Sublime

An inspiration engine for ideas

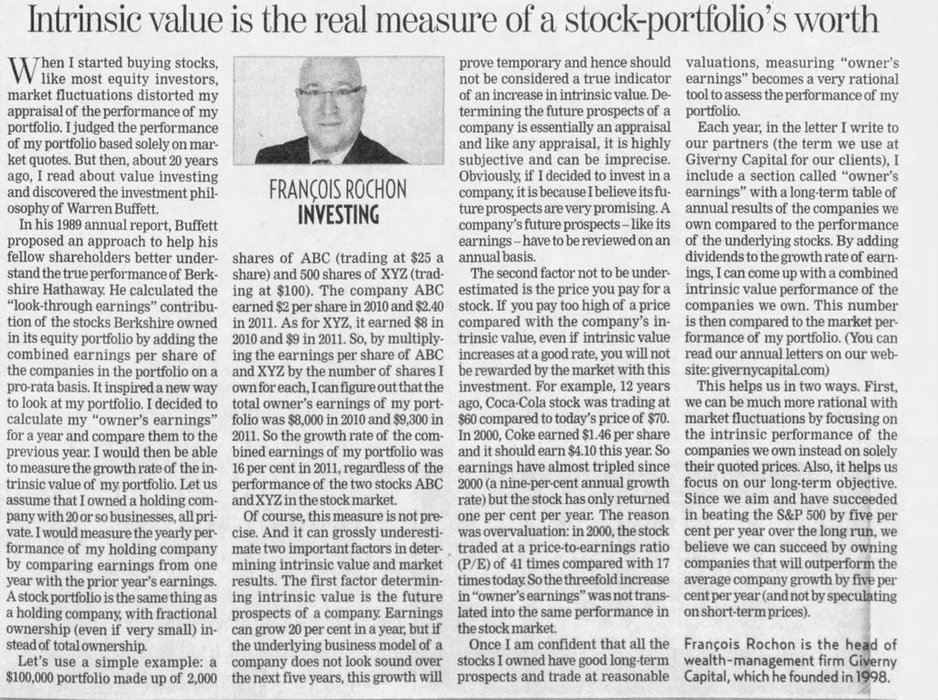

Intrinsic value is the real measure of a stock- portfolio’s worth https://t.co/6VUlfNh7wF

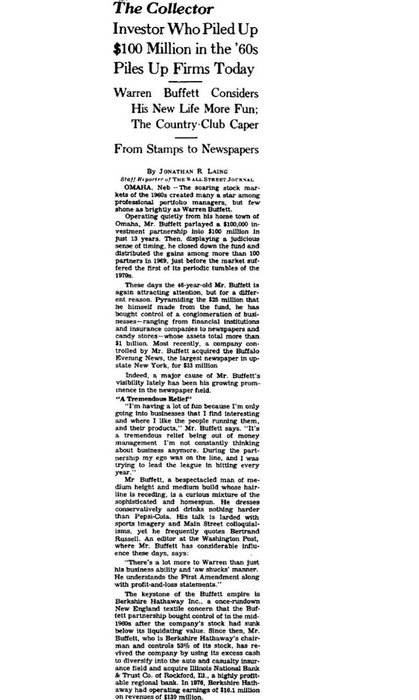

A WSJ article on Warren Buffett.

It’s worth the read https://t.co/7yqN1kv2OT

The best investing tools on the internet:

Free & Pro (Paid)

Investors are spoiled.

We have access to information that would have cost thousands just a few decades ago.

Here are the best tools I've ever... See more

#178 with Balaji - Balaji on How to Fix the Media, Cloud Communities & Crypto

open.spotify.com

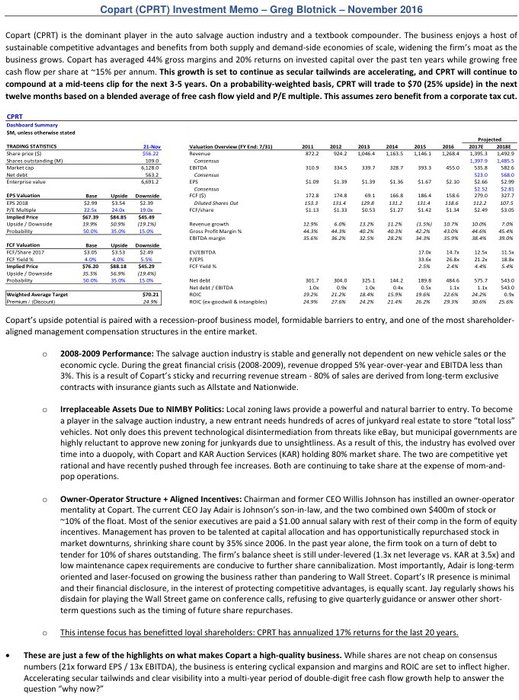

(1/7) CPRT long from 2016 - pretty thorough pitch, 15 pages or so.

the length itself isn't what matters - the first page has to hit or else the rest is wood. Beyond that, the next 10, 20, even 30 pages of supporting material are all fine, they just need to reinforce the message you laid out on page one. Hemingway said... See more

Morgan Housel — The Psychology of Money, Picking the Right Game, and the $6 Million Janitor (#576)

tim.blogSome highlights have been hidden or truncated due to export limits.

Michael Lewis • Going Infinite: The Rise and Fall of a New Tycoon