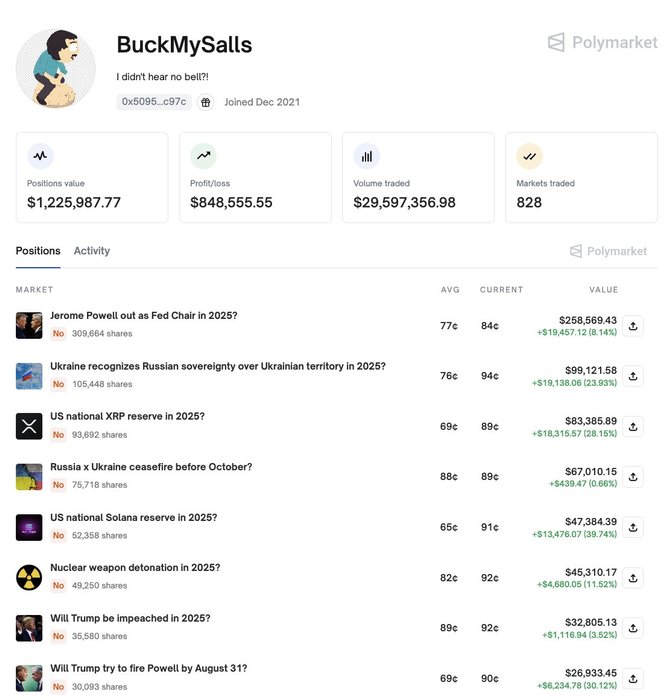

A trader @BuckMySalls (yes, his real name) is printing money betting that nothing will happen.

Nearly $1 million in profit… https://t.co/IbR2qOl6U1

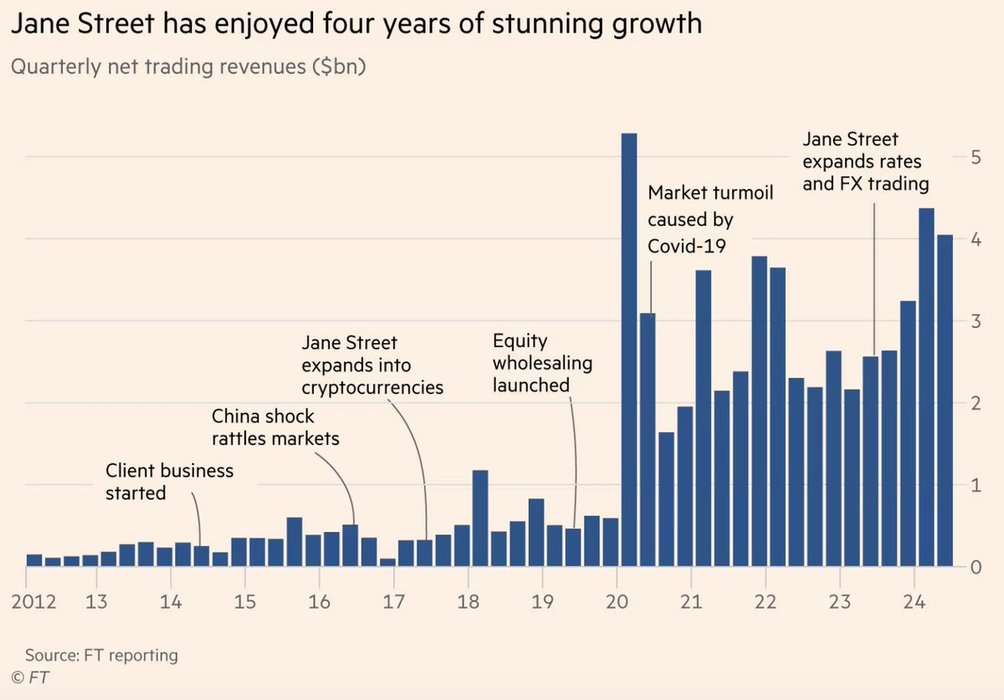

In 2000 a relatively unknown proprietary trading firm was founded - Jane Street Capital

Last year was the fourth straight year Jane Street generated net trading revenues of more than $10 Billion, comfortably beating Goldman Sachs and many others

🧵 Here's how they did it... See more

When the bond market entered its golden era and became known as smart money, the U.S. federal debt-to-GDP ratio was only about 30%. That was a small and nimble market, and one that was effectively priced by professional traders.

Lyn Alden • May 2024 Newsletter: The Bond Market Is the “Dumb Money” Now

He then joined Micky while he was at Stanford GSB. Nikolay joined them from Morgan Stanley, where he was a tech investment banker.

*Dear Micky, if you are reading this, please let me know if the estimates are close.

Ribbit’s Fund I had BBVA and Silicon Valley Bank as institutional investors, rest mostly being high-net-worth individuals. F

*Dear Micky, if you are reading this, please let me know if the estimates are close.

Ribbit’s Fund I had BBVA and Silicon Valley Bank as institutional investors, rest mostly being high-net-worth individuals. F

Allocator’s Notebook: Ribbit Capital Funds I-III, 2012-2017

A short-lived capital stock will manifest in accelerated depreciation and a fragile capital structure will incur an undue interest charge.