Sublime

An inspiration engine for ideas

The ULTIMATE dividend growth stock portfolio. Get paid dividends every month with these 12 names.

Stocks and their 5 year dividend growth rate (DGR):

$AMT | American Tower: 17.7%

$ABBV | AbbVie: 15.9%

$HD | Home Depot: 16.4%

$NKE | Nike:... See more

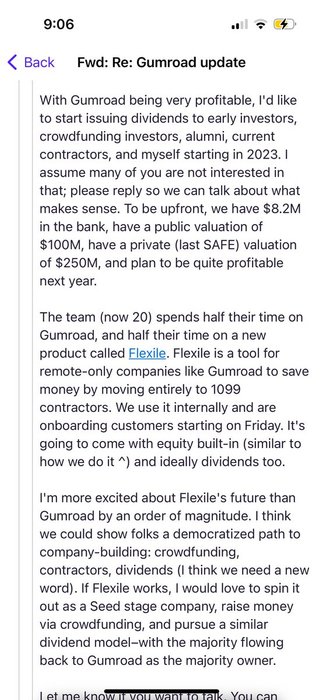

Didn’t take convincing, just asking with intention.

Here are the notes I sent.

(Narrator: everyone was interested in that.) https://t.co/rQZ9EvvO9w

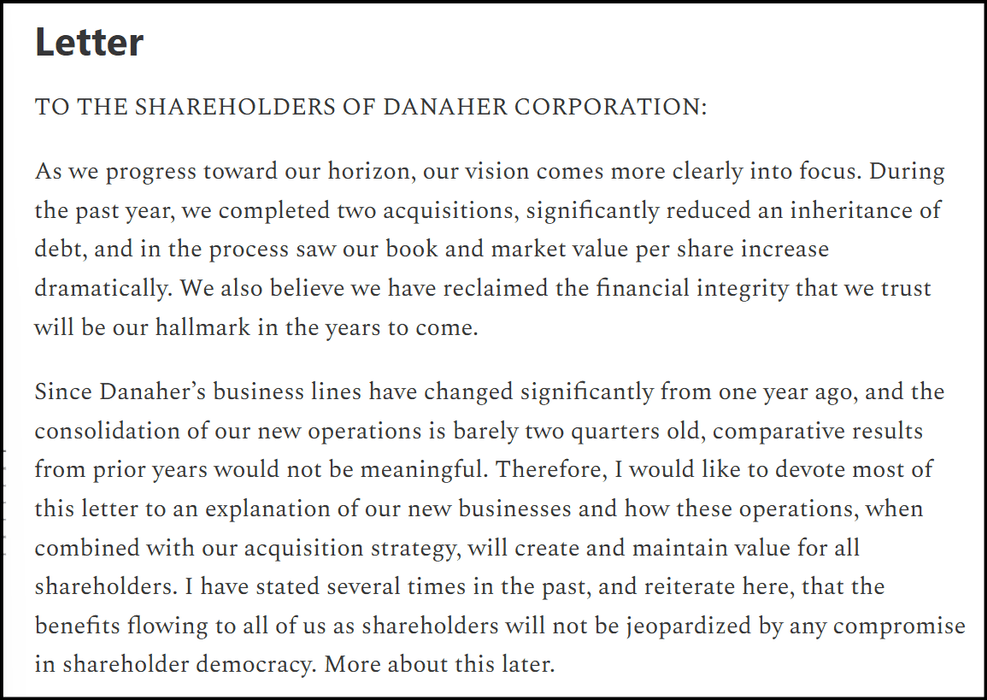

This month marks 40 years since Danaher was founded. And over those 40 years, Danaher has delivered total shareholder returns over 180,000% and is the only US publicly traded company that has outperformed the S&P 500 in every five year period.

Today, I wanted to share with you their very first shareholder... See more

Time flies my friends. My son will be 20 later this year.

Just $250 a month in a dividend reinvestment plan is now worth $353,000 and earns almost $10,000 in dividends.

By all means swing for your fences. But don't ignore the tortoise.

Bob Loukas 🗽x.com

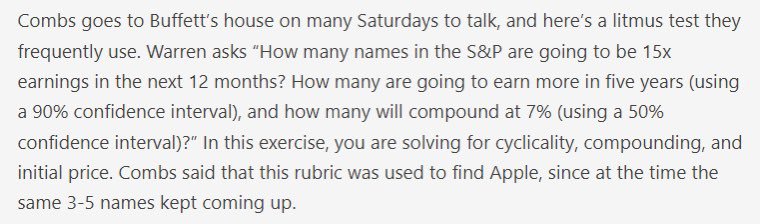

Todd: “Warren, I have a new company that likely clears our hurdle. We used to own it back in 2011. We made a quick 50% on the stock. It’s Dollar General.”

