Sublime

An inspiration engine for ideas

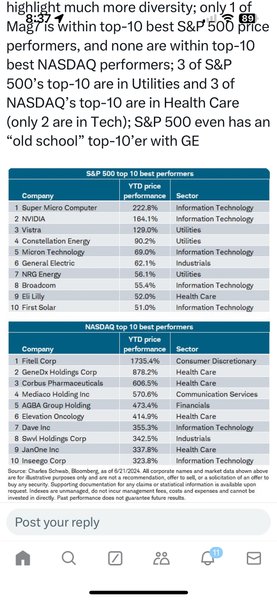

My top 3 dividend payers:

$ET $504 yearly

$VICI $198 yearly

$SCHD $195 yearly

Brick by brick 💪🏾

What’s yours?

TheDividendDogx.comInvestor Communications

sari and • 10 cards

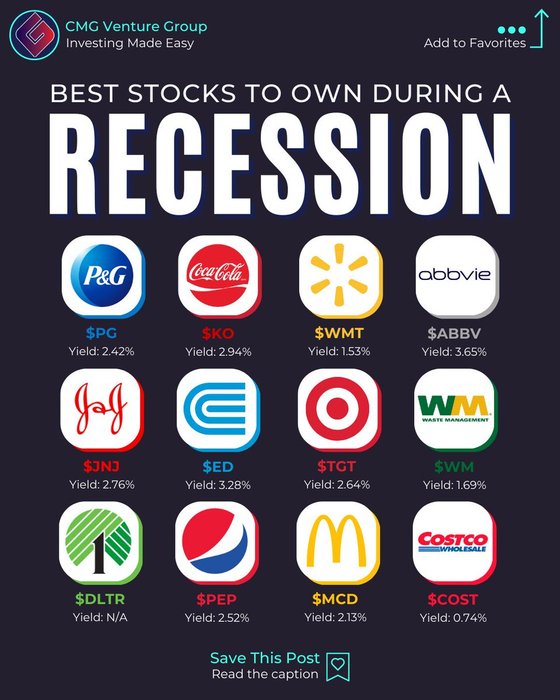

12 Recession Proof Stocks:

$PG | Procter & Gamble

$KO | Coca-Cola

$WMT | Walmart

$ABBV | AbbVie

$JNJ | Johnson & Johnson

$ED | Con Edison

$TGT | Target

$WM | Waste Management

$DLTR | Dollar... See more

2023 has been an incredible year for both of my public portfolios -- here are my top 10 biggest winners of 2023 across both portfolios 🧐

1. $PLTR +232%

2. $MDB +107%

3. $CRWD +97%

4. $BEAM +70%

5. $ASTS +70%

6. $TMDX +63%

7. $NET... See more

Shay Boloorx.com

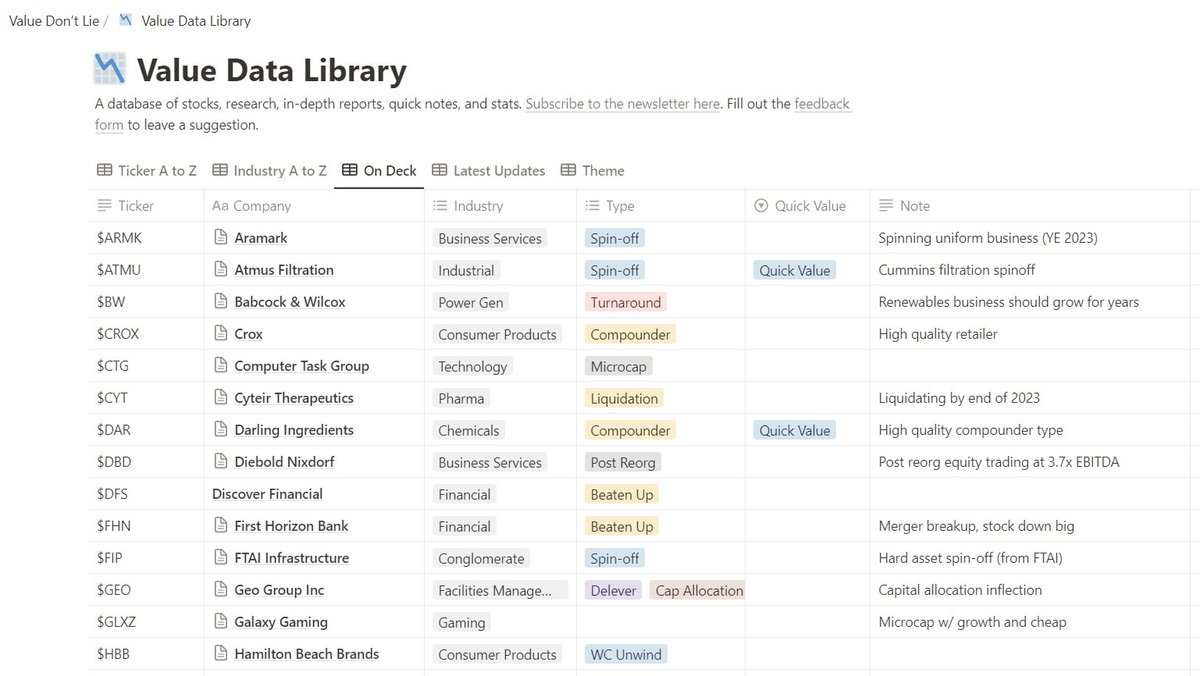

For new followers

All (most) of my research notes are kept in a Notion database which is accessible (free for now since it's pretty haphazard)

