Sublime

An inspiration engine for ideas

21st Century Monetary Policy: The Federal Reserve from the Great Inflation to COVID-19

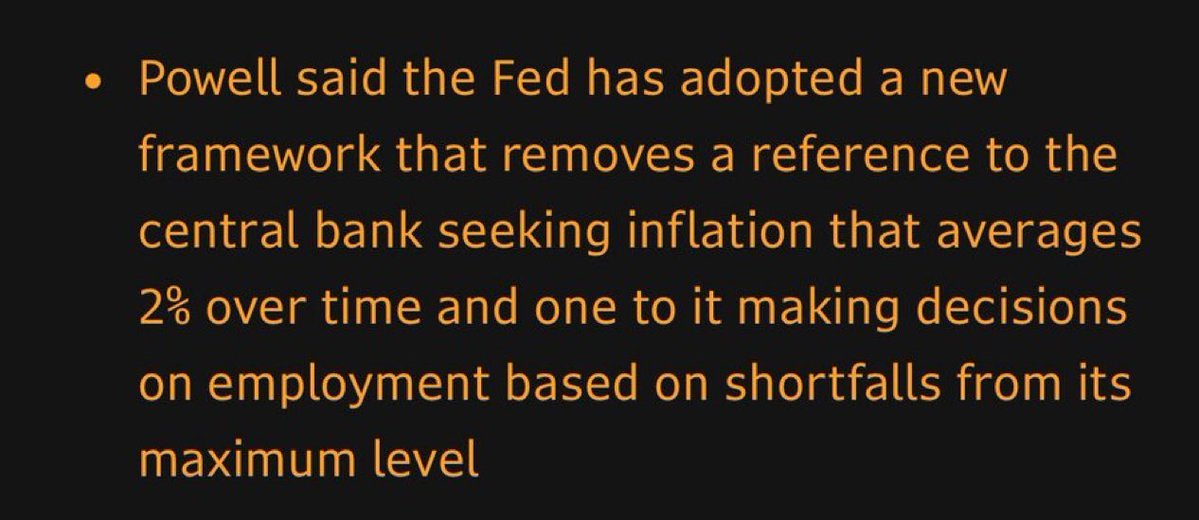

Let me translate, if you don’t own assets you better find a way to get some and fast. https://t.co/jyLmrK7qA1

Only Alan Blinder, once a Fed vice chairman and a former Princeton colleague of Bernanke’s, defended the Fed. Blinder told this tale:

Andrew Ross Sorkin • Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the FinancialSystem--and Themselves

🇺🇸 all-in takes dc!

@chamath and @friedberg sat down with @USTreasury secretary @SecScottBessent for an incredible long-form interview

-- main street vs wall street

-- the trump admin's economic strategy

-- scott's involvement in the... See more

The All-In Podcastx.comThis is absolutely insane…

This is Jared Bernstein. Chair of the Council of Economic Advisers.

He advises Biden on economic policy.

https://t.co/Gi2j99dn5d

Geiger Capitalx.comLe 15 mars, Jay Powell, le gouverneur de la banque centrale étatsunienne, la Fed, est contraint à un speech d’une ampleur équivalente au « quoi qu’il en coûte » de Mario Draghi. Le 18 mars, la BCE emboîte le pas et met en œuvre une injection gigantesque de liquidités dans le système financier via plusieurs facilités dont la principale est le

... See more