Buffett: … https://t.co/6j16vwZKmk

I opened my dividend growth portfolio in 2011 with about $100 and very small monthly contributions.

Since then…

The portfolio has grown an average of 43% each year (including my contributions).

Dividend income has grown each year by an average of 39%.... See more

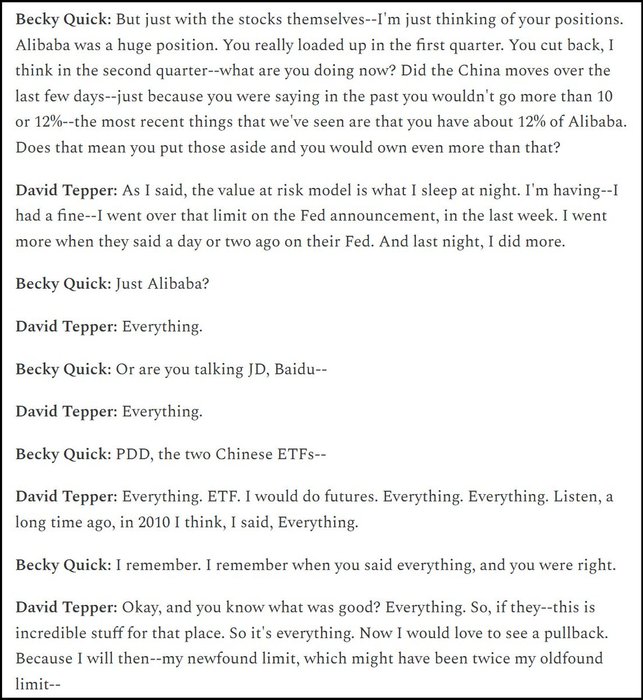

Fourteen years ago, David Tepper went on Squawk Box and shared how he made $7bn in a single year and laid out his worldview and a strategy that worked for the coming decade.

Last week, almost fourteen years to the day, David returned to Squawk Box to discuss China, stimulus, AI, and more. He starts by discussing whether... See more

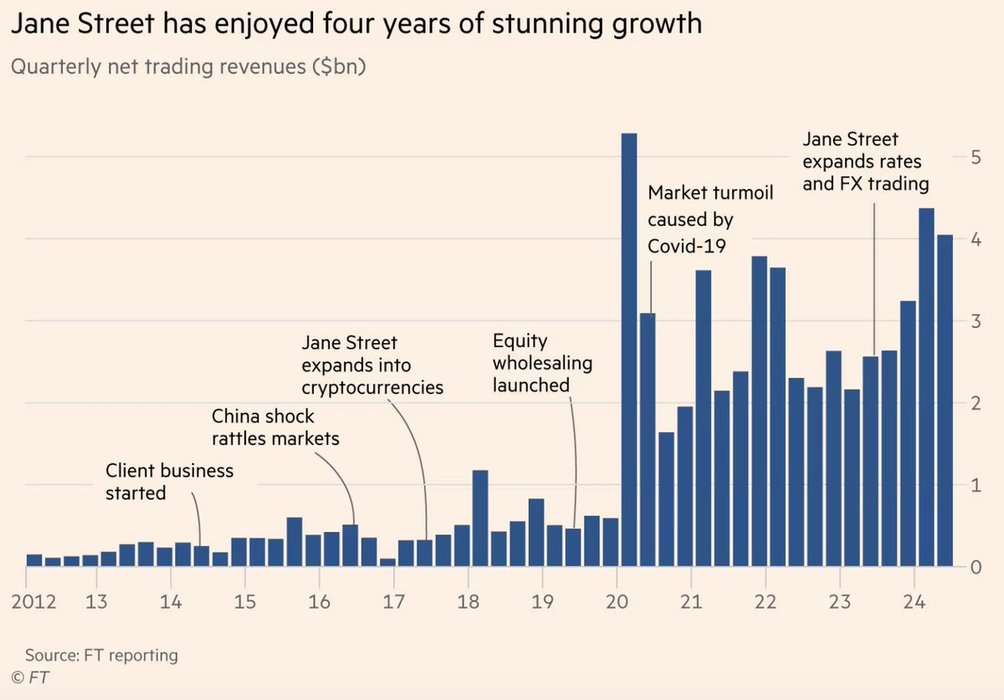

In 2000 a relatively unknown proprietary trading firm was founded - Jane Street Capital

