Sublime

An inspiration engine for ideas

Balancing efficiency with genuine relationship-building by slowing down, dropping agendas, and prioritizing brief but real connection moments.

TRANSCRIPT

At work, it's probably saying, hey, tell me a little about your long weekend and not kind of counting down the seconds for them to finish so you can tell them what to start on this week, but kind of giving yourself permission to say, can I actually just kind of drop down into that moment? Right?

And so I think it's the mindset And then it's

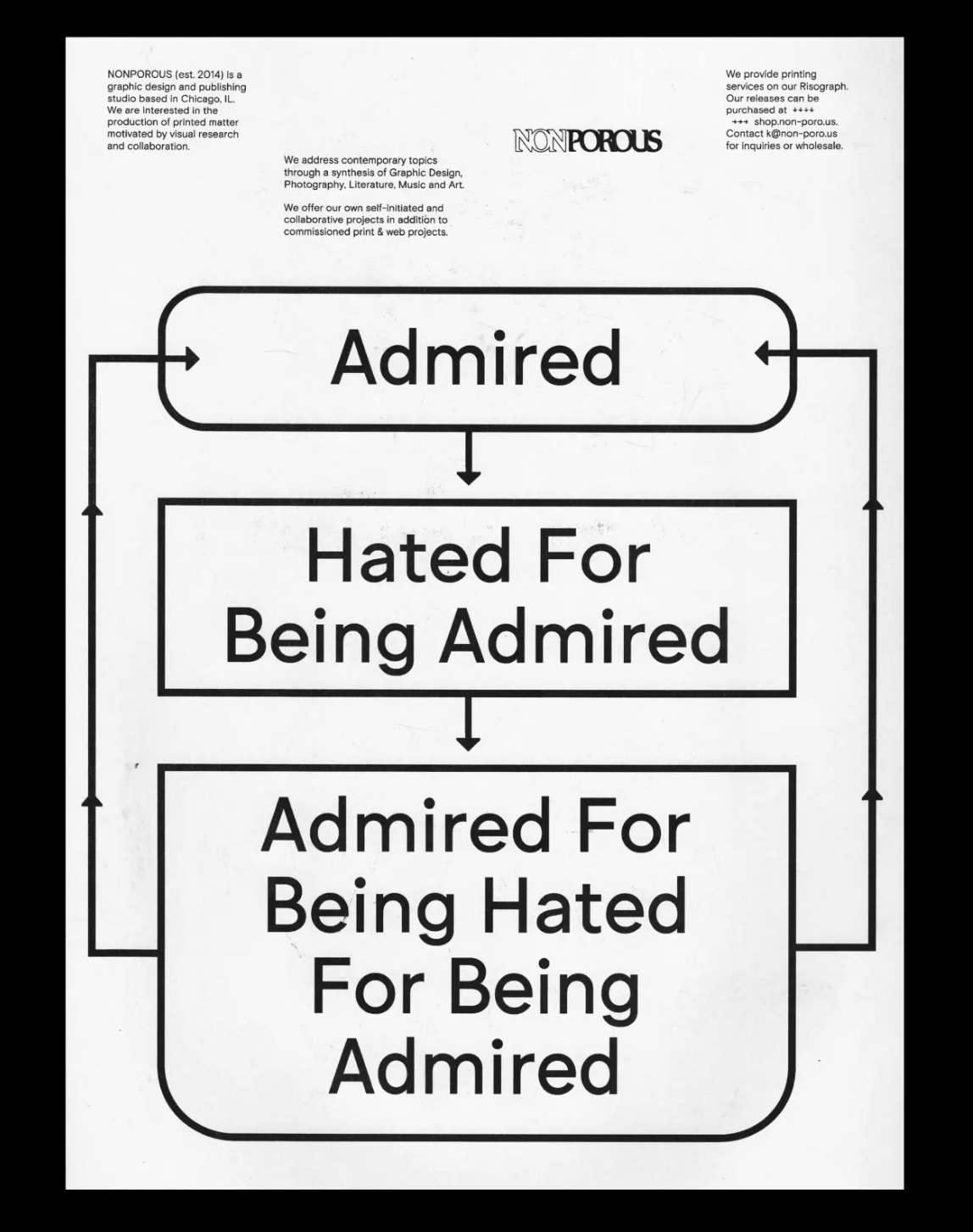

... See moreThe status signal is circular: you can afford to be selectively online because you have capital, and being selectively online signals you have capital. The rest of us are still grinding for algorithmic visibility because we don’t have another choice.

Eugene Healey • Post-Luxury Status Symbol #1: Connected Privacy