Sublime

An inspiration engine for ideas

🚨 2023 Small-Cap Portfolio Yearly Update 🚨

Small-Cap Portfolio: +$13,877 / +49.1% 📈

$ARKK +71.9%

$QQQ +54.8%

$SPY +24.8%

$IWM +15.7%

I often hear people questioning the wisdom of investing in small-cap stocks, seeing them as too risky... See more

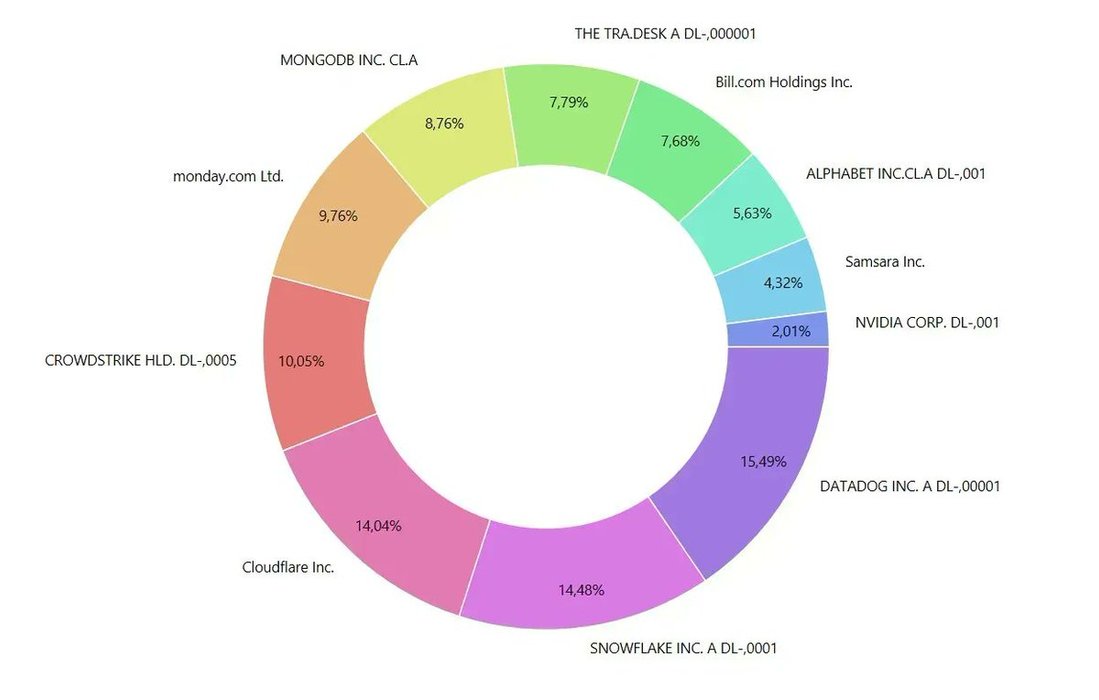

My Growth Portfolio - June '23

+39% YTD Performance (TWR)

Core Positions:

$DDOG - 15%

$SNOW - 14%

$NET - 14%

$CRWD - 10%

$MNDY - 10%

$MDB 9%

$BILL - 8%

$TTD -... See more

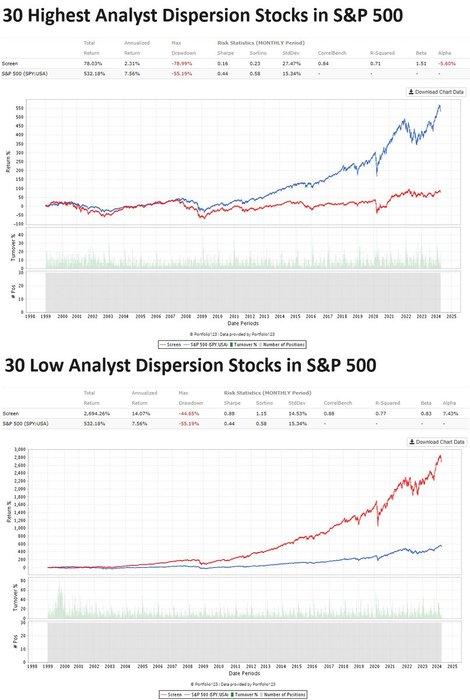

I am a big fan of the analyst dispersion anomaly. Depending on how you model dispersion, it can forecast momentum. This is why...

