Sublime

An inspiration engine for ideas

1/ New investment ideas from VIC 👇

Incl: $IDT, $QRVO and $HUN

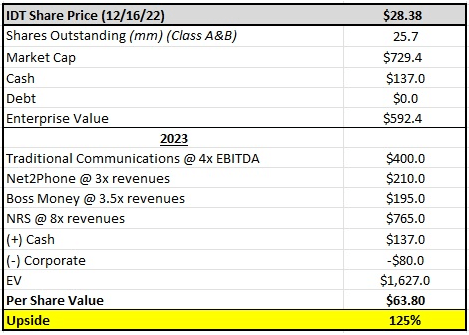

$IDT pitch:

– A founder-led company with an incredibly strong history of value creation.

– Every $1 invested in IDT in 2012 is worth over $35 today.

...👇 https://t.co/4PEzfzxmQA

In 2020 $UWMC made $3B. They used the money to invest in MSRs which have appreciated about $1B or so. They also paid out over $1B in dividends from cash flow. $5B of value created between dividends and book value over 3 years. Co. is poised for refi boom and only valued at $6.6B

Son of a Bichon (Humility and Gratitude)x.com

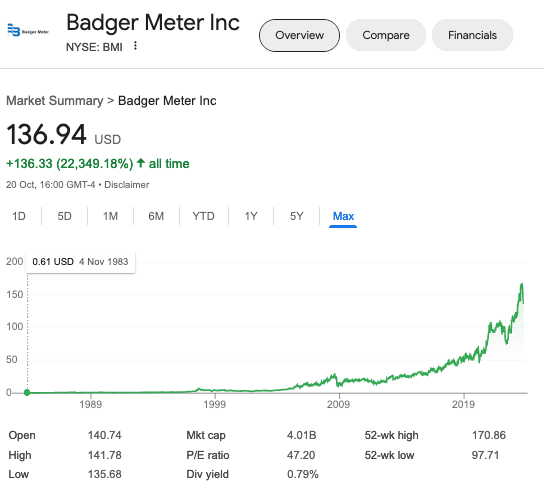

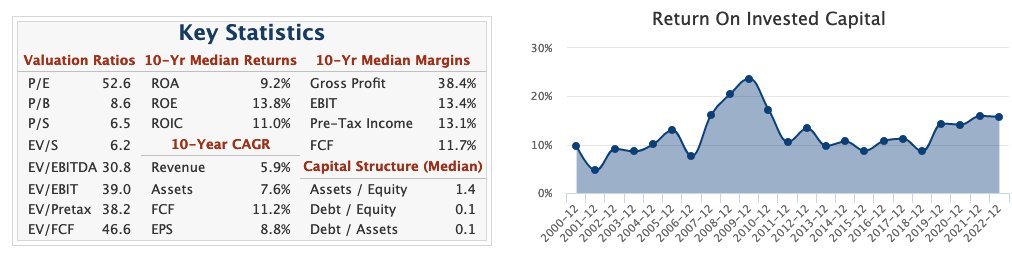

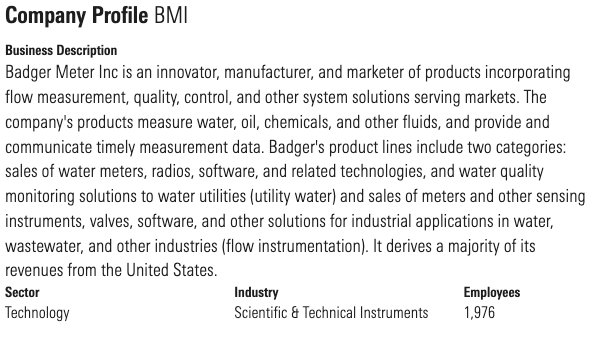

Here's a quality compounder / dividend growth stock you've never heard of...

Introducing: Badger Meter Inc. $BMI https://t.co/NFNah6tvLd

The following Dividend Growth Screen results in over 250 companies for research:

1) Company raised dividends for at least 5 years in a row

2) Sum of Dividend Yield and Dividend Growth > 12

3) Dividend Payout Ratio below 60%

Dividend Growth Investorx.comMy favorite Dividend growth stocks: 📈📈

$ASML ASML

Yield 1.16%

10Y Dividend CAGR 29.95%

$V Visa

Yield 0.73%

10Y Dividend CAGR 16.89%

$LOW Lowe's

Yield 1.89%

10Y Dividend CAGR... See more

TheNextInvestorx.com

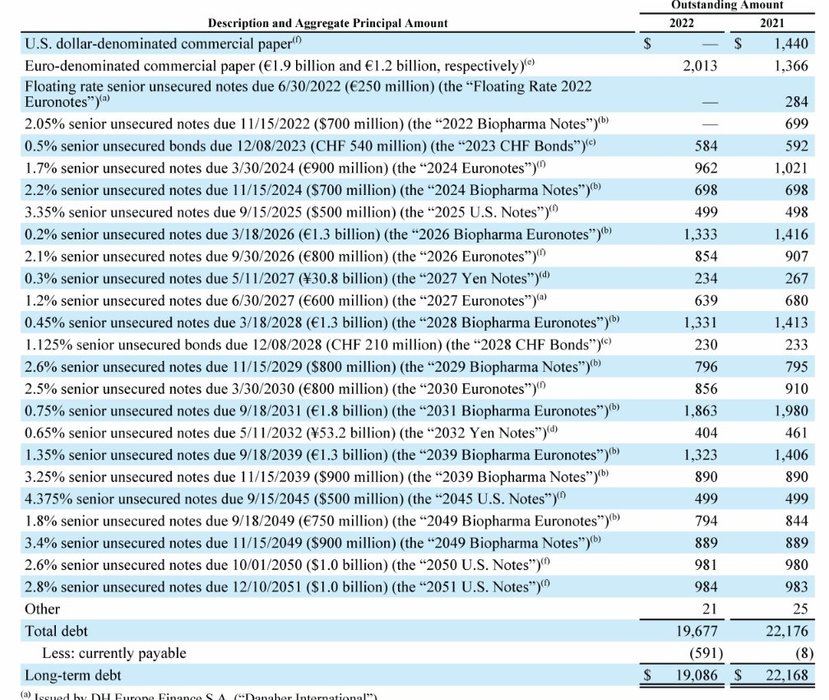

Financing done right. Just look at some of these long-term notes $DHR secured. https://t.co/S6LsbhZT5W