Sublime

An inspiration engine for ideas

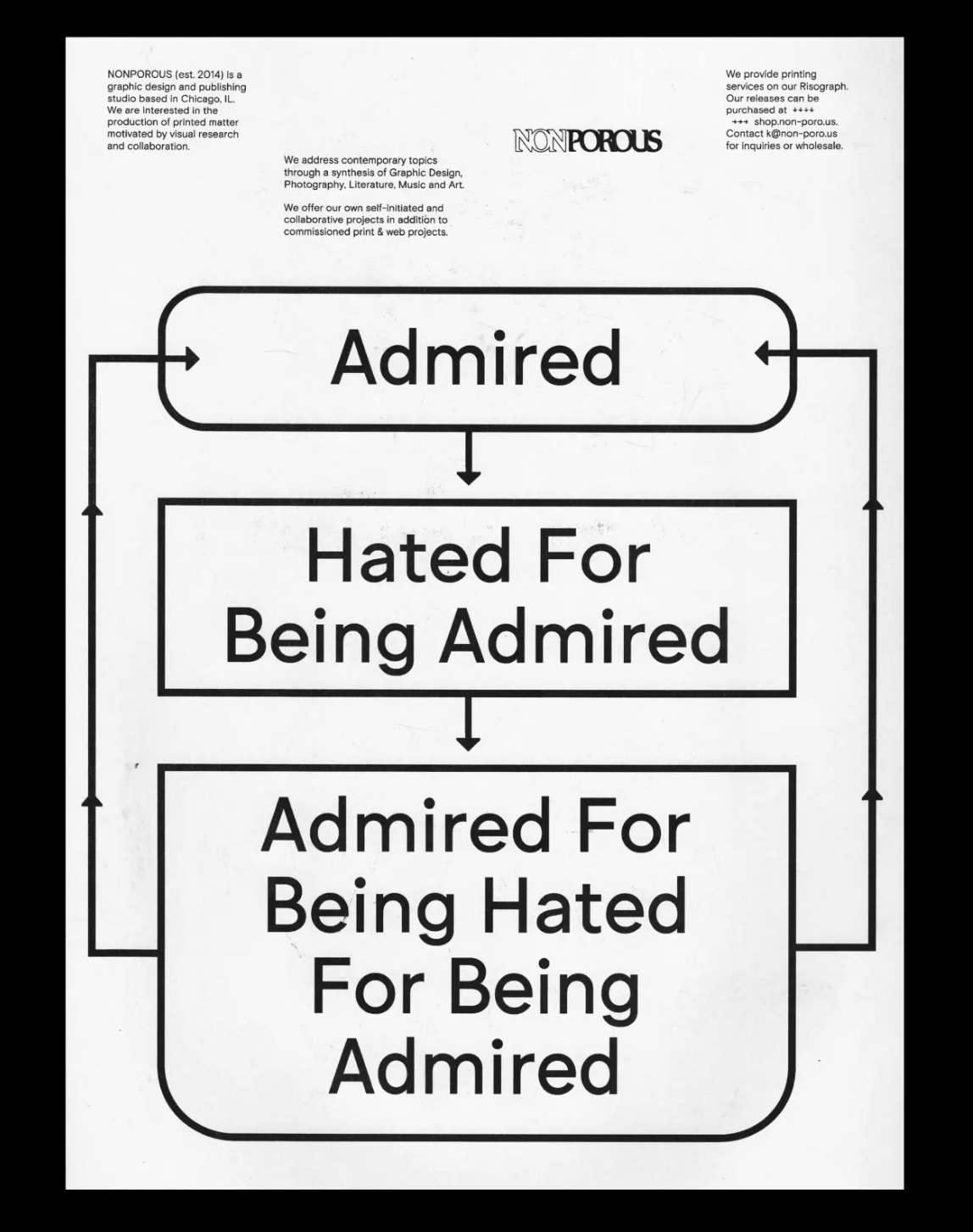

The status signal is circular: you can afford to be selectively online because you have capital, and being selectively online signals you have capital. The rest of us are still grinding for algorithmic visibility because we don’t have another choice.

Eugene Healey • Post-Luxury Status Symbol #1: Connected Privacy