According to some research papers, high standard deviation of analyst estimates around the mean translates into a few overly optimistic people who are not properly discounting risk. Stock is... See more

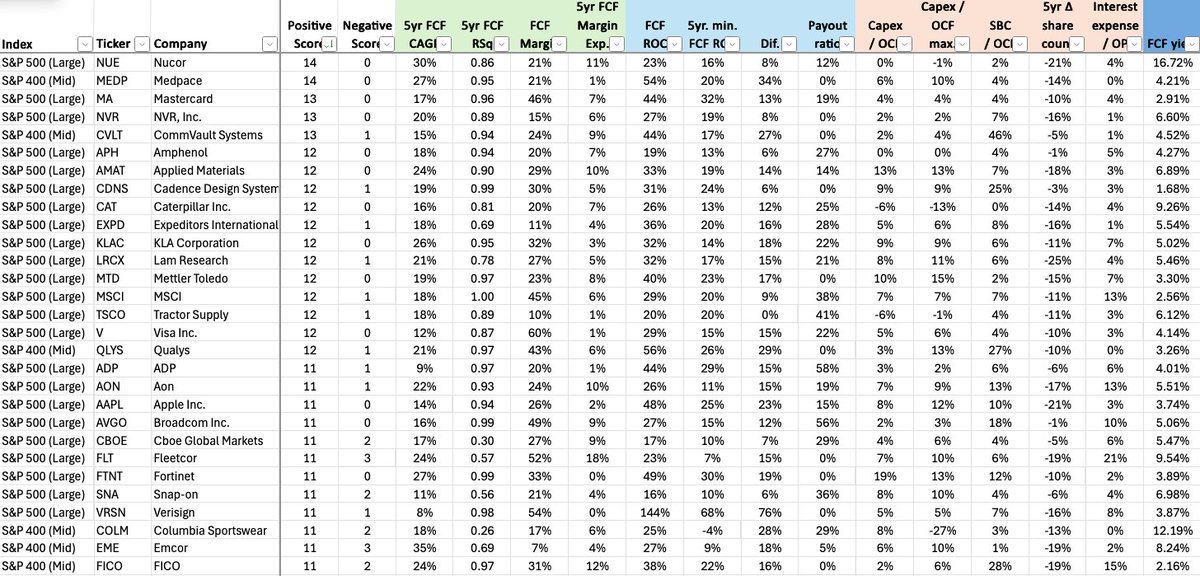

JUST RELEASED: I think it's ready!

For only $25, here are five spreadsheets containing metrics for quality growth, linearity and dividends for over 3000 companies (inc. US, UK, Germany, France, Sweden).

https://t.co/aJvHrbwPTQ https://t.co/yO8o2mXvjX

Here are the 15 Small Caps that we believe are the best to own for the next 3Y. Criteria:

- Mcap $300M-$2B

- EPS & Revenue next 3Y >11%

- FCF+

- ROIC >0%

- PEG (NTM) <5

- Altman Z >3

1. $CAR - Inter Cars - $1.96B

2. $QTCOM - Qt Group -... See more

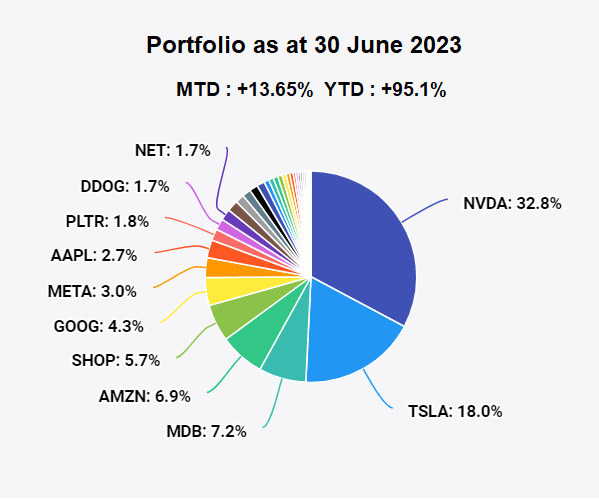

June 2023 closing - YTD +95.1%

Added : $PLTR

Sold : $LSPD $DOCS https://t.co/gIn8fP59LE