Sublime

An inspiration engine for ideas

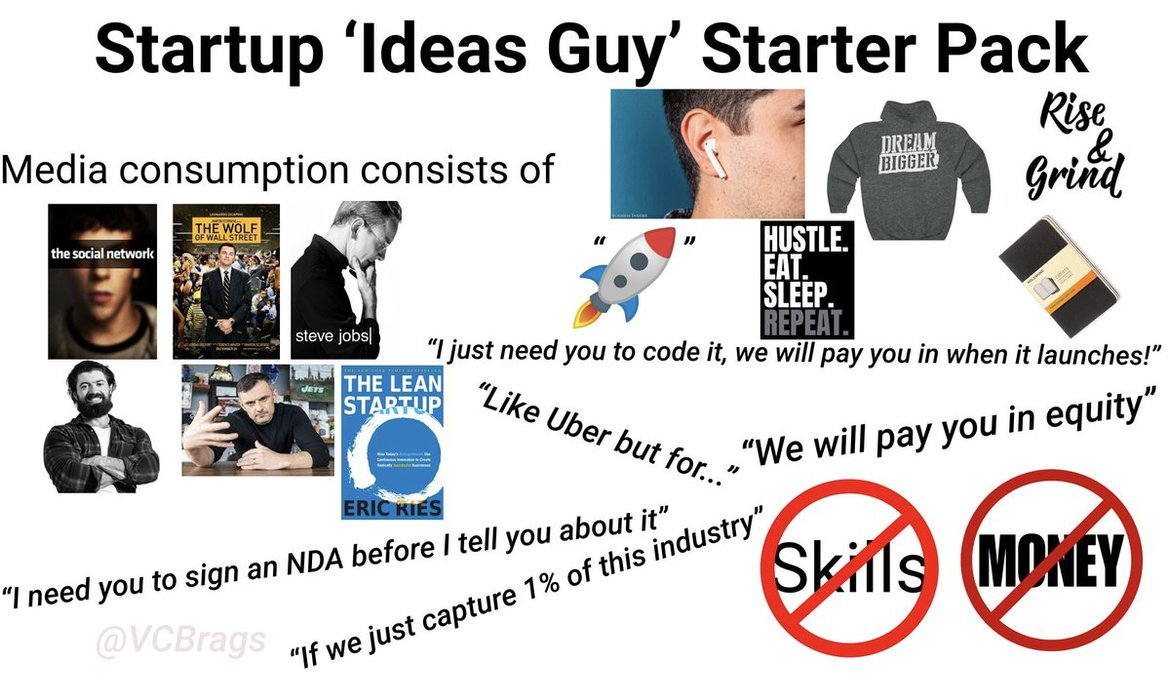

if you are motivated by young entrepreneur success stories, you might jot down a clever business idea, create a Web site, and launch your very own dorm-room corporation.

Cal Newport • How to Win at College: Surprising Secrets for Success from the Country's Top Students

I teach at business schools, attend startup community events, and host small gatherings of young entrepreneurs. By serving as a mentor at accelerators such as Columbia's Greenhouse, Yale's Entrepreneurial Institute, DreamIT Ventures, and Founders Institute, and as a speaker/participant at events organized by groups such as Sandbox Network,

... See moreDavid S. Rose • Angel Investing: The Gust Guide to Making Money and Having Fun Investing in Startups

I’m 22 and my micro Holdco. is worth 6 figures

I started less than a year ago with <$10k

July 2023: I acquired @sourcelyai for $4,000 on @acquiredotcom

In 8 months: $30k in revenue + acquired 4 micro startups <$10k

How I think about my Holdco, from someone just 2 steps ahead:

For me, a holding company is just a fancy way of saying I have ADHD and enjoy working on multiple companies at once.

4 micro startups acquired for <$10,000: 2 SaaS, 2 media: 1 TikTok, 1 newsletter

Now I'm looking at deals $100k+

1. Startup marketplaces are a cheat code

There is an unbelievable amount of alpha in the form of deal flow on a weekly basis on Acquire. The deal flow in the last 3 months has been unlike anything I’ve seen. Marketplaces like @acquiredotcom, @godealwise, @micronsio are changing how founders approach building startups with acquisition opportunities and exit options.

2. Lesser known markets have outsized opportunity

There’s a whole wide world of alternative micro assets that no one talks about much. Insta theme pages, viral TikTok accounts, Facebook groups.

This leads to interesting opportunities like a student tok account for our student tools or a photography account for a friend with a photography SaaS. Many in this world are scammers so please tread carefully. DM me if you have any criteria for media acquisitions like these!

3. Contrary to popular belief, there is lots of opportunity <$10k

Find underoptimised potential. You need the patience to find it and the right skills to capitalize.

Highest possible upside by % is with smaller acquisitions. However, I've realized that smaller companies take as much work as the larger ones so I’m now looking at $100k+

4. Acquisition entrepreneurship in the media + ETA is No. 1 at MBAs

ETA will only get more popular as people realize the opportunity. Many new MBAs, especially those at top schools, are heavily considering search funds and Entrepreneurship Through Acquisition.

As it gets more popular and the media begins to pick up and distribute success stories the space will see a huge surge in demand and prices changing. This will lead to the ecosystem evolving in different ways.

5. We are in a golden age of acquisition

prices are low and the supply is high. It's a buyer's market and now is the time to buy. The popularity of marketplaces has exploded leading to higher supply with high interest rates and a general dip in valuations.

6. Find your competitive advantage and lean into it.

Focus on finding your advantage. For me, it's the fact that I’m a student and a lot of my friends are too (my OG startup at 18 was for students). I’m also super ADHD, prefer working on multiple projects in a day and can context switch quite easily. Hence a holding company focused on education.

I’m good at seeing things in a very straightforward way and how to break down a business to the basics to understand the most effective levers that can be pulled. The Pareto principle comes into play as most of this is identifying the 20% better than others can.

7. Identify the levers to pull early on (Pareto principle: 20% of work-> 80% of the result)

Before acquiring/ starting a business get a comprehensive understanding of the different levers that make up the business and how you can most effectively access these.... See more

Regular biz guy who's ballin': Well yeah, so we've been waiting for this gov't permit for the past 8 months, just got it, now taking a big risky loan of $6M so we can expand our operations with my 129-person team. Took me like a full quarter to secure the loan, had to put all of my network from school and family for banking... See more

Pyratex.combusiness

Mo Shafieeha and • 33 cards

Biz Building

Oren Shai • 5 cards

Building Business

Matt Mower • 24 cards