Sublime

An inspiration engine for ideas

Compounding is the Accumulation of gains over time. Whenever you’re able to reinvest gains, your investment will build upon itself exponentially—a positive Feedback Loop (discussed later).

Josh Kaufman • The Personal MBA: A World-Class Business Education in a Single Volume

$QQQI ETF 15.35% dividend yield 💸

Here’s how much you'd earn per year just holding it:

$10 → $1.53

$100 → $15.35

$1,000 → $153.50

$10,000 → $1,535

$100,000 → $15,350

$1,000,000 → $153,500 https://t.co/C5Ud1Uze68

“Fairfax management first introduced guidance for annual operating income of $3bn ($100 eps) in Q4 ’22. $ffh.to achieved these levels through the first 9 months of '23. With Q4 '23 results, we expect management will raise the bar on this outlook from $3bn to upwards of $5bn."

Trevor Scottx.com

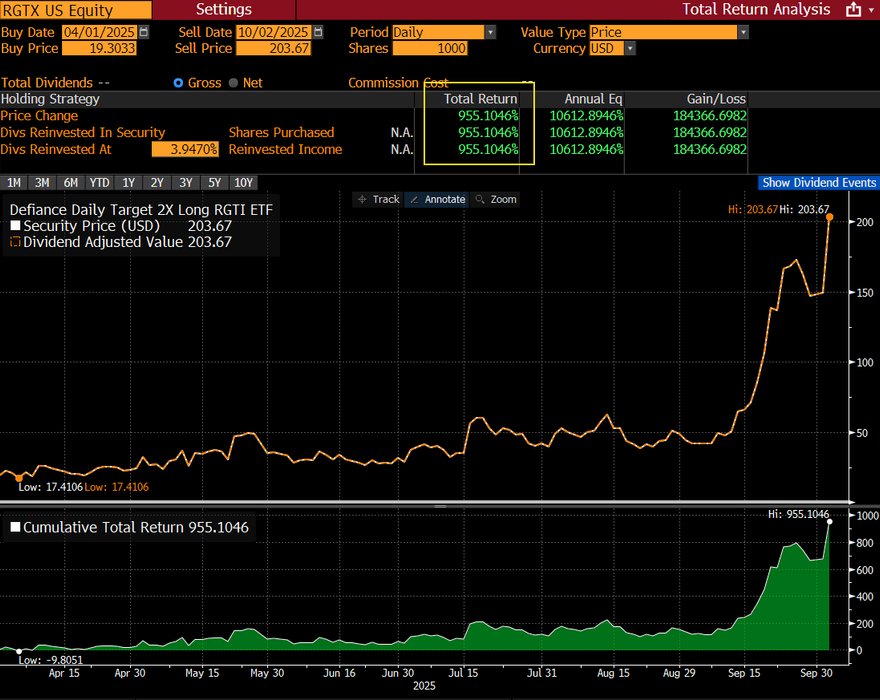

The 2x Rigetti Computing ETF is up just about 1,000% since it launched just 6mo ago, which is 3x the stock bc of the compounding effect (which is the opposite of vol drag, when underlying rockets up in fairly smooth path, nice when it happens but you can't count on it) https://t.co/7M5otpfJeY

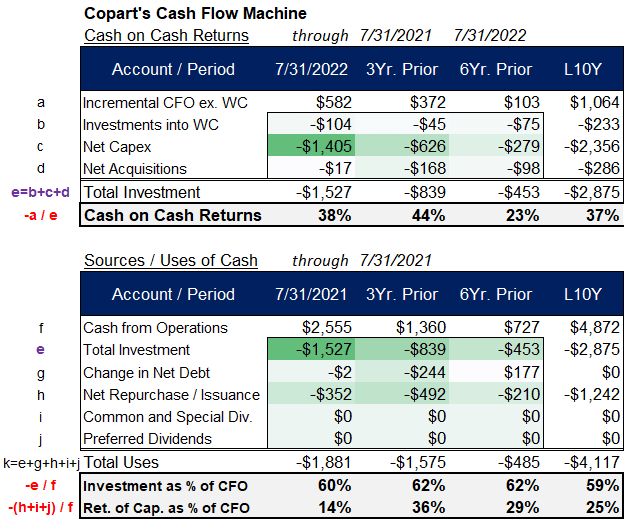

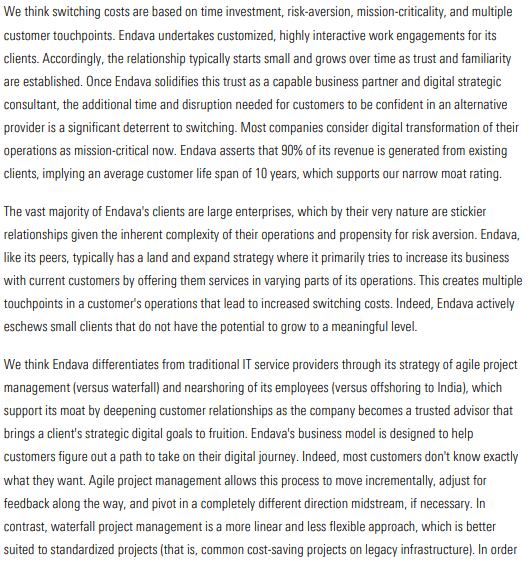

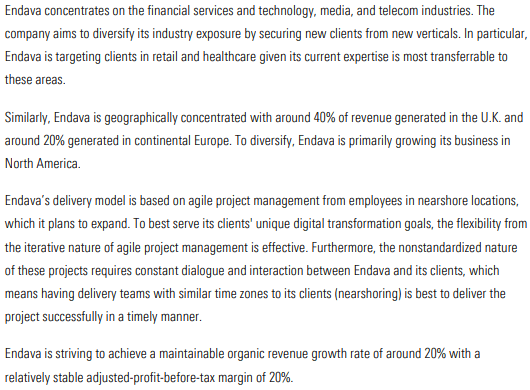

$DAVA 20/20/20/20

"historical ROIC has typically been in the 20%-30% range...We expect Endava's ROIC to be relatively stable in the low 20s"

"striving to achieve a maintainable organic revenue growth rate of around 20%"

"Mastercard has been a client for over 20... See more