Sublime

An inspiration engine for ideas

Printing money is a stealth tax on wealth that disincentivizes holding money, as above. It has the same first-order effect on wealth transfers but has hidden second-order effects of misdirecting capital due to political expediency and cowardice.

Sacha Meyers • Bitcoin Is Venice: Essays on the Past and Future of Capitalism

During the reign of the actual Henry II (1154–1189), just about everyone in Western Europe was still keeping their accounts using the monetary system established by Charlemagne some 350 years earlier—that is, using pounds, shillings, and pence—despite the fact that some of these coins had never existed (Charlemagne never actually struck a silver

... See moreDavid Graeber • Debt: The First 5,000 Years,Updated and Expanded

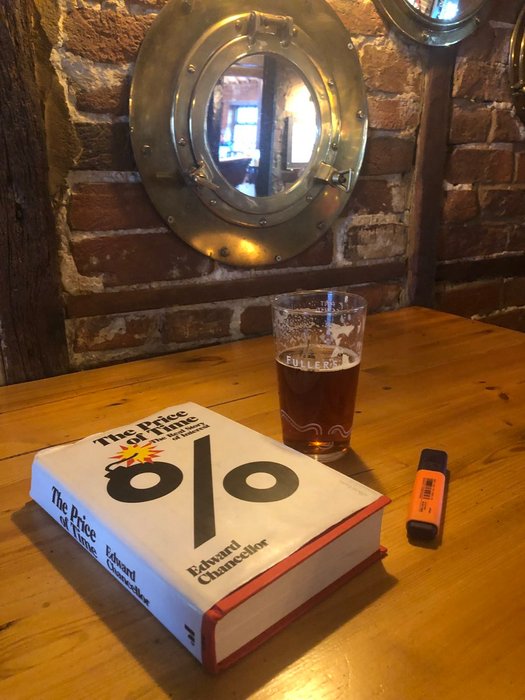

There is nothing so unstable as a stabilized price level. James Grant, 2014

Edward Chancellor • The Price of Time: The Real Story of Interest

3 to 5 is more than 20.

Ray Dalio • Principles: Life and Work

Michael Howell • The Debt-Liquidity Spiral

“gold standard” has a nice ring to it; however, the system made for catastrophic monetary policy during the Great Depression and can seriously impair monetary policy even during normal circumstances. When a currency backed by gold comes under pressure (e.g., because of a weakening economy), foreigners start to demand gold instead of paper. In order

... See moreCharles Wheelan • Naked Economics: Undressing the Dismal Science (Fully Revised and Updated)