Sublime

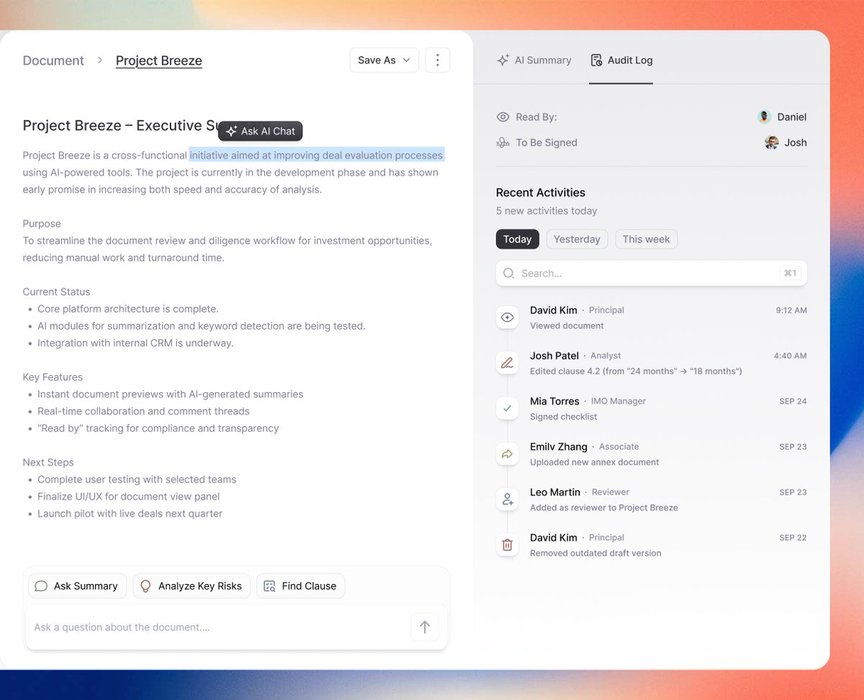

An inspiration engine for ideas

Must Read.

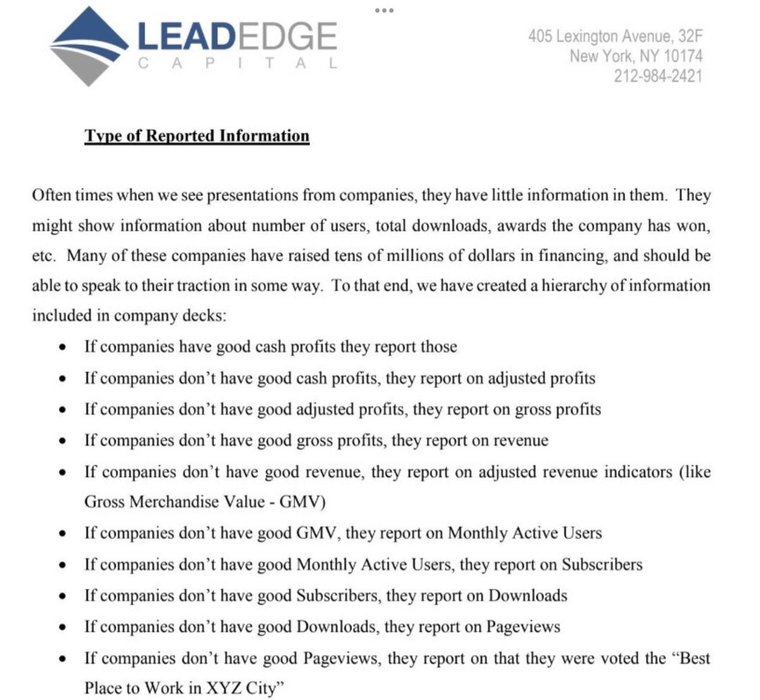

I need to find more of their letters

Source :@pitdesi https://t.co/Js1H1jdu8q

AI Insights

simo • 2 cards

.@DocSend released annual study of preseed fundraising: examines impact of deck construction, geo, gender, amounts raised (or not), and more across 174 companies. One takeaway - deck clarity matters: < time investor reads deck, >$ raised #uncorkcap https://t.co/11uFiaLAJG

Stephanie Palmerix.com

AI company, Beyond Limits, just raised $133M in its Series C round to help them expand globally.

Beyond Limit offers AI-backed software for industrial powerhouses that focus specifically on energy, utility, and power.

Here's the pitch deck they used to raise $133M 👇 https://t.co/xIUCJgPY55

Recase (YC F24) automates fintech onboarding and underwriting tasks, turning manual reviews into instant approvals. Connect data vendors, build rules, and use AI to automate any blocking action.

https://t.co/54GvQxJtya

Congrats on the launch, @johnyeocx and @ay_ushr! https://t.co/WWzr4qJKiM

Y Combinatorx.comFintech

Aadik • 2 cards

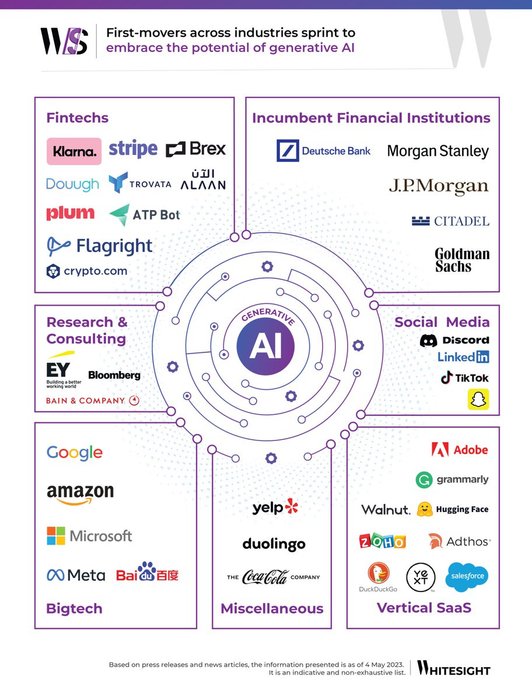

💥#GenerativeAI in finance!

#AI #MachineLearning #DeepLearning #DataScience #Cloud #fintech #Python

#Coding #100DaysOfCode #tech #ChatGPT

https://t.co/JtB76OAYGX @WhiteSight_

@CurieuxExplorer @PawlowskiMario @mvollmer1 @gvalan @ipfconline1... See more