Sublime

An inspiration engine for ideas

Public markets reward predictability.

Patrick Vernon • Venture Capital Strategy: How to Think Like a Venture Capitalist

venture capital is the business of risk taking.

Arlan Hamilton • It's About Damn Time: How to Turn Being Underestimated into Your Greatest Advantage

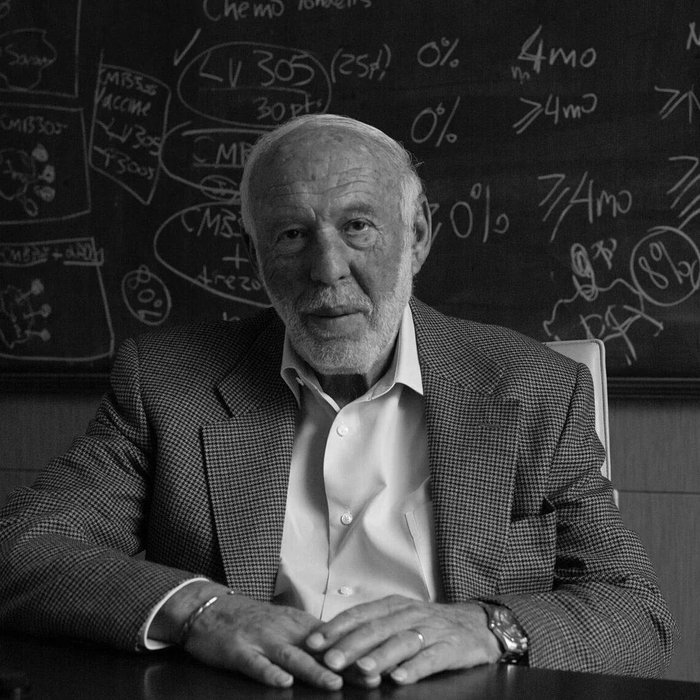

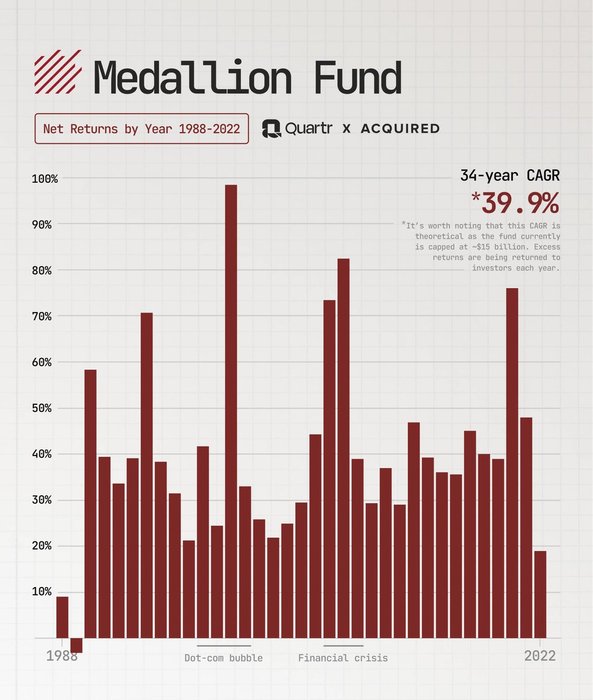

Many people have wrestled to explain how Quant King Jim Simmons managed to outperform the S&P500 for 30 years in a row with a reality defying 40% CAGR.

The answer is he was given access to classified mathematics, cryptography, and physics in exchange for his LPs getting secret kickbacks to fund black projects for the... See more

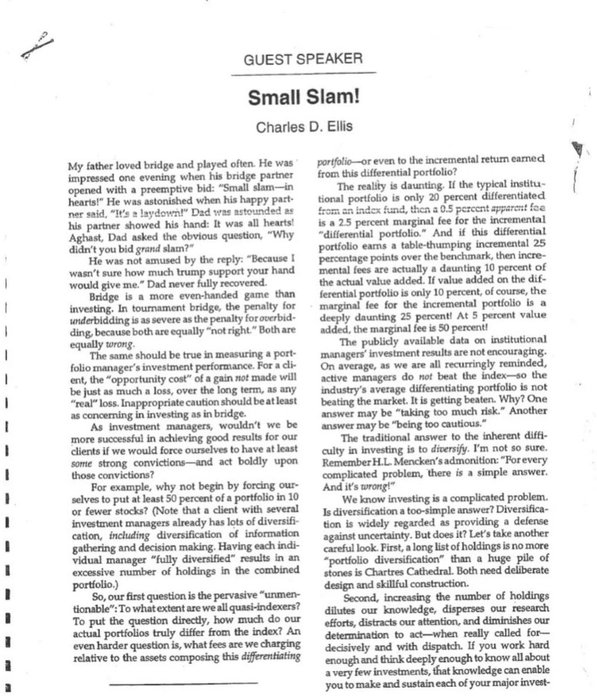

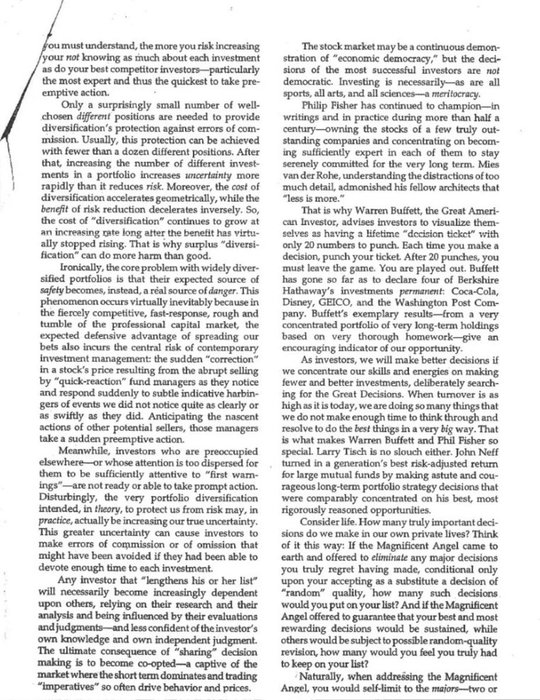

Charles D, Ellis just absolutely rips through diversification. https://t.co/crJxUAexWW

More Than You Ever Wanted To Know About Volatility Swaps

Explores volatility and variance swaps, their properties, uses for trading and hedging volatility exposure, and methods for replication and valuation using options, while addressing practical challenges and implications of volatility skews.

emanuelderman.comA professor of finance and a student are strolling across the Chicago campus. The student stops and exclaims, “Look! There’s a five-dollar bill on the ground!” The professor replies, “It can’t be a five-dollar bill or someone else would have picked it up already.”

William Green • Richer, Wiser, Happier: How the World's Greatest Investors Win in Markets and Life

Economically relevant information is discovered from experimentation, not deduced from a model.

Sacha Meyers • Bitcoin Is Venice: Essays on the Past and Future of Capitalism

It is the nature of an average that some investors will beat it. With large numbers of investment managers, chance will—and does—explain some extraordinary performances.