Last year was the fourth straight year Jane Street generated net trading revenues of more than $10 Billion, comfortably beating Goldman Sachs and many others

🧵 Here's how they did it... See more

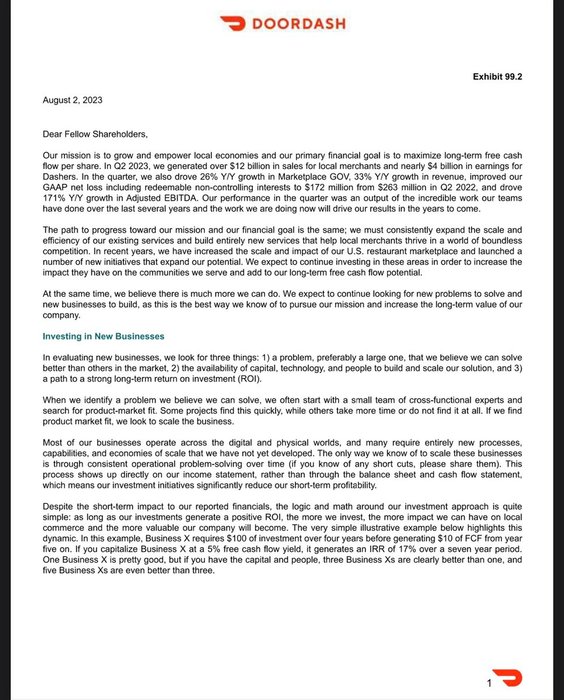

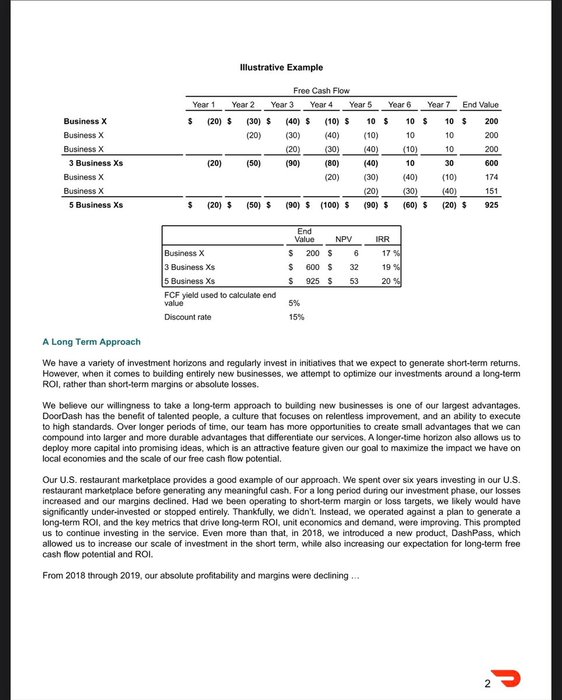

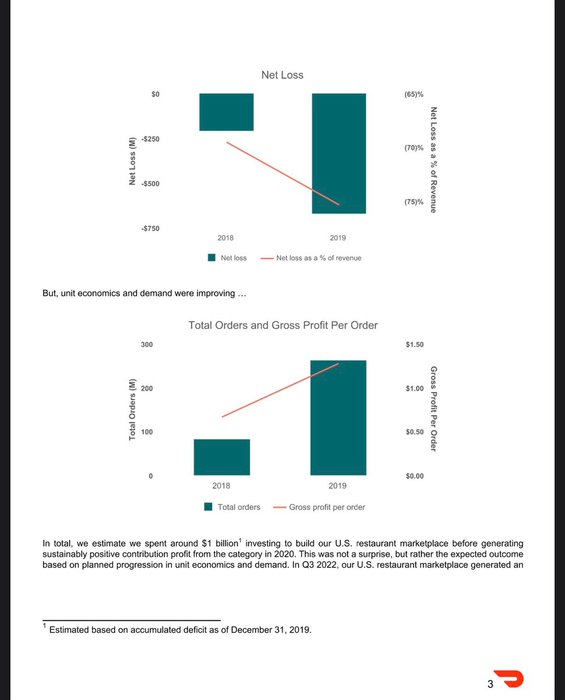

A CFO recently recommended we read DoorDash’s shareholder letters for a simple articulation of their capital allocation strategy and it’s now obvious to me why: this is such a user friendly way of explaining R&D investment in software and internet companies. Summary/notes: (1/) https://t.co/JzAvJBXCDE