Sublime

An inspiration engine for ideas

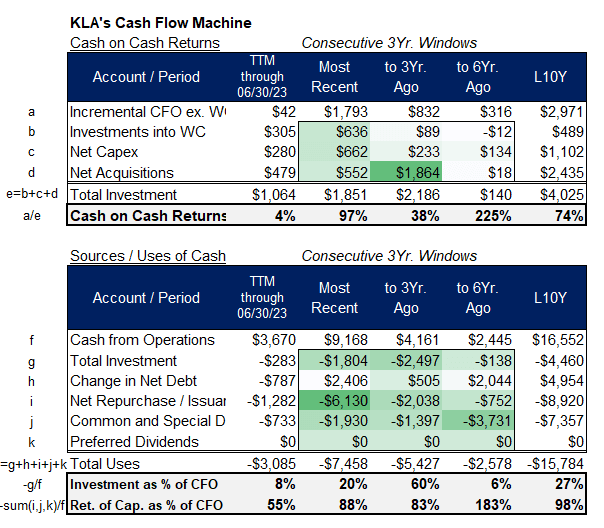

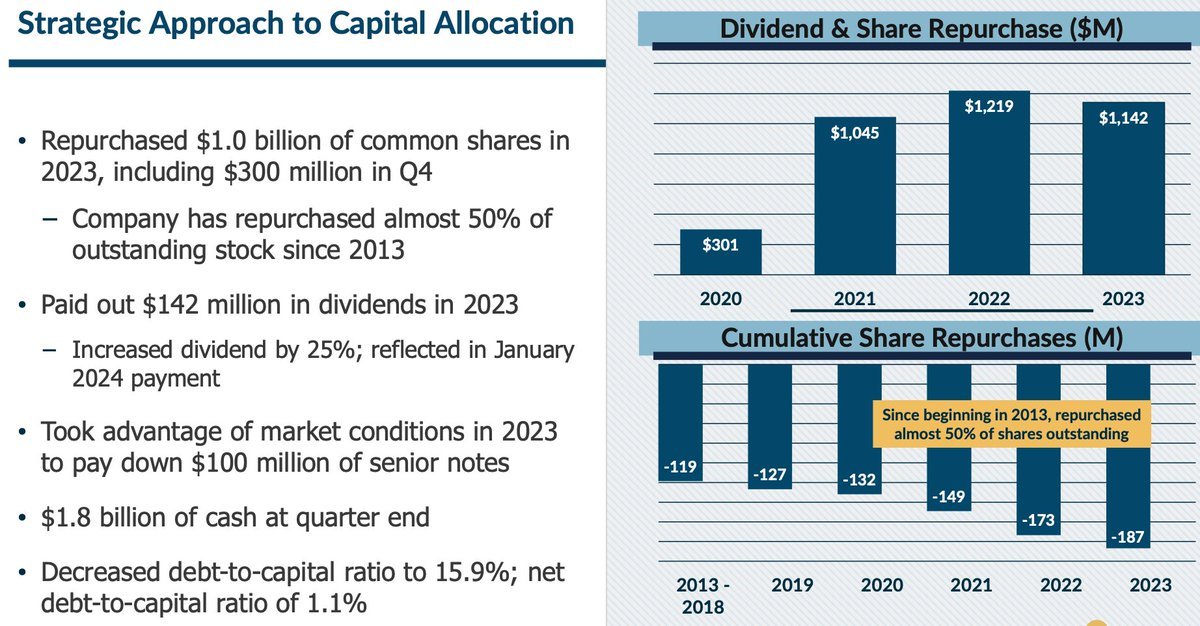

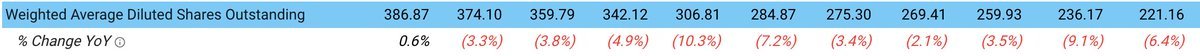

KLA looks like AMAT, but smaller and better.

