Sublime

An inspiration engine for ideas

Some highlights have been hidden or truncated due to export limits.

Michael Lewis • Going Infinite: The Rise and Fall of a New Tycoon

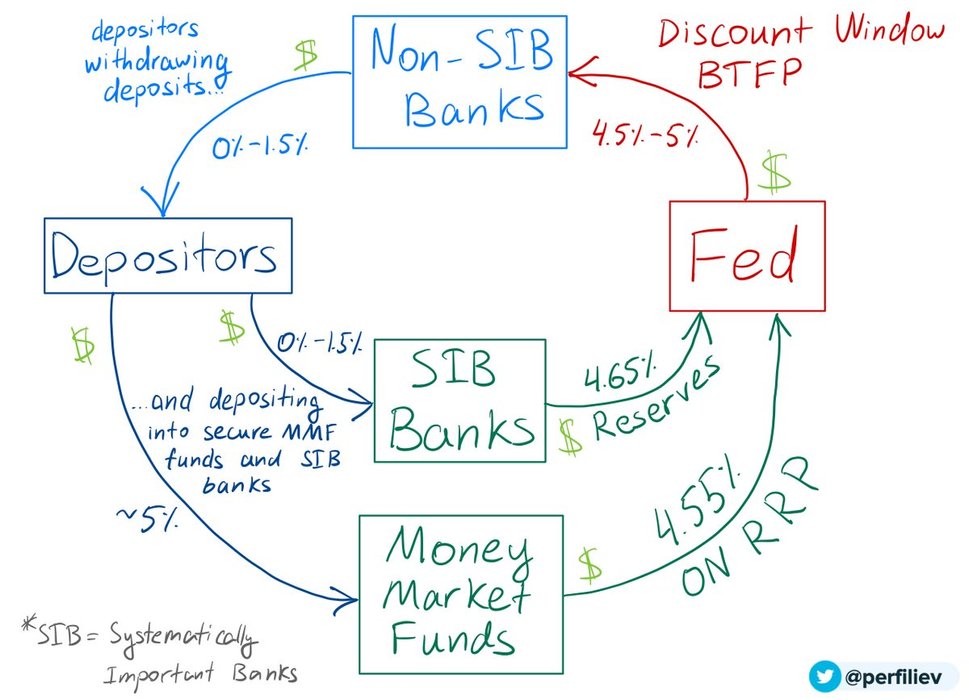

Finance Visuals

Memo Esparza • 1 card

Investments

Anthony Fiedler • 2 cards

Equity Markets

Emi Gal • 1 card

Stephen McKeon • Components of Coordination

Consequently, a business may be short of cash until payment is received.

Michael W. Preis • 101 Things I Learned® in Business School (Second Edition)

at the frontiers where new capital rights are minted day by day in the offices of law firms, states take a back seat. But states provide the legal tools that lawyers use; and they offer their law enforcement apparatus to enforce the capital that lawyers have crafted.

Katharina Pistor • The Code of Capital: How the Law Creates Wealth and Inequality

For finance to consistently grow as a proportion of GDP, either it is simply upping its take — which might be reasonable within bounds, but raises questions of adequate competition in the sector and of possible regulatory capture — or it is making more and more MBS-like time bombs. It is spinning off flows of toxic financial exposure, of whose

... See more