Sublime

An inspiration engine for ideas

I opened my dividend growth portfolio in 2011 with about $100 and very small monthly contributions.

Since then…

The portfolio has grown an average of 43% each year (including my contributions).

Dividend income has grown each year by an average of 39%.... See more

Time flies my friends. My son will be 20 later this year.

Just $250 a month in a dividend reinvestment plan is now worth $353,000 and earns almost $10,000 in dividends.

By all means swing for your fences. But don't ignore the tortoise.

Bob Loukas 🗽x.com

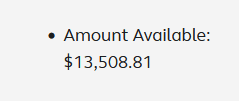

Total monthly income for December 2023

December 15th Bonus - 10,432.00

Dividends - 13,508.81

Total $23,940.81

Dividends Paid in December

$ABR, $DUK, $ENB, $JEPQ, $O, $TFC, &... See more

Excluding dividend income, an initial investment of $10,000 in the S&P 500 on January 1, 1926, would have grown to more than $1.7 million as 2017 began. But with dividends reinvested, that investment would have grown to some $59.1 million!

John C. Bogle • The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns (Little Books. Big Profits)

Fun graphic on $META from the Rowan Street annual letter (a hedge fund that printed a 102.6% net return in 2023): Shows how non-linear the path to good returns can be and how conviction pays off. https://t.co/jWQGVSc7LS pic.twitter.com/scq24Mjkzc

Michael Dempseyx.com

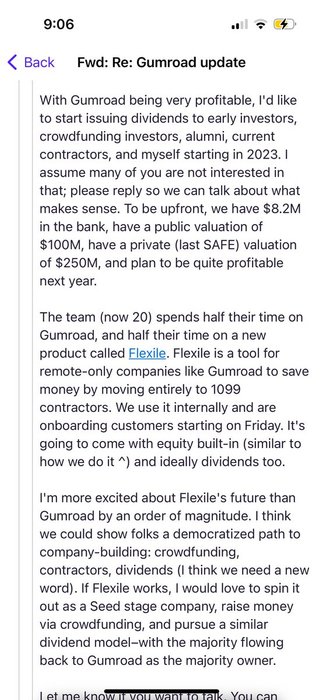

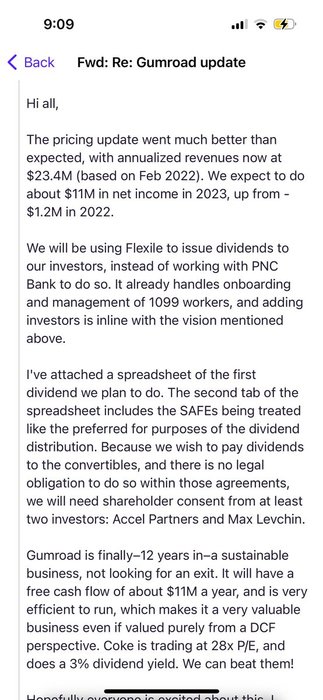

Didn’t take convincing, just asking with intention.

Here are the notes I sent.

(Narrator: everyone was interested in that.) https://t.co/rQZ9EvvO9w