Sublime

An inspiration engine for ideas

Arthur Hayes • Trump Truth

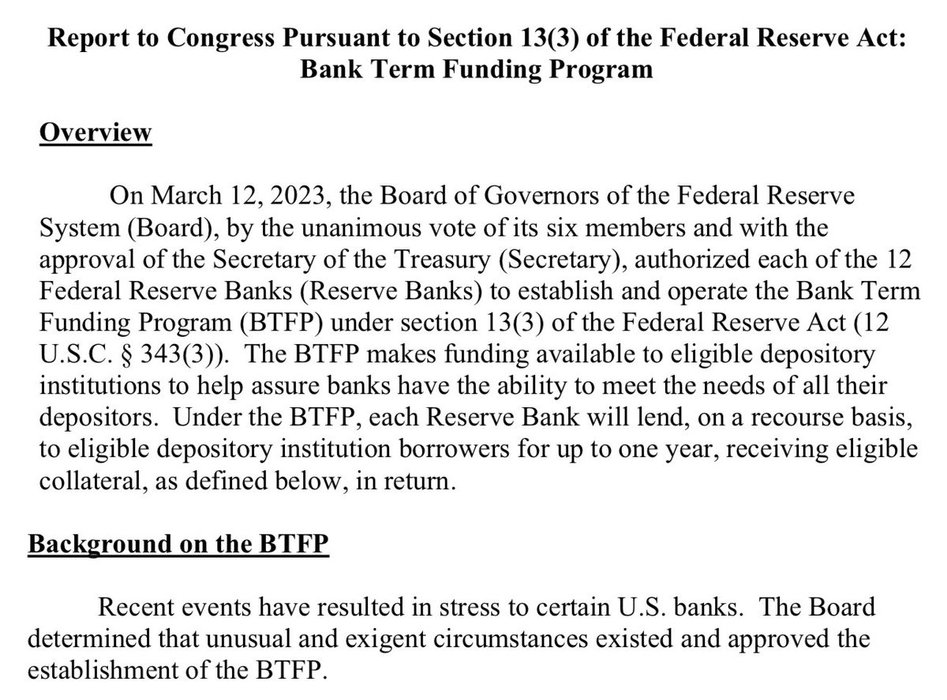

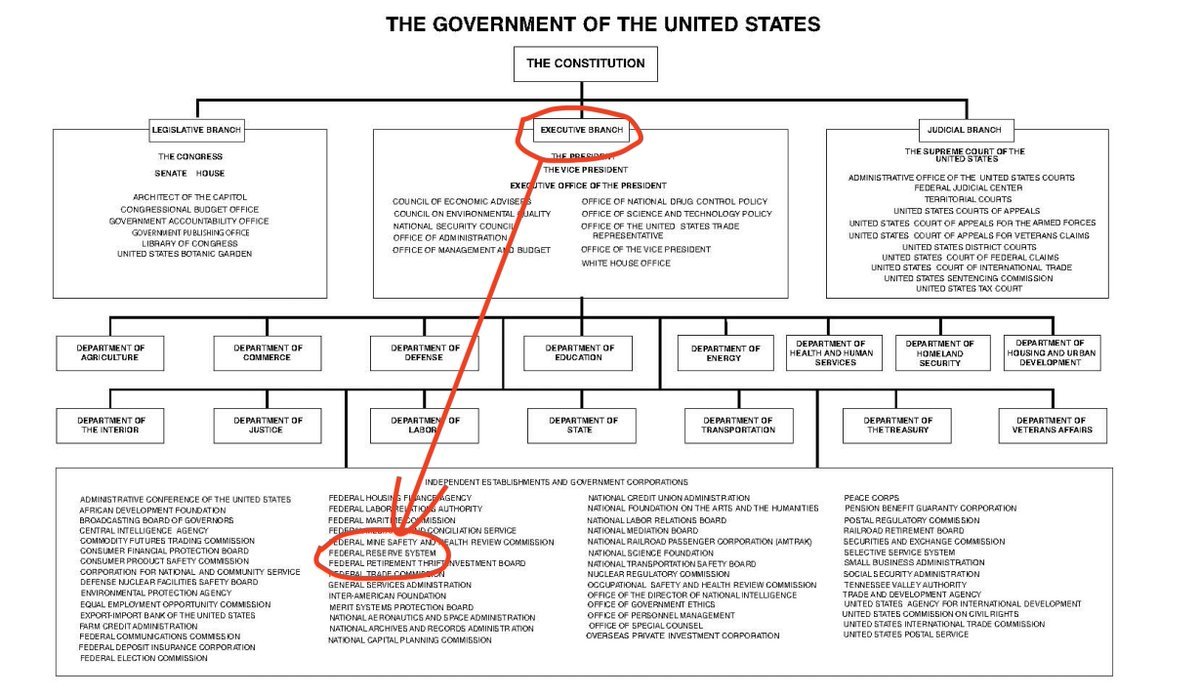

Drawing a parallel between the US Forest Service and Federal Reserve is irresistible. The Fed was created less than a decade after its environmental counterpart. By the 1920s the Fed was attempting to suppress the business cycle. While ‘federal fire suppression acts to subsidize developments of private lands in fire-prone areas’, the Fed’s policy

... See moreEdward Chancellor • The Price of Time: The Real Story of Interest

Relying largely on intuition and common sense, Woodin had cut through a fog of financial advice and adopted the simplest of all possible solutions: the government would simply print new money. It would be backed not by gold or silver but by the assets of the banks in the Federal Reserve system.

Jean Edward Smith • FDR

Le périmètre d’action des banques centrales est donc un x à définir : les obligations auxquelles ces institutions sont assignées résultent de luttes sociales et politiques qui leur impriment une marche à suivre.

Benjamin Lemoine • La démocratie disciplinée par la dette (French Edition)