I write a weekly/monthly newsletter highlighting these stocks

Both are linked in my bio https://t.co/zyO0AZz3an

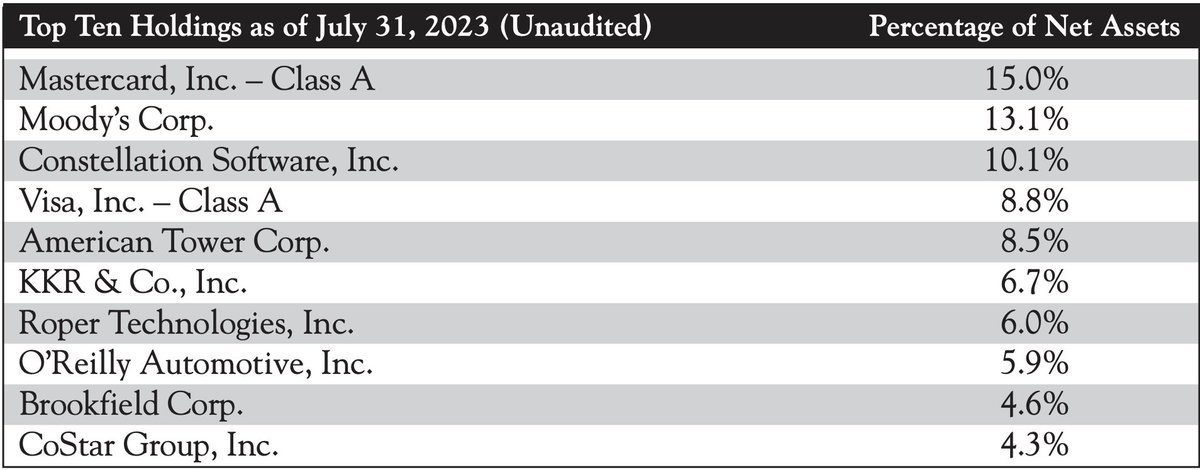

Just learned Akre Capital Management holds semi-annual investor calls where they answer questions about their current holdings & investment philosophy

Replays of the calls starting from 2021:

https://t.co/RBQ4GCtz9p

h/t @Anrosenblum @goodinvestingc https://t.co/bj59Po3DpJ

“Fortunes are made by buying right and holding on.“

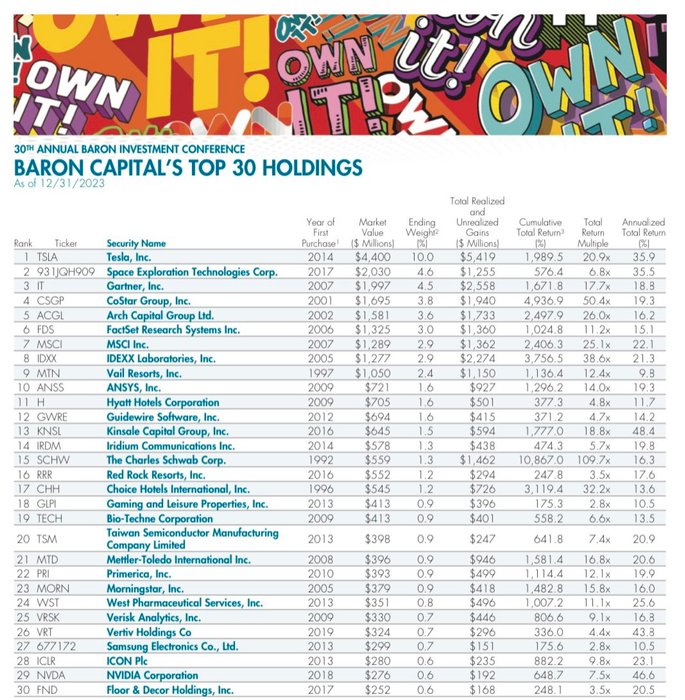

@BaronCapital has been reading Thomas Phelps https://t.co/h2wD1W3X6f

Goldman Sachs (red line) is one of the largest and most powerful financial institutions in the world. The blue line makes condoms and baking soda. https://t.co/9xioV6t0sa