Sublime

An inspiration engine for ideas

Home of Trustless, Programmatic Credit

debtdao.org

a portion of that monthly payment you’re making is actually embedded interest because the investors bought it at a discount. So there’s an effective interest component up to this. Pipe actually has thought of this and they have a really nice little report inside their marketplace that shows you the discount or component of interest. And your... See more

Scott Orn • Accounting for startup financing from Pipe

Startups shouldn't put expensive equity $$ into bending metal, pouring concrete, and paying vendors

Debt CAN be a cheap method to finance the "projects" startups need to build to go up the food chain and offer services vs. products vs. tech

Debt repayment can also be a massive drag on the... See more

Rightfoot | Fully embeddable debt payment APIs

rightfoot.com

A debit is a piece of your future that someone else owes.

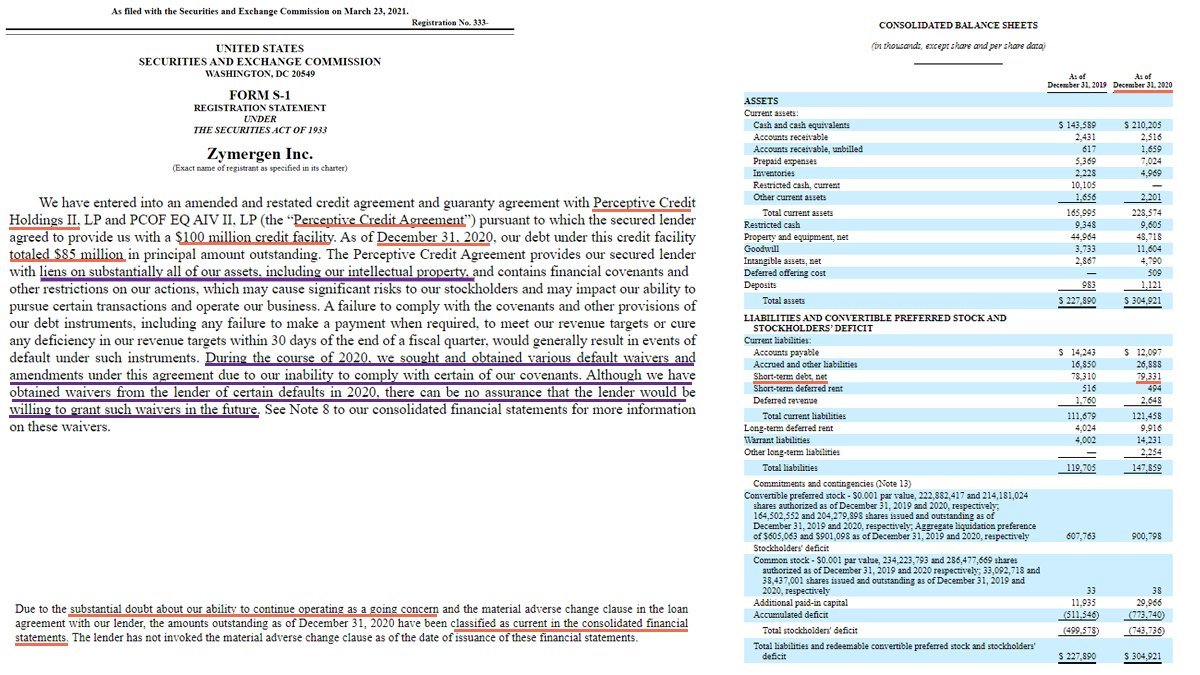

^ Sept 2020 Perceptive / $ZY "growth financing" was actually $100M credit facility

By YE20, $ZY was unable to comply w debt covenant, but got waiver

If $ZY defaults, Perceptive gets "SUBSTANTIALLY ALL assets, including IP"

So $ZY has an immediate interest in... See more

The average leveraged loan had a debt-to-Ebitda ratio of 6x at year-end 2021, and this calculation was often based on aggressive Ebitda adjustments, meaning true leverage was often greater.

Typically, firms only provide venture debt for companies that have balance sheet debt under 20 percent of operating expenses. Since future incomes must be used in order to pay down the debt, seeing venture debt on a balance sheet can be considered risky to prospective investors.10

Bradley Miles • #BreakIntoVC: How to Break Into Venture Capital And Think Like an Investor Whether You're a Student, Entrepreneur or Working Professional (Venture Capital Guidebook Book 1)

On January 1st, the US debt ceiling will be reinstated (based on the amount of debt outstanding on that date). Until legislation is passed to raise or suspend the debt ceiling (yet again), the US Treasury will have to tap cash on hand in the TGA to finance its spending obligations.