Sublime

An inspiration engine for ideas

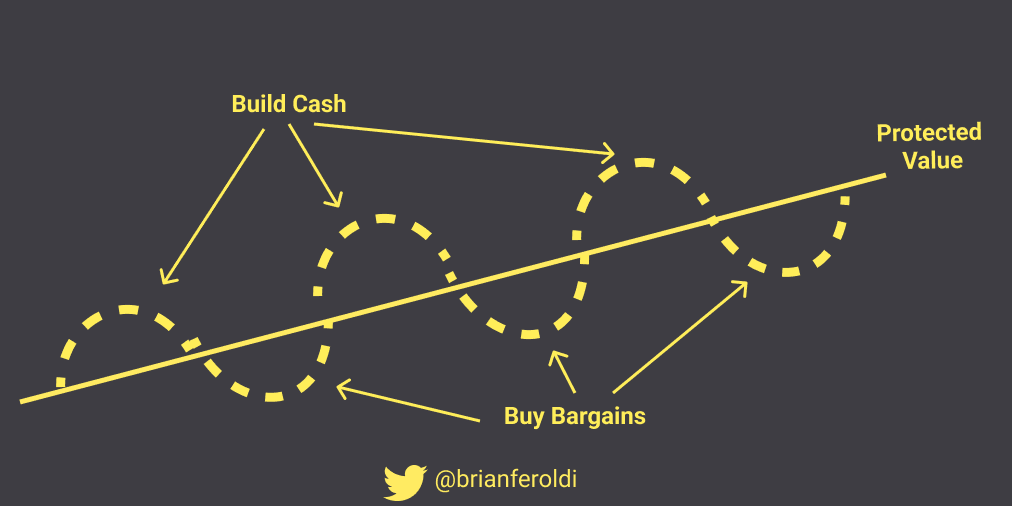

Steve Birch, another of our in-house money managers, started managing money earlier. He took advantage of the roaring bull market of the late 1990s and protected most of his gains by going mainly to cash in the bear market. Between 1998 and 2003, he had gained over 1,300%.

William J. O'Neil • How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition

Charlie Munger says the first rule of compounding is to never interrupt it unnecessarily. But how do you not interrupt a money plan—careers, investments, spending, budgeting, whatever—when what you want out of life changes? It’s hard.

Morgan Housel • The Psychology of Money: Timeless lessons on wealth, greed, and happiness

An Allocator's Manifesto: Setting the Stage

These differing results tell an important capital allocation parable: the value of being in businesses with attractive returns on capital, and the related importance of getting out of low-return businesses.

William Thorndike • The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success

Core This bucket aims to keep your money prudently invested and working for you over time. Ideally, it would protect your principal and grow it by inflation plus 4 percent on average.

Thomas J. Anderson • The Value of Debt in Building Wealth

A practical strategy for launching an investment fund by first building an audience and email list through content.

TRANSCRIPT

And so it wasn't like, I guess one thing that I, in hindsight, that I'm glad that I did, I registered as an RIA, a state-based, state registered RIA, even though I had no clients right away. So I could have a website and on my website, I would post stock ideas and I always ask people to give me an email address before they view the idea.

So I

... See more