Sublime

An inspiration engine for ideas

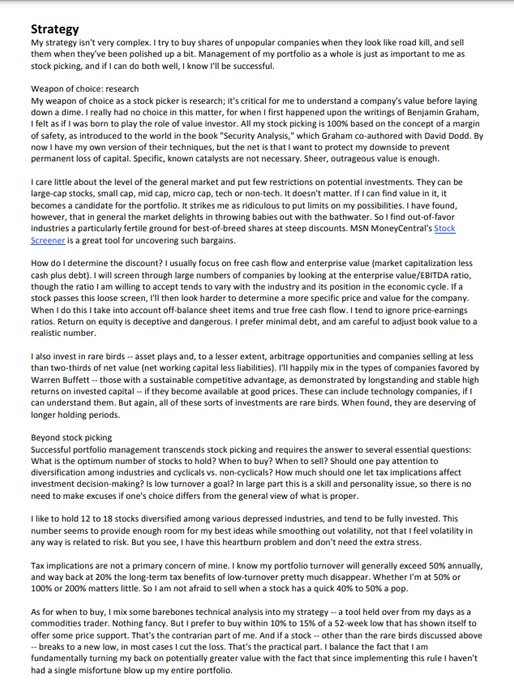

Burry's investment one sheet

worth reading for any investor https://t.co/ZqFn52xLsv

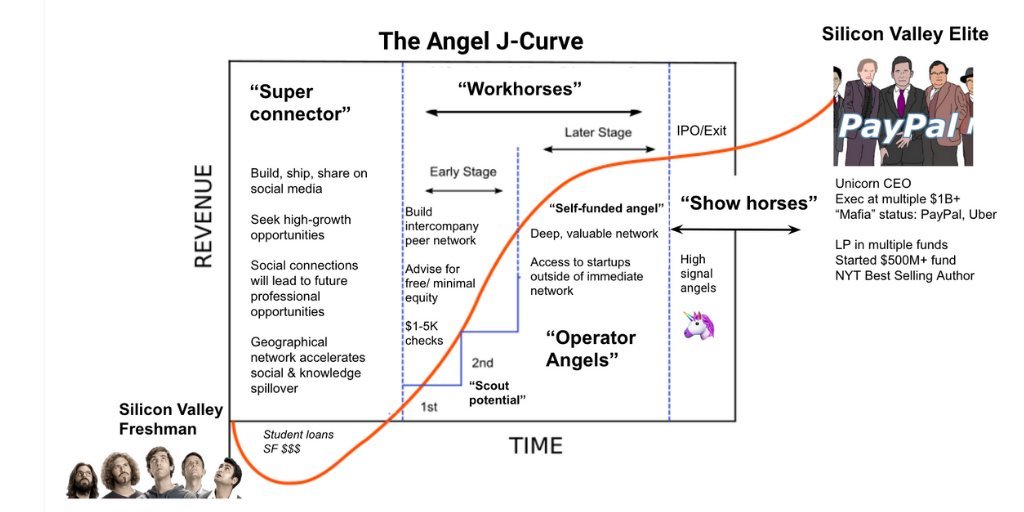

After 12+ months of research, dozens of angel dinners and a new micro-fund:

The Angel J-Curve is a framework for operators w/ tactical advice to build & scale your angel portfolio

We need more “triple threats” who operate, angel invest & have a beat!... See more

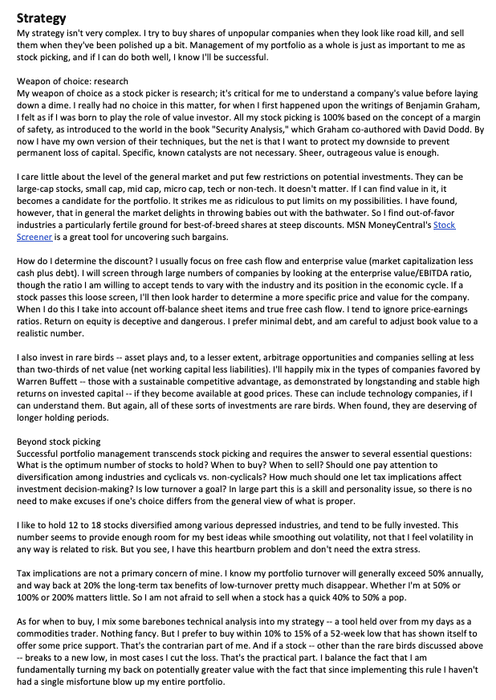

Michael Burry's (@michaeljburry) Investment Strategy One-Pager

- Buy roadkill

- Sell when roadkill's been polished

- Care little about general market

- Focus on FCF & Enterprise Value

- Invest in Rare... See more

3 minute masterclass on the only "free lunch" in finance.

Taught at MIT by Jake Xia,

With no student debt needed. https://t.co/oZyfHSzZ5R

Goshawk Tradesx.comIn an industry of outliers, many allocators have ignored outliers for a long time and preferred funds that are sustainable, process-driven , big enough to scale relationships, often to settle with 3x returns over 12 years with no clear path to liquidity.

An Allocator's Manifesto: Setting the Stage

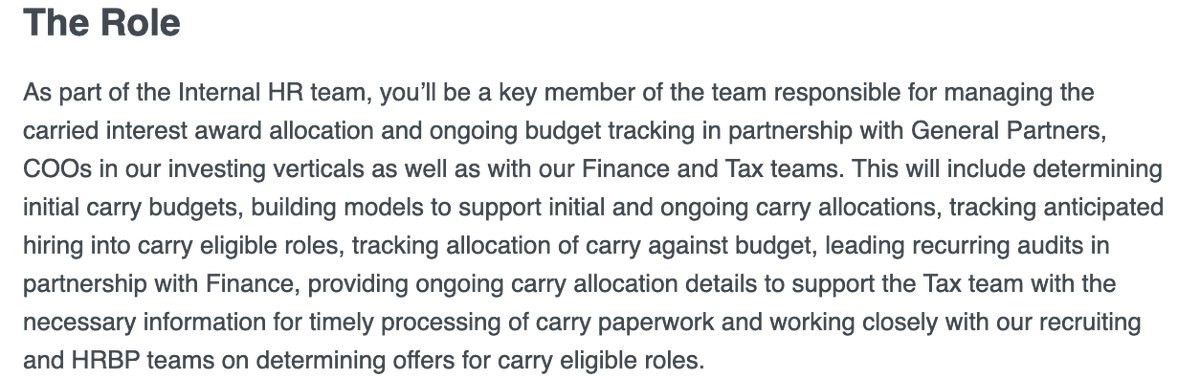

Wow. a16z hiring a full-time person just to keep track of carry. https://t.co/WDzfFXpDB6 https://t.co/5WI1NsYPau

The single biggest undertapped powder keg in American politics is showing the average voter where their retirement money/union pension funds are gambled.

For example, last night David Sacks made a fool of himself at the RNC by claiming that Biden provoked Putin into attacking Ukraine. Even the Republican crowd didn't... See more

Great capital allocators always have a sense of the difference between price and value in all of their businesses. And, as important, they are willing to act to build value when those gaps become large enough to overcome frictions such as taxes and fees.