Sublime

An inspiration engine for ideas

Embracing Paradox

Exploring the balance between opposing principles in investment, such as trust versus skepticism, patience versus urgency, and transparency versus confidentiality, emphasizing the importance of harmony in decision-making.

static1.squarespace.comCliff Asness of AQR has written an interesting paper available online.

Basically he asserts markets are now less efficient due to index funds, low interest rates, and most importantly the influence of access to technology that encourages memes and meme philosophy that increases the attractiveness of markets that have... See more

Bill Grossx.com

Fundamental Equity Analysis: A Primer

https://t.co/xz4Qu4TLGb https://t.co/uWqt0bzFk0

The net worth of Ray Dalio, founder of Bridgewater Associates:

$22,000,000,000

Bridgewater is one of the biggest hedge funds on Earth.

How did it get so big?

A portfolio strategy 100s of PhDs developed over 10+... See more

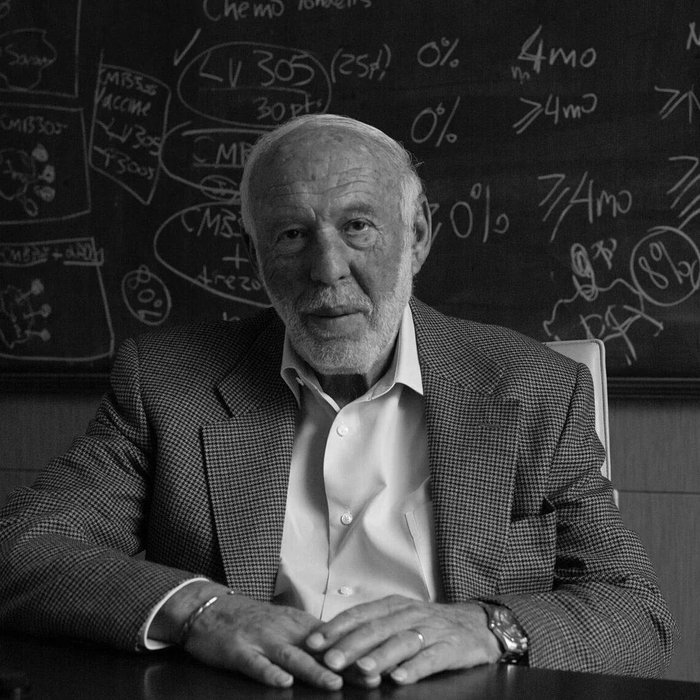

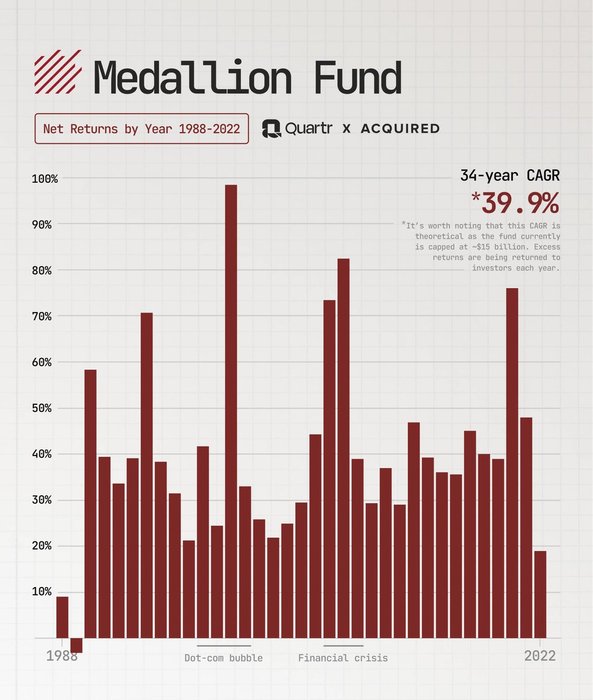

Many people have wrestled to explain how Quant King Jim Simmons managed to outperform the S&P500 for 30 years in a row with a reality defying 40% CAGR.

The answer is he was given access to classified mathematics, cryptography, and physics in exchange for his LPs getting secret kickbacks to fund black projects for the... See more

Jim Simons didn't want finance majors at Ren Tech. He believed they brought bias, not breakthroughs. Instead, he built his team with PhD’s in physics, math, and computer science.

The result? A hedge fund with 39% average annual returns and one of the best track records in history.

ₕₐₘₚₜₒₙ — e/accx.com

Joel Greenblatt would always hand out charlie479’s(Nobert Lou) first three write ups to his students a Columbia to show them what a brilliant investment thesis looks like.

Here is one of the VIC write ups that Joel Greenblatt hands out to his students:

$NVR https://t.co/HiemeJWYtL