Sublime

An inspiration engine for ideas

A word on Rockefeller as a manager, for he has a claim to be not only the first great corporate executive but one of the greatest ever.

Charles R. Morris • The Tycoons: How Andrew Carnegie, John D. Rockefeller, Jay Gould, and J. P. Morgan Invented the American Supereconomy

"the History of Ideas club"

(I'm reading Peter Watson's "Ideas: a history of thought and invention, from fire to Freud") https://t.co/Ot0w7d6Rpy

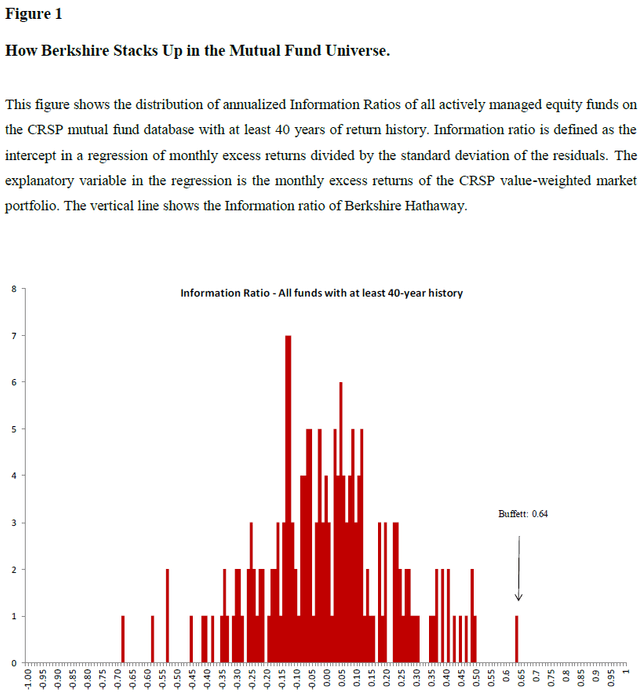

1/ Buffett's Alpha (Frazzini, Kabiller, Pedersen)

AQR finds that Berkshire Hathaway's large 13% CAPM alpha and 0.79 Sharpe ratio becomes insignificant after controlling for BAB and QMJ. Warren Buffet may have been the first multifactor investor.

https://t.co/OV60Vpg9HC... See more

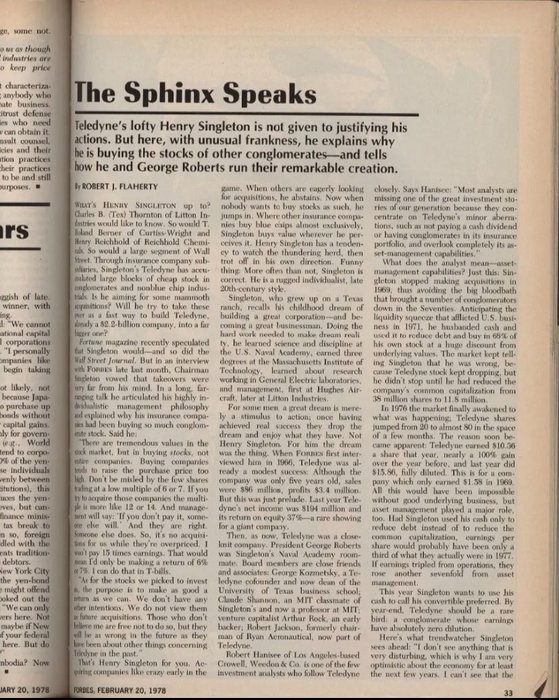

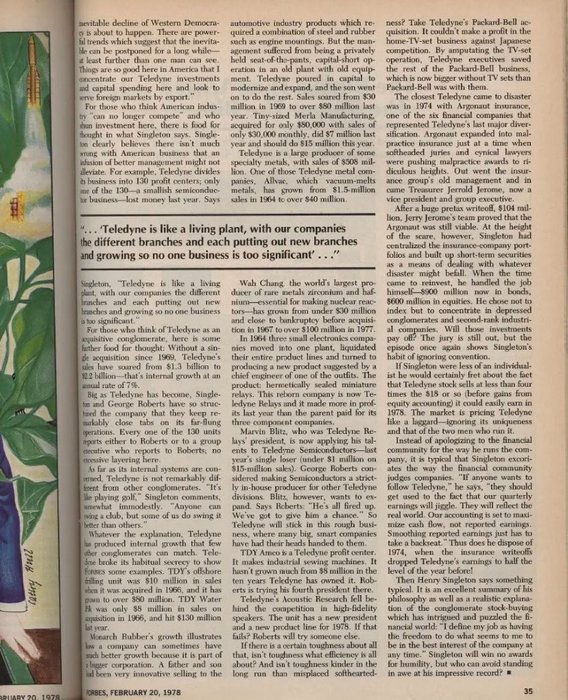

Henry Singelton really is one of the greatest business minds to ever exist . https://t.co/eGDAyvS9Yy

Brandon Marcus

@brandonjmarc

“There is something very odd about a society where the most talented people get all tracked toward the same elite colleges, where they end up studying the same small number of subjects and going into the same small number of careers… It’s very limiting for our society as well as for those students.”

David Perell • Peter Thiel’s Religion

Benjamin Belton

@benjaminbelton

(As his predecessor John Pierpont Morgan had said about a banker’s reputation at the Pujo hearings in front of the House Banking and Currency Committee in 1912, “[It] is his most valuable possession; it is the result of years of faith and honorable dealing and, while it may be quickly lost, once lost cannot be restored for a long time, if ever.”)

Duff McDonald • Last Man Standing: The Ascent of Jamie Dimon and JPMorgan Chase

Joshua Davis

@joshuadavis