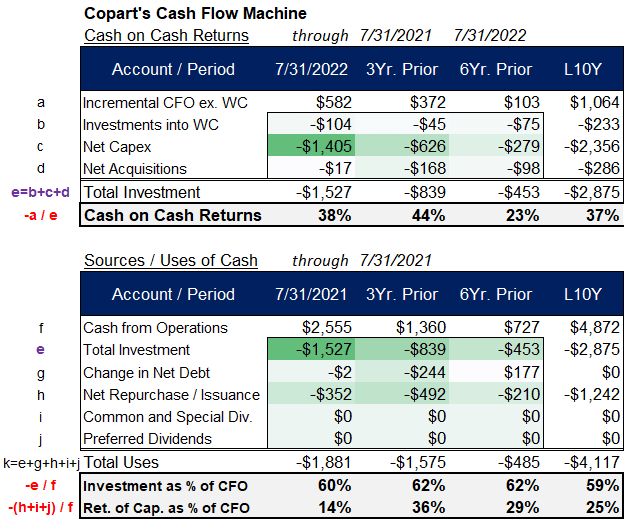

74% 10Y cash on cash returns, including their '19 acq. of Orbotech for $1.9Bmm, vs. AMAT's 52% w/o any big acq.

Orbotech was funded 1/2 with newly issued shares but KLAC increased their buyback such that FDSO out actually went down in... See more

* RaaS: Offering resale-as-a-service for brands like Everlane and Madewell. They helps merchants monetize returns. As e-commerce grows, so will this channel.

James Reinhart • Lessons in Process Power

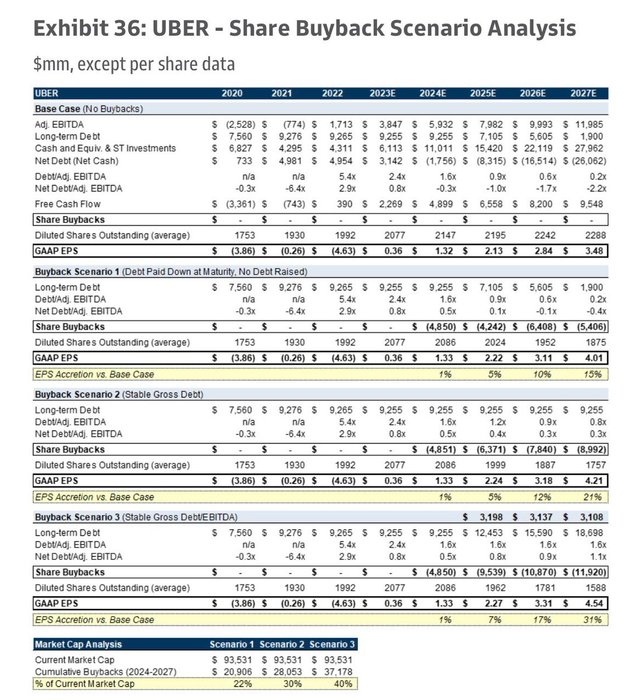

GS base case for Uber has no share repurchases and ending 2027 with $26B in net cash.

They show 3 scenarios for capital return, the most “aggressive” of which maintains constant gross leverage at 1.6x, resulting in $14B buybacks by 25 and $37B by 27 (40% of current mkt cap) https://t.co/NASlRENweM

Here's how I would do it.

I would buy 2 off-market SaaS with a big email list of inactive users for $10K in the eCom space.

I'm going off-market so I wouldn't have to pay 10x ARR and can get seller financing too.

I am selecting eCom space because that's the... See more

Honey Syedx.com

$PHM doing best at what all builders are trying to do: more options, less land, more buybacks: the $NVR plan

Share count down ~50% in 10 yrs; and with its cheaper P/E, the buybacks went further for PHM's owners:

32% total CAGR last 5 yrs vs 22% NVR

20% last 10 yrs vs 19% NVR https://t.co/8KmlKraGij