Sublime

An inspiration engine for ideas

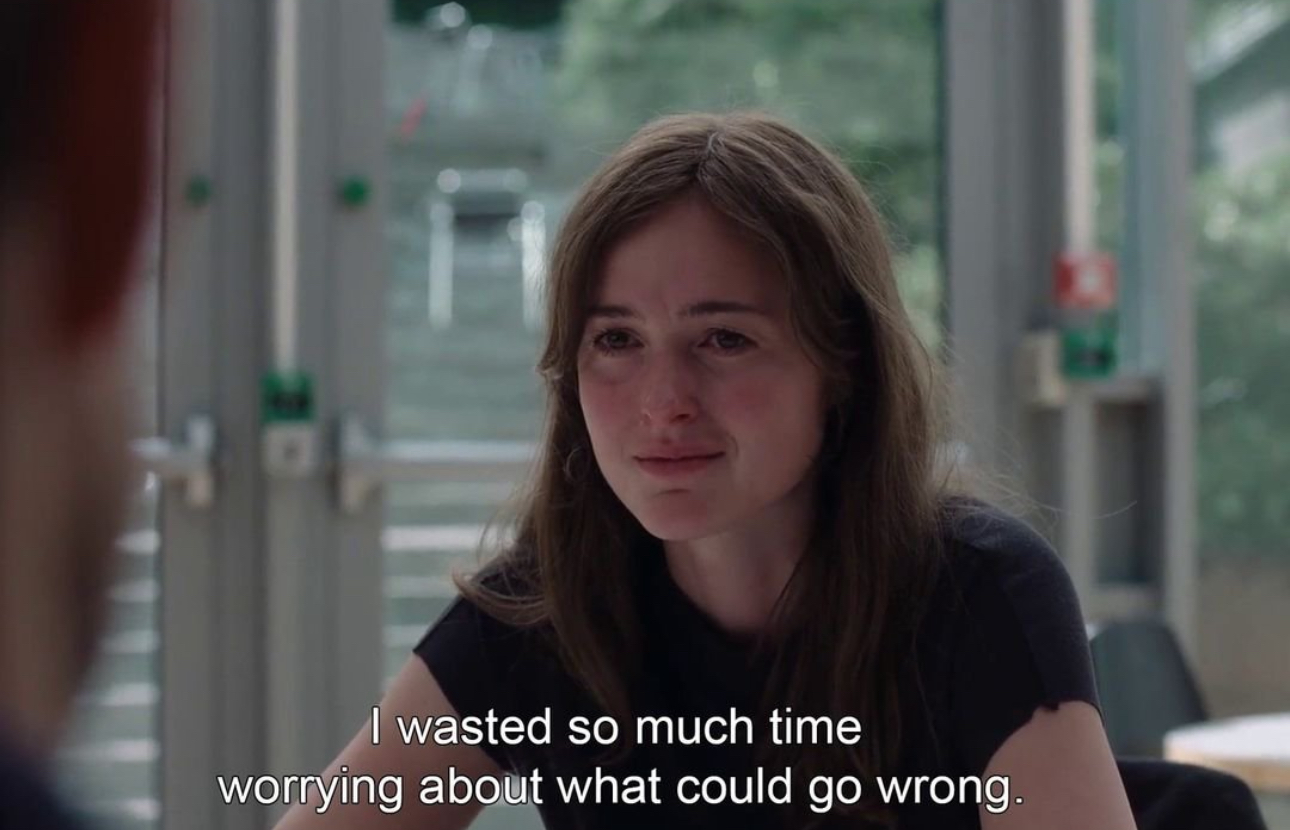

Those who can ask without shame are viewing themselves in collaboration with—rather than in competition with—the world

Amanda Palmer • The Art of Asking: How I Learned to Stop Worrying and Let People Help

Your thought patterns aren't just habits— they're prophecies, and what looks like a harmless habit today is actually destiny under construction.

Parakeet • Skittle Factory Dementia Monkey Titty Monetization

What technology takes from us – and how to take it back | Rebecca Solnit

theguardian.com

"Please let this be over. I'm not ready for it to be over."

Andre Agassi

Andre Agassi

Dragonfly-Eye | Sight

dragonfly